Pressured domestic market widens spread to May: Grain Market Daily

Friday, 25 October 2019

Market Commentary

- UK feed wheat futures fell £1.15/t yesterday to close at £135.00/t.

- Sterling ended yesterday lower against both the dollar and the euro. A decision over an extension to the Brexit deadline is expected today, as such sterling will likely be important to today’s market movements.

- The euro ended yesterday lower despite early gains. In Mario Draghi’s final news conference as President of the European Central Bank little changed with regard to ongoing monetary policy. Despite the lack of changes to policy, negative market data later in the day pushed the euro lower.

Pressured domestic market widens spread to May

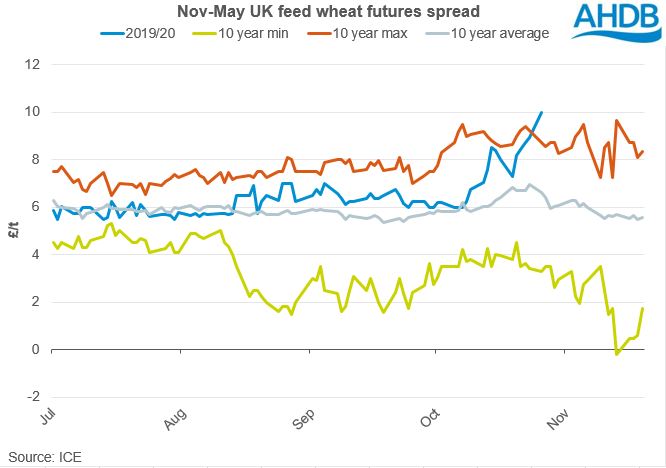

In yesterday’s market commentary we briefly touched upon the spread between Nov-19 and May-20 UK feed wheat futures. At yesterday’s close the spread had widened further to £10.00/t, comfortably the largest gap between November and May contracts for this time of year over the past 10 years.

Even with volume on the November contract falling, the spread is still very telling of the state of the domestic market. Lacking short term demand, with political uncertainty and a heavily frontloaded export schedule, has pressured the futures market.

The pressure in futures market is harder to identify in the physical market due to the thin levels of trade through to May. That said the carry in Delivered feed wheat (East Anglia) last week from November to May, at £7.50/t, is wider than the “typical” £1.00/t/month you might expect and is likely to have widened further this week.

With the carry as it is the incentive to sell wheat into the nearby market is minimal. Moreover, the value of nearby ex-farm feed wheat is significantly below the 1-year rolling average, further reducing the incentive to sell into a declining market.

French planting and harvest delays

While rain has delayed many growers from getting on with winter drilling this autumn in the UK, similar issues are being experience on the continent with French soft wheat plantings 21 percentage points behind year-ago levels in the week ending 21 October.

Similarly, the rainfall affecting the continent is delaying the French maize harvest which, at 46% complete, is 45 percentage points behind normal. The condition of the crop is almost unchanged on year ago levels.

So far this week Paris maize future (Nov-19) have been falling, despite heavy rainfall in parts of France. Going forward rainfall and temperature will be monitored closely for their impact on crops.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.