Oilseed rape prices under pressure: Grain Market Daily

Tuesday, 22 October 2019

Market Commentary

- The US harvest has continued to progress slowly. The maize harvest is now 30% complete, falling further behind the long-term average. More northerly states, such as North Dakota, have barely begun. Similarly, the soybean harvest is also delayed, especially in the more northerly states, with yield concerns for both major crops.

- Ongoing dryness in Australia has led to downgraded production outlooks. Rabobank have further cut their wheat production forecast, down to just 15.8Mt. This is now potentially the smallest crop since 2007/08 and over 2Mt less than the latest USDA WASDE estimates.

Oilseed rape prices under pressure

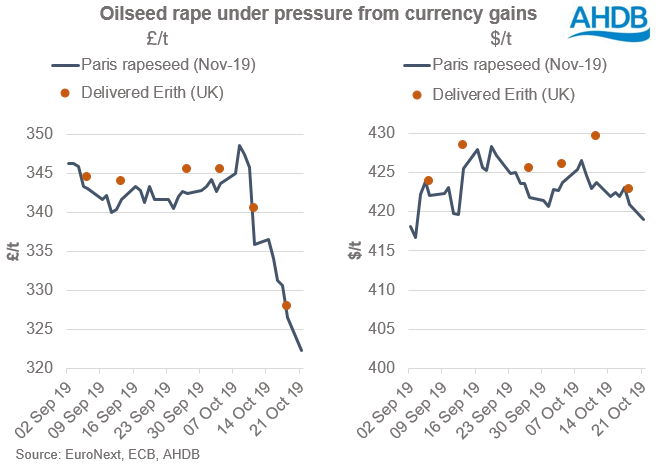

Oilseed rape prices have come under increasing pressure throughout October. Yet with the fundamentals for a tight supply and demand outlook, why have domestic prices (delivered Erith) fallen by £17.50/t during October?

Strengthening of currency

One of the main drivers has been the strengthening of the pound against the euro throughout October. Strengthening by over 4% from 9 October, £1 was worth €1.1621 by market close yesterday, the strongest the pound has been since early May.

The more positive Brexit outlook has also lent support to the euro, firming by nearly 2% against the dollar. A combination of increased confidence in both the pound and euro has led the pound to gain 6% against the dollar.

Underlying oilseed market

Although the major market for oilseed rape is the EU, priced in euros, the underlying oilseed market of soyabeans is priced in dollars. With a strong degree of interchangeability between soyabean oil and rapeseed oil, the dollar denoted price premium of rapeseed over soyabeans can only extend so far. In addition, a strengthening of the euro and pound has mitigated some of this dollar denoted premium, which has fallen by €7.89/t during October.

Future Direction

Although in pound terms oilseed rape has come under pressure, the global supply and demand fundamentals are pointing toward a tightening outlook.

Ongoing dryness in Australia has reduced the production outlook for canola, with Rabobank now forecasting a sub 2Mt crop at just 1.83Mt. Further, the US soybean crop harvest is 18 percentage points behind the 5-year average, and dry conditions in South America are hampering planting, with poor germination fears, despite some recent rainfall.

With a reducing soyabean surplus, and an increasingly tight oilseed rape outlook, the fundamentals are increasingly less bearish. However, strengthening of currency has outweighed the supply and demand fundamentals for now. Further parliamentary votes this week could further strengthen the value of the pound, depending on the outcome.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.