Rains forecast over US Midwest pressure rapeseed market: Grain market daily

Wednesday, 31 July 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £189.05/t yesterday, falling £0.85/t from Monday’s close. The May-25 contract lost £0.70/t over the same period, to close at £200.55/t.

- Global wheat markets were pressured yesterday following northern hemisphere harvest supply. The US winter wheat harvest was reported 82% complete as at 28 July. While Russian wheat continues to price competitively for export, there is some speculation that prices have since reached a floor.

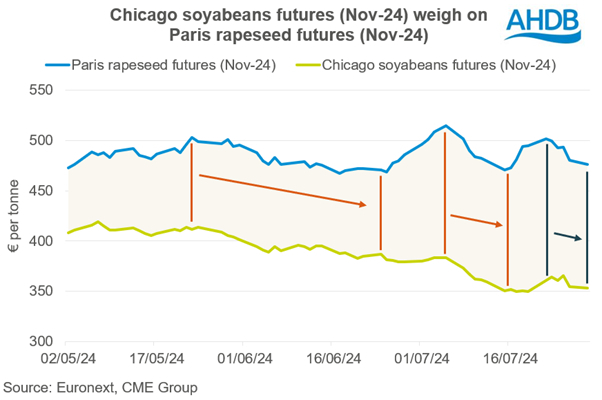

- Paris rapeseed futures (Nov-24) closed at €472.00/t yesterday, down €4.50/t from Monday’s close. The May-25 contract fell €3.75/t over the same period, to close at €475.50/t.

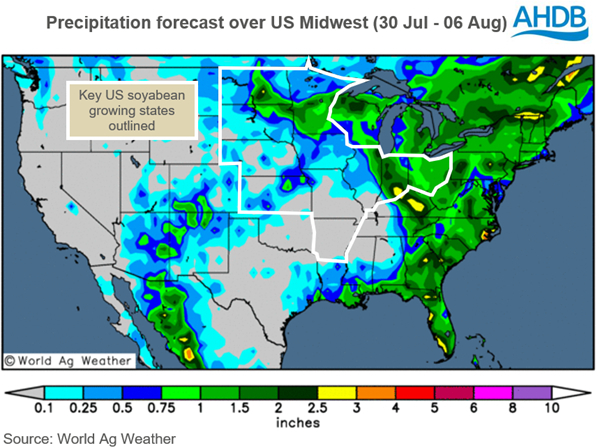

- Rains forecast over Canadian Prairies in the next fortnight alleviated dryness concerns for the rapeseed crop. Also, weakness in Chicago soyabeans futures is weighing on the oilseed complex as favourable US soyabean conditions and rains forecast over the US Midwest support the production outlook, see more on this below.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Rains forecast over US Midwest pressure rapeseed market

Last Friday (26 July), following concerns over dryness, some rainfall and less extreme heat was forecast over the US Midwest, a key soyabean growing region. This pressured Chicago soyabeans futures considerably, with weakness spilling over into rival oilseeds, including European rapeseed prices. Chicago soyabeans futures (Nov-24) have recently been trading below $380/t, a low not seen since March 2021.

Last week was the driest period of the growing season so far as recorded by the US crop watch, a survey across nine states in the US key for soyabean production. Therefore, when rains and lower temperatures were forecasted on Friday, this had alleviated fears of drought during August, regarded by some as the most critical month for US soyabean yield prospects.

US soyabeans boast favourable condition scores

In comparison to this time last year and the five-year average, US soyabeans are in much better condition. On Monday, the crop was rated 67% good or excellent, 15 percentage points more than this time last year and 7 percentage points above the five-year average for the same time period.

Furthermore, drought conditions have been far less prevalent with only 4% of the crop experiencing drought (as at 23 July), 49 percentage points less than this time last year.

It is important to note that this year’s US soyabean crop is forecasted at 34.5 Mha, up 3% from last year and the five-year average. Given the considerable area, and above average forecasted yields (3.5 T/Ha), the US is expected to produce its second largest soyabean crop on record of 120.7 Mt following the 121.5 Mt in 2021/22 (USDA).

US soyabeans continue to weigh on rapeseed

Rapeseed markets have not been excluded from pressure as prices have weakened to remain competitive against other oilseeds.

Rains forecast over US Midwest not guaranteed

While there are forecasts of rain over the US Midwest, there is still no guarantee that these rains will be of the volume forecasted or if they will fall at all. Therefore, the market will continue to watch weather over the US Midwest closely as US soyabeans progress through the sensitive pod setting stage. As at week ending 28 July, 44% of the crop had reached this stage. Should forecasted rains in August fall short of supplying the necessary moisture levels, markets could respond quickly to concerns of drought and consequently yields, potentially offering wider support to the oilseed complex.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.