A look at UK rapeseed imports: Grain Market Daily

Friday, 13 September 2019

Market Commentary

UK feed wheat futures (Nov-19) fell £0.75/t yesterday to close at £134.00/t. This meant the price closed £0.28/t below the 5-day moving average.

Sterling yesterday moved lower against the euro cancelling gains seen in the first half of the week. Despite this, Sterling has remained on an upwards trend since the start of September.

Paris rapeseed futures (Nov-19) increased €1.25/t to close at €382.75/t.

The USDA supply and demand estimates were released yesterday. US corn production estimates were lowered 2.57Mt to 350.52Mt from the August estimates. US soyabean production estimates were lowered 1.29Mt to 98.87Mt from the August estimates.

Potential UK oilseed imports?

This season, the UK will look to imports of rapeseed to meet demand, it will be no different on the continent with lowered production in the EU. However, one difference to other seasons could be the origin of our imports.

As highlighted earlier this week, rapeseed production in the EU is down 13% against last year. Eastern European rapeseed production is largely up from the year before, countering losses in western European area. This could see lower UK imports from eastern European origins, which may move to supply continental EU demand.

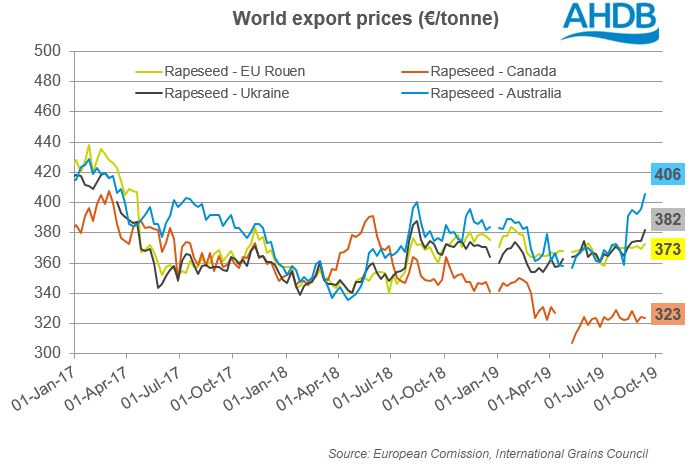

Typically the UK looks to Black Sea and French supply to meet import requirements. As well as this, European rapeseed imports can also consist of Australian and Canadian origins.

Whilst, Australian canola production is forecast to increase 6% this year, recent consecutive drought seasons have left the figure 29% below the 10 year average.

Canadian production of canola is expected at 19.4Mt, a fall of 4.8% on the year, according to Statistics Canada. Despite the GM traits of Canadian canola, it is permitted for imports into the EU. This season so far, Canadian origin has accounted for 13% of total EU rapeseed imports according to EU customs data.

The UK and the EU could look to alternative oilseeds to meet the deficit. Earlier this year, the EU announced that US soyabeans meet its sustainability standards for imports. US exports of soyabeans to the EU this season have totalled 920Kt so far, according to EU customs data.

With global soyabean supplies at a high, prices remain at a discount to rapeseed, acting as a ceiling to price gains in the latter.

Should the UK leave the EU in a no-deal scenario, tariffs will not be placed on rapeseed or rapeseed meal. Rapeseed oil will be subject up to a 9.6% tariff depending on quality.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.