Positive EU yield prospects remain despite dryness concerns: Grain market daily

Wednesday, 23 April 2025

Market commentary

- UK feed wheat futures (May-25) closed yesterday at £167.55/t, down £5.40/t from last Thursday’s close. The Nov-25 contract fell £3.35/t over the same period, ending the session at £183.55/t.

- Domestic wheat futures followed European prices down yesterday as the expectation of ample supplies next season, following slow exports this season, weighs. Read more on European crop prospects below.

- May-25 Paris rapeseed futures fell €8.75/t yesterday, to close at €526.35/t. The new crop contract (Nov-25) ended the session at €473.25/t, down €6.25/t from last Thursday’s close.

- Despite gains in US soybeans and Winnipeg canola, European rapeseed followed the wider vegetable oils complex down. Chicago soyabean oil futures (May-25) fell 0.5% over yesterday’s session. The euro also strengthened further against the US dollar yesterday, leading to greater pressure on European markets.

Positive EU yield prospects remain despite dryness concerns

As we progress through spring, winter crops in the Northern Hemisphere are largely in their key development phase, meaning they are more sensitive to moisture and temperature stress. The progression of spring planting is also in focus, as we start to gain a clearer picture of what to expect from harvest 2025. So, what is the current crop outlook for the EU?

Yesterday, the European Commission released its latest crop monitoring report. Estimated yields of total wheat, total barley, rye, triticale and rape and turnip rape, all increased or remained unchanged from last month’s estimates. As could be expected, yields are forecast up significantly on year earlier levels. For EU soft wheat, the 2025 yield is currently pegged at 6.03 t/ha, up from the 6.00 t/ha forecast in March and the 5.58 t/ha from harvest 2024. For total barley, the yield is expected to reach 5.08 t/ha, up from 5.06 t/ha estimated previously, and 4.82 t/ha a year earlier.

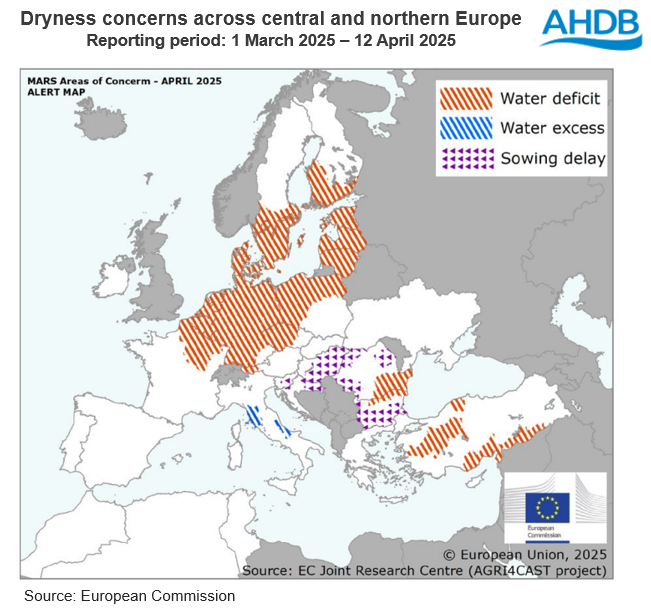

However, climatic conditions in Europe are currently split. Northern and central regions are experiencing dry and warmer conditions, leading to a soil moisture deficit in some areas. On the contrary, some southern regions have experienced plentiful rainfall, with some areas even in excess, and some delays to spring planting progression.

Some of the areas experiencing a water deficit include key crop producing regions such as north-eastern France, Germany, and western and northern Poland. These regions are experiencing a rainfall deficit of at least 50% in comparison to average. In eastern Ukraine, the dry winter conditions have continued into the spring, with winter crops performing poorly, and yield potential below average.

Looking ahead

Overall, the yield outlook remains positive across the EU. However, over the next few weeks, rainfall is required to support development of winter crops, and emergence/initial growth of spring crops. Currently, up to two inches of rain is forecast across parts of central Europe over the next seven days, relieving concerns somewhat. Though if rainfall remains minimal longer-term, we could see some revisions to the European Commission’s estimates next month. If we do see tighter-than-expected supplies, we could see some support in European, and therefore domestic prices as a result, something to look out for.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.