More potential pressure for soyabean prices in 2025: Grain market daily

Tuesday, 7 January 2025

Market commentary

- UK feed wheat futures (May-25) closed at £189.05/t yesterday, down £1.70/t from Friday. The new crop (Nov-25) contract fell £0.80/t to £192.20/t.

- Domestic wheat futures dropped following Paris milling wheat and maize futures. Conversely, Chicago wheat and maize prices rose, supported by a correction in the US dollar. Currency fluctuations are significantly impacting commodity markets currently, with hot and dry weather in Argentina also supporting maize.

- May-25 Paris rapeseed futures rose to €511.50/t yesterday, up €1.50/t from Friday.

- Paris rapeseed futures and Winnipeg canola futures (May-25) both closed higher. This was despite palm oil prices being weighed down by weaker soybean oil prices and low demand from buyers at the start of the year.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

More potential pressure for soyabean prices in 2025

Chicago soyabean futures (May-25) carried its late-2024 rally into 2025, ending the first trading day of the year at $376.58/t. This was the highest closing price since 18 November 2024. Although weak US export sales data on Friday (03 January) exerted some pressure on prices, but they rebounded yesterday, with the Chicago May contract rising by $1.83/t to close at $370.61/t. Currently, dry weather concerns in Argentina, a major exporter of both soyabeans and soyabeans oil, are supporting prices.

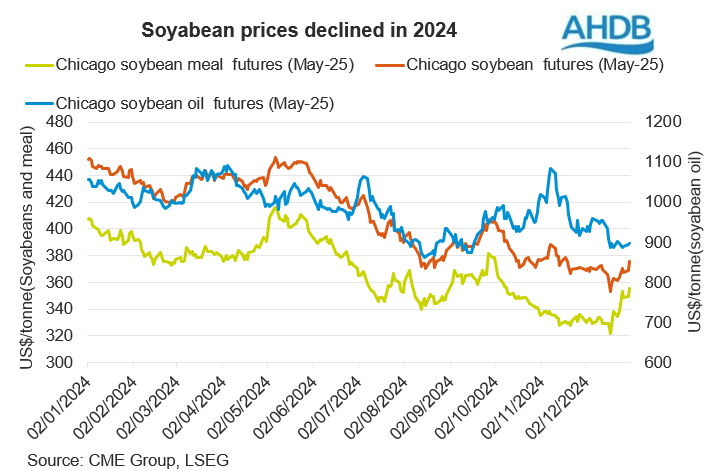

However, overall US soyabean prices fell in 2024 due to a strong supply forecast. Soybean oil and meal prices also declined. Chicago soybean oil and meal futures (May-25) dropped by 18% and 15%, respectively over the year.

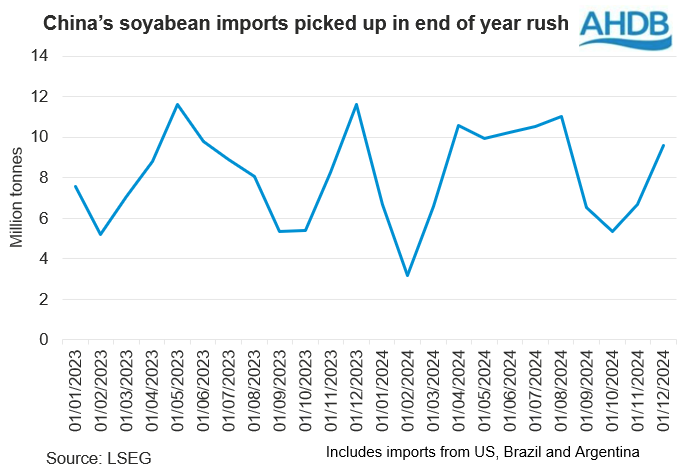

According to the USDA, China remains the top importer (buyer) of soyabeans accounting for 61% (109.0 Mt) of the total estimated of imports of 178.2 Mt in the 2024/25 season (USDA). China’s year-end surge in soyabean imports temporarily helped support prices, driven by a rush and panic buying ahead of Trump’s return to the US presidency. However, this demand boost may not be sustainable.

On the supply side, a record global soyabean harvest is projected for the 2024/25 season, with harvesting due to begin in South America in the coming weeks. Production in South America (particularly Brazil and Argentina) is expected to be significantly higher than the previous season. Brazil is forecasted to produce around 169.0 Mt of soyabeans, a significant increase from the previous season’s 153.0 Mt (USDA), with some private forecasts even higher. The US also had a strong harvest in 2024, contributing to the overall ample supply. Argentina, despite facing dry and hot weather conditions, is currently projected to produce 52.0, which is an improvement from the previous year’s 48.2 Mt (USDA).

Summary

After a large US crop in 2024, good prospects for Brazil are expected to offset concerns in Argentina. Together these seem likely to keep soyabean prices under pressure this year.

The uncertainties around Trump's presidency and a potential trade war with China may also impact demand for US soyabeans. Brazil and Argentina might fill this gap, but logistical challenges could pose issues.

Soyabeans make up a large proportion of global major oilseed production, including sunseed and rapeseed. As a result, soybean prices greatly influence rapeseed prices, which historically tracks soyabeans price movements. Pressure on soyabean markets could lead to a potential downward trend in rapeseed prices, unless a US-China trade war shifts demand towards rapeseed.

However, the USDA’s January WASDE report, due this Friday, may provide further insights into price trends.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.