Potential roads to recovery from African Swine Fever in China

Thursday, 19 December 2019

By Rebecca Wright

African Swine Fever (ASF) is endemic in China. Nonetheless, many forecasts expect Chinese pork production to be on the way to recovery by the middle of the coming decade. As part of the EU medium-term outlook, the European Commission has produced two scenarios for China’s ASF recovery – one slower, and one faster. The scenarios assume there is no usable vaccine available before 2021.

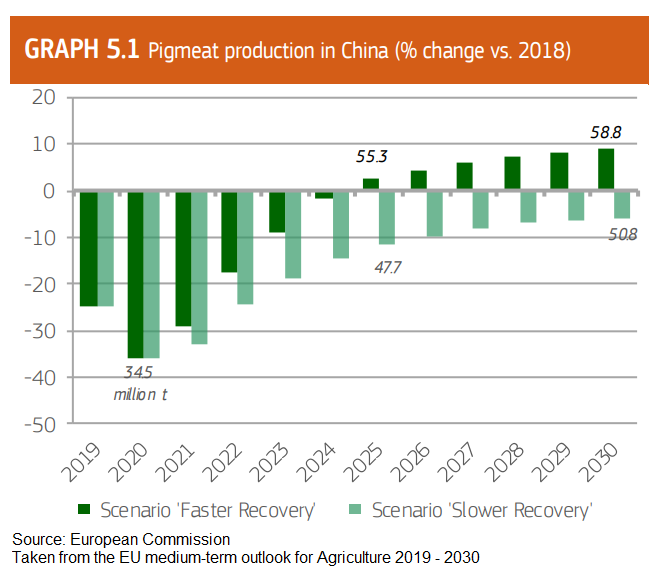

In 2020, the EU is forecasting for Chinese pig meat production to hit a low of 34.5 million tonnes. Under the faster recovery scenario, production is forecast to reach pre-ASF levels in 2025, and continue growing to 2030. In the slower recovery scenario, production does not fully recover in the coming decade.

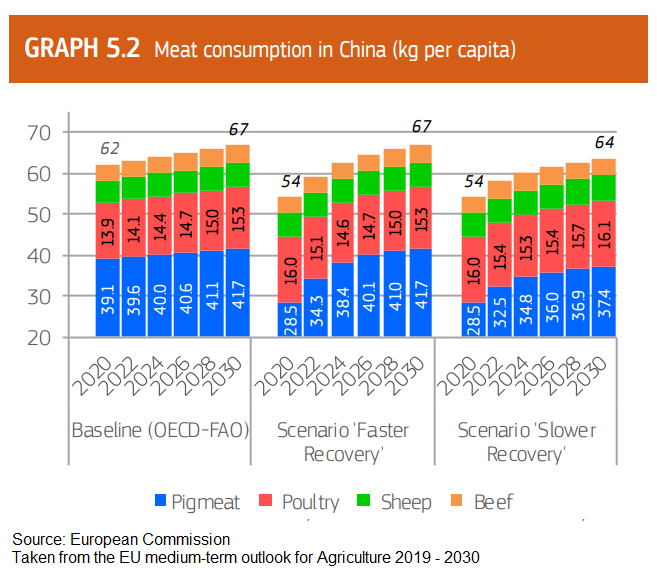

Per capita meat consumption in China is forecast to decline further in 2020. Poultry, sheep meat and beef cannot fully fill the gap left by the decline in pig meat supplies. Whether meat consumption will return to pre-ASF levels over the outlook period depends on the speed of recovery. Under the slower recovery scenario, a gap of at least 3kg/capita remains throughout.

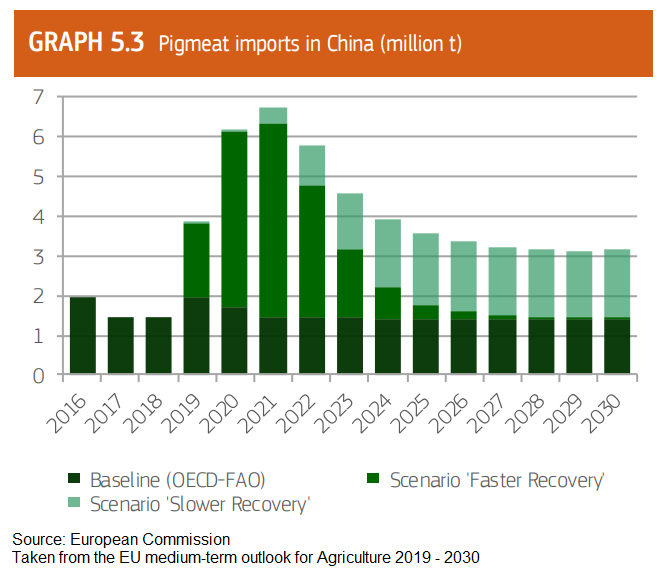

For the European market, a key interest is how long will there be an increase in pig meat import demand from China. With a faster recovery, import demand would be back to near 2018 levels by 2025. With a slower recovery, import demand from China remands elevated for the coming ten years. This demand, alongside US/China trade tensions and access to lower-cost feed, means the short-term outlook for profitable EU pig production is positive. Environmental policy will limit opportunities for vast expansion though.

Production expansion outside of China is expected to peak within the next two to three years, as producers respond to the higher farmgate prices. However, especially with a faster recovery, once Chinese import demand begins to drop prices would be under pressure.

China’s pig industry is generally expected to overcome ASF, with the industry coming back more consolidated and vertically integrated. Currently, high meat prices in China are driving inflation up, something the government is keen to prevent. The Chinese government is therefore supportive of ensuring Chinese pig meat production comes back online as soon as possible.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.