Pig farm income higher in 2019/20

Friday, 8 January 2021

By Charlie Reeve

Defra’s latest set of Farm Business Income accounts have now been released. The figures are based on 2019/20 with an accounting year ending February 2020 and replace the estimates for this period published in February last year.

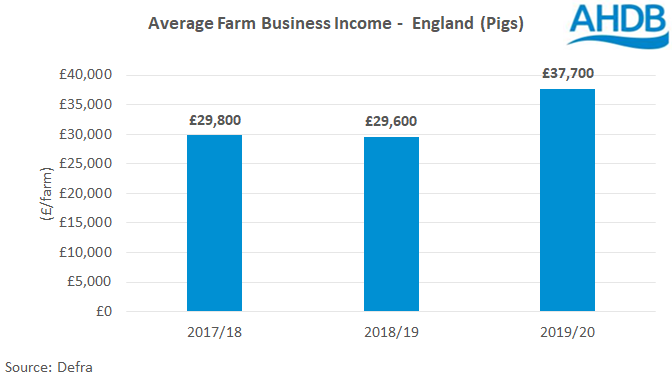

Based on the Farm Business Survey (FBS) results, average farm business income for English specialist pig farms jumped up during 2019/20 with a 27% increase on the previous year. Farm business income is estimated at £37,700, an increase of £8,100 on the previous year.

One of the major drivers for the increase in income was reduced input costs; in particular, lower feed costs were observed during 2019/20. Fixed costs on farm such as property, machinery and regular labour were also reported to be down, following on from an increase during the previous year.

High farmgate pig prices during 2019/20 was another major driver of income for the pig industry with pig meat prices up on the previous year. Pig prices were well supported throughout the year by demand for protein from China following the African Swine Fever outbreak.

The sample of specialist pig farms used for Defra’s Farm Business Survey reported a decrease in pig throughput for the 2019/20 period. This limited output from pigs despite the higher farmgate prices. However, Defra acknowledge that the FBS sample for specialist pig enterprises is relatively small, which means it may not represent the English pig industry overall. Defra slaughter figures for England and Wales indicate that overall clean pig throughputs were actually up year-on-year by around 2%. Due to the limitations in the data, estimates for pig farm business income should be treated with some caution.

Looking at the wider agricultural industry, the profitability of the other sectors over the year was mixed. A heavy reliance on BPS and agri-environment payments remains across most sectors. DEFRA calculated that the average basic payment received by businesses totalled £27,800 across all types of farming enterprises.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.