Potential WASDE drivers: Grain market daily

Friday, 10 June 2022

Market commentary

- UK wheat futures saw little change yesterday. Both the Nov-22 and May-23 edged up £0.05/t, closing the session at £302.55/t and £308.75/t respectively. The Nov-23 contract saw more upward movement, gaining £0.60/t on the day to close at £262.50/t.

- Paris rapeseed futures continued to soften, with the Nov-22 futures down €7.00/t to close Thursday at €778.75/t.

- Indonesia have announced today that palm oil export rules will be further loosened, in an attempt to easing bottlenecks and growing inventories. Now companies who have not joined the government’s domestic oil distribution will be allowed to export, although will have to pay an additional levy of $200/t.

Potential WASDE drivers

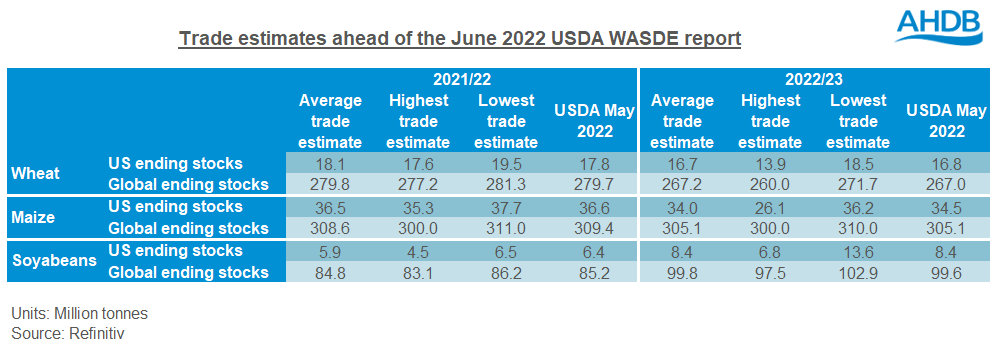

With grains and oilseeds markets continuingly volatile amidst supply concerns, the latest USDA World Agricultural Supply and Demand Estimates (WASDE) report, released at 17:00BST tonight, will be greatly anticipated. Although the June report is usually a quieter release, current market volatility could still prompt a reaction. But what might the report show? Below is what the trade are anticipating.

Wheat

For the end of this marketing year, the trade is estimating that US ending stocks will be revised up a touch. However, we could well see the US wheat production number for 2022/23 revised down, given the dry winter and soggy spring affecting some of the major US growing regions. In regard to global production, downward revisions might be expected for the EU and Argentina. The French wheat crop has been downgraded over the past six consecutive weeks (pegged today at 66% good to excellent). The Rosario Grains Exchange in Argentina yesterday reduced their country’s prospects to 18.5Mt, citing La Niña caused dryness. Both SovEcon and IKAR have revised up their Russian production forecast for 2022/23 in recent weeks, so we might expect the USDA to follow suit. Although with sanctions in place, it remains uncertain as to how much will enter the global marketplace. That said, SovEcon have this week revised up Russian wheat exports for next season to a record high of 42.3Mt.

Maize

Global ending stocks for 2021/22 are expected to be revised back a touch this evening. For 2022/23 production, various factors could come into play. Stratégie Grains have raised their EU-27 maize production forecast (2022/23) to 66.8Mt this week, up 0.1Mt from last month, although still back on last year by 2.7Mt. In addition, planting in the US is almost complete at 94% (6 June), slightly ahead of the five-year average of 92% at this stage. However, the ongoing Ukrainian war impacting both planted area and progress in the region may see further downward revisions being made to next season’s production estimates.

Soyabeans

Global ending stocks for 2021/22 are expected down, driven by reductions in the US due to strong recent soyabean exports. China has returned to the buying table and imported 9.67Mt of soyabeans in May, a jump of 20% on the previous month. However, some of this increase may be a result of delayed shipments finally making port.

While the June report is generally a quieter release for the industry, there could still be some movement in markets if projections fall outside expected ranges. With UK prices tracking global values so tightly, this will be felt in domestic markets too.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.