Dry weather in Central Brazil could delay soyabean planting: Grain market daily

Tuesday, 10 September 2024

Market commentary

- UK feed wheat futures (Nov-24) closed yesterday at £182.45/t, up £0.65/t from Friday’s close. However, the May-25 contract ended the session at £195.50/t, down £0.25/t over the same period.

- Nov-24 domestic wheat futures followed Chicago wheat prices up yesterday. The dry weather in the US Midwest and re-positioning ahead of Thursday’s USDA world agricultural supply and demand estimates supported prices. Meanwhile, the strong export competition from suppliers in the Black Sea region capped gains.

- Nov-24 Paris rapeseed futures closed at €468.25/t yesterday, gaining €4.25/t from Friday’s close. The May-25 contract gained €4.75/t over the same period, ending at €471.25/t.

- The European rapeseed prices tracked soyabean prices higher. This price rise was driven by dry weather in the US Midwest crop belt and uncertainty about the start of soyabeans planting in Brazil (more details on this below).

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Dry weather in Central Brazil could delay soyabean planting

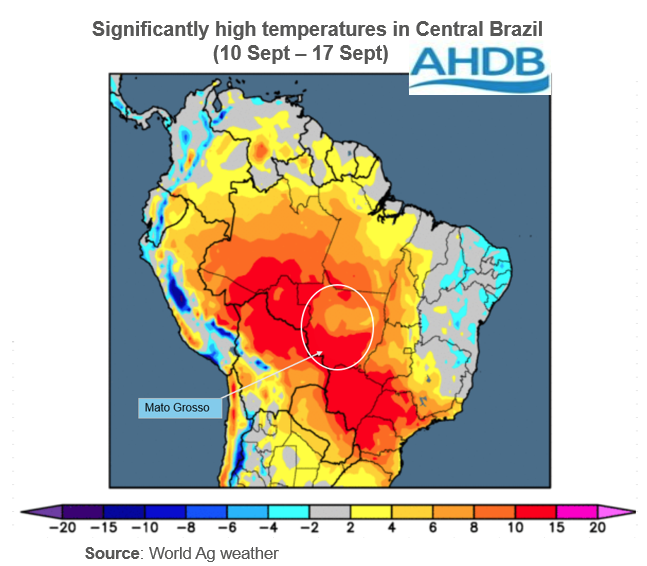

Ongoing dry weather and hot temperatures in Brazil have been in focus lately, as soyabean planting starts this month. According to the country’s national disaster monitoring centre, Cemaden, Brazil is facing one of the worst droughts on record, with more than one-third of the country affected. The dry weather poses challenges to famers, including in Mato Grosso, a central state that produces about 29% of the country’s soyabeans.

The drought could delay the start of soyabeans planting, which in turn could push back both the harvest and export timelines. Weather forecasters predict that the situation will continue through mid-September; something which will need to be monitored.

This is concerning as Brazil remains the largest producer of soyabeans globally and expected to achieve a record-high crop this season. The USDA estimates Brazil’s soyabeans production to reach 169.0 Mt for the 2024/25 marketing year, up 10.4% compared to last year.

There is already concern about the estimates from the lower price environment; soyabeans prices in Brazil are at their lowest in four years. This could cap area expansion this year, with the area estimated to grow at the slowest pace in 18 years.

Also, the dry spell may raise concerns about the overall yield and quality of the crop, especially with the approaching La Niña weather event. These are typically accompanied with drier weather in central Brazil.

In conclusion

The extent of the impact of dry weather in Brazil on global supply and prices of soyabeans is uncertain at this point, but it is an important area to monitor. The world is expecting ample supply of soyabeans this year, with a predicted growth of 9.0% or 33.6 Mt compared to last year. Nearly half of this growth is expected to come from Brazil. Therefore, a disappointing output in any of the major producers could reduce the expected supply growth and reduce pressure on prices.

What does this mean for maize?

Mato Grosso also accounts for 33% of maize produced in Brazil. The success of the second maize crop, also known as the Safrinha crop, which is typically planted in February, is linked to an early harvest of soyabeans. Safrinha is the largest maize crop in Brazil. Delays to soybean planting and so harvesting could push back the planting of Safrinha maize, and potentially affecting its yield.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.