Rapeseed imports for EU-27 + UK off to a slow start: Grain Market Daily

Tuesday, 4 August 2020

Market Commentary

- UK feed wheat futures edged lower yesterday, following increases to Russian and Australian wheat production forecasts. The Nov-20 contract closed down £1.75/t to £164.10/t from Friday. The May-21 contract closed yesterday at £169.00/t, down £1.80/t from Friday.

- In the weekly USDA crop ratings released yesterday, the US maize crop was rated as 72% good to excellent, unchanged from the week previous. Soyabean ratings increased 1% to 73% rated good to excellent following ‘near-perfect’ weather for the crop across the US Midwest. This was largely in line with trade expectations.

- French barley exports for July overtook their wheat exports, with feed and malting quality shipments totalling 447.0Kt to China alone. French soft wheat shipments to Non-EU destinations fell to their lowest in at least ten years, according to Refinitiv.

Rapeseed imports into the EU-27 + UK off to a slow start

Rapeseed imports into the EU27 + UK are off to a slow start this season, in a year where the trading bloc faces another 6.0Mt import requirement. Difficult sowing conditions, coupled with extended periods of dryness, have hit production estimates for much of the continent. This has resulted in the bloc’s production estimated at 16.8Mt this season – 0.3Mt less than last season (Strategie Grains).

However, it is not just the EU who have been hit with dry conditions. Dryness concerns have also featured prominently in Ukraine, a key import origin for the EU27 + UK trade bloc. Last season, Ukrainian origin rapeseed accounted for over 49% of EU rapeseed imports from Non-EU countries, a figure of 2.87Mt as of 21 June. However, this large of an import figure is unlikely to be repeated this season. Forecasts by the Ukrainian Grain Association (UGA) for their total rapeseed export campaign were reduced to 2.65Mt, down from 3.00Mt.

With both Australian and Canadian diplomatic relations strained with China, it might be possible that supply originally destined for China could now be available to the EU27 + UK.

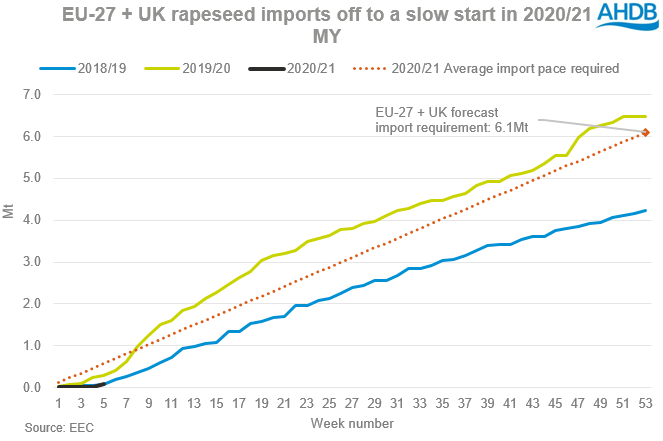

The above graph highlights how the EU is lagging on its rapeseed import tonnages, not helped by the delayed Ukrainian harvest. With a 6.1Mt import requirement, average weekly shipments would average 115.1Kt. To date, the opening five weeks total import volume stood at 90.4Kt (02 Aug). This is 192.2Kt below the figure for the same week last year and 485.1Kt off the pace required.

However, both the previous two seasons have seen the import pace pick up from week 5 onwards. Ukrainian ports have seen increased activity recently, with 163.0Kt of rapeseed shipped in the week ending 31 July, according to UkrAgroConsult. These tonnages will likely be picked up in data update next week.

The diminished presence of rapeseed imports into the EU through July has been one supporting factor for domestic delivered prices. On Friday, delivered rapeseed into Liverpool (Hvst) was quoted at £341.00/t, £5.00/t above prices for the same period last year. Ukrainian FOB rapeseed (Aug) was quoted at $445.00/t - $450.00/t (£340.42/t - £345.58/t) on 31 July.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.