Processors' perspective on Harvest ‘19: Grain Market Daily

Wednesday, 17 July 2019

Processors' perspective on Harvest ‘19

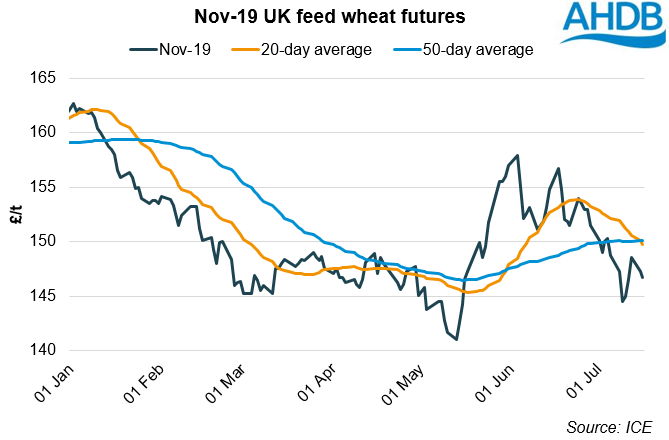

- Yesterday, global grain continued to fall back from their recent rally. Nov-19 feed wheat lost £0.50/t to close at £146.75/t. At yesterday’s close the 20-day moving average for UK feed wheat futures has nearly broken below the 50-day average.

- The shorter term average breaking below the longer term average is a potential sign of a bearish trend setting into markets. Despite the move below the long run average for UK wheat markets, a similar move has not been seen in Paris or Chicago futures. That said, the trend is developing with short term averages for both markets moving lower.

Processors perspective on Harvest ‘19

- Plenty of grain around with demand from both the bioethanol and animal feed sector remains uncertain.

- Should be sufficient milling wheat available - the the approximate area planted to nabim Group 1 and 2 wheat has only fallen by 7Kha, at 648Kha.

The #AHDBCropTour visited flour millers and feed manufacturers Heygates in Northampton last week, speaking with George Mason to get his views from a processors perspective.

2019 harvest

“We are optimistic,” said George when asked his thoughts on the upcoming harvest. “Crops have come through the season relatively well, so I’m quietly confident for a 15Mt+ wheat crop. With plantings as they appear, there should be sufficient milling wheat available, although much depends on the harvest quality.”

The AHDB Planting and Variety Survey highlighted he area planted to nabim Group 1 and 2 wheat is down at 36% compared with 38% last season. However, the approximate area planted has only fallen by 7Kha, at 648Kha.

The area planted to Group 3 wheat is up 3% year-on-year at 195Kha.

The marketing season ahead

George felt that globally, there was plenty of grain around. This poses the question on a local level, what to do with the surplus? Demand from both the bioethanol and animal feed sector remains uncertain.

Challenges on the horizon

Consolidation continues throughout the agricultural sector; with George highlighting the challenge to ensure that all players remain profitable. Brexit uncertainty is the biggest unknown, but the ramifications of the new Agricultural Bill will also have an impact. Could this affect the wheat area if less efficient land comes out of production? The continual ban of certain chemicals remains challenging. Finally, George believed that better rotation planning was key in controlling blackgrass. However, less wheat may be grown as a result, causing a potential headache for processors – especially those who wish to use as much British wheat as possible.

Follow #AHDBCropTour on Twitter to see where we’ve been and what people are saying.

During last week's #AHDBCropTour we caught up with George Mason from Heygates mill in Northampton for his thoughts on the 2019/20 crop. pic.twitter.com/0cuBFKu7St

— James Webster (@James_R_Webster) July 17, 2019

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.