Policy shifts considered as price rises continue: Grain market daily

Friday, 4 March 2022

Market commentary

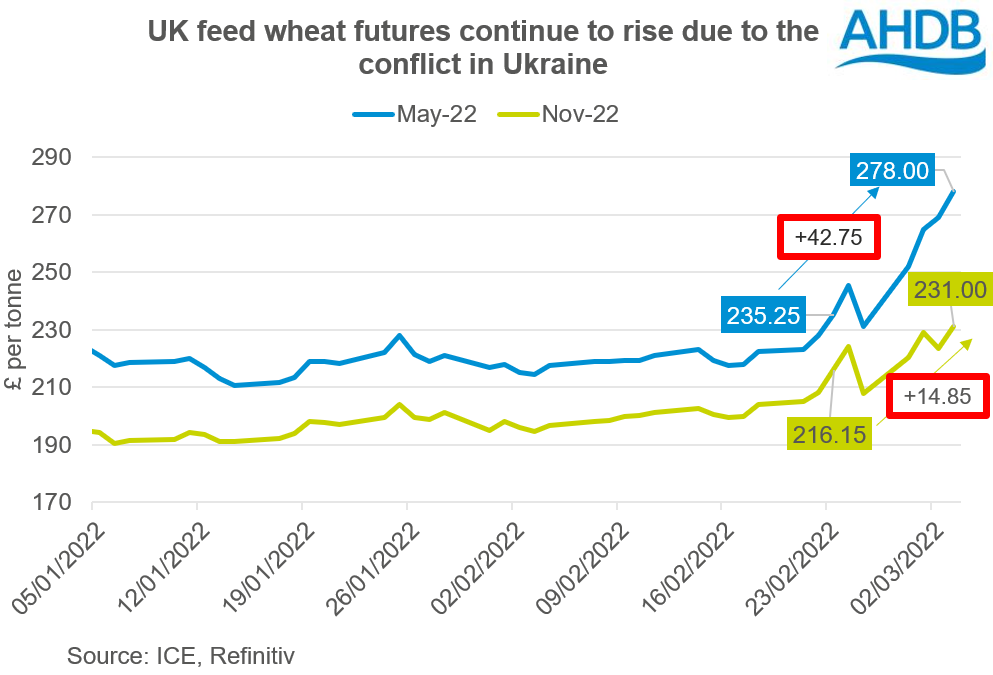

- UK feed wheat futures for May-22 gained another £9.00/t yesterday to close at £278.00/t, another new record. The Nov-22 and Nov-23 contracts also rose to their highest prices to date, closing at £231.00/t and £204.05/t respectively.

- Paris rapeseed futures for May-22 rose a further €6.00/t yesterday to €809.75/t. In contrast, the Nov-22 contract slipped back slightly, closing at €692.00/t, down €4.75/t from Tuesday.

- Russia could now export 27.0Mt of wheat in 2021/22 according to Russian firm ProZerno. This is down 5.0Mt from its previous forecast of 33.0Mt, and 8.0Mt below the current (Feb) USDA forecast (35.0Mt).

- AHDB released the latest updates to the Nutrient Management Guide (RB209) this morning. You can find details of the latest changes here, which include guidance on adjusting nitrogen rates.

Policy shifts considered as price rises continue

Global grain prices continued to rise yesterday due to the conflict in Ukraine, with UK and Paris wheat futures again reaching new records. In response to the rising prices, several countries are considering policy changes that would affect the world market.

Some of these changes are protectionist in nature, designed to shield domestic populations from rising food price inflation. These types of changes may provide relief in the country they’re implemented in. However, they may tighten supplies for the rest of the world and contribute to higher world prices overall.

Other policy changes could increase the available supplies to the world market and dampen some of the price rises. Changes in global prices then usually feed through to domestic prices in the UK.

These are some of the changes reportedly being considered:

Short-term impact (2021/22 season)

- Algeria – In its latest import tender, Algeria’s state buyer OAIC, allowed French wheat to be offered. French wheat was previously excluded, with Algeria buying heavily from the Black Sea. This will give OAIC more options, but could increase demand for French wheat in the short term and push up European prices.

- Bulgaria – While there’s no official announcement, there are reports that customs checks are taking longer in Bulgaria on exports currently. There’s speculation that this is to reduce exports and potentially try to mitigate some domestic price inflation.

Short and longer-term impact

- Argentina has created a ‘trust’ to try to tackle food price inflation (Refinitiv). For each tonne of wheat exported, exporters must pay a percentage of the value of that into the trust, capped at 1%. This money will be used to subsidise domestic prices of flour and dry pasta. The policy is due to be in force until January 2024. Despite a bumper crop, the country had already limited wheat exports amid high demand. It also taxes exports of wheat, maize, soyabeans and soy oil. In the short term, the new policy could add complexity to exporting wheat from Argentina. There could also be a longer-term impact if the various policies mean farmers’ change what crops they plant.

Longer-term impact (2022/23 season)

- EU-27 – The EU Commission will consider allowing cultivations on ‘set-aside’ land to boost production in 2022. Currently the Common Agricultural Policy doesn’t allow this to happen. Proposals will be discussed at the next meeting on 21 March. Meanwhile, spring planting is already underway across Europe, especially for cereal crops. For example, 36% of spring barley has been planted in France (FranceAgriMer). So, any change to the rules would likely affect maize or protein crops, spring sown oilseeds or pulses.

- US – Refinitiv report that the US government is considering waivers to biofuel blending mandates. However, the White House has said it is not being ‘seriously considered’ right now. The volume of biofuels blended into road transport fuels is set annually in the US. Issuing waivers would allow blenders to reduce the amount of biofuel blended. This could cut demand for maize and soy oil to be used as biofuels, and so increase available supplies to the world market. The US is forecast to use 135.3Mt of maize and 5.0Mt of soy oil for biofuels this season. This equates to 12% and 8% of global demand, respectively (USDA).

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.