Oilseed rape net margins fluctuate over past five years: Grain market daily

Friday, 31 May 2024

Market commentary

- Wheat markets lost more ground yesterday on forecasts of rain for Russia. Selling by speculative traders added to the downward momentum. Nov-24 UK feed wheat futures lost £5.40/t to settle at £216.60/t.

- Paris rapeseed futures also declined, with the Nov-24 contract down €6.50/t to €494.25/t. Weaker vegetable oil prices weighed on rapeseed markets, along with forecasts of rain in Canada, which would support crop conditions. In top producing province, Saskatchewan, planting progress had advanced notably over the past week, though was still behind the five-year average.

- After the markets closed, the EU Commission released updated supply and demand forecasts. EU 2024/25 wheat production was kept unchanged at a four-year low of 120.0 Mt. However, the Commission raised its stock projections for both the end of 2023/24 and 2024/25 because of higher imports this season (2023/24). EU barley production edged higher, while maize production was trimmed. The Commission also cut its forecast for EU rapeseed production from 19.4 Mt to 19.1 Mt, now 0.6 Mt below 2023.

- The EU will enforce high tariffs on imports of grain, oilseeds and oil meals from Russia and Belarus from 1 July. Russia and Belarus supplied relatively small amounts of common wheat, barley and maize to the EU this season (1 Jul – 27 May). However, the countries supplied sizeable proportions of EU durum wheat, rapeseed meal, sunflower meal and rape oil imports over the same period.

Oilseed rape net margins fluctuate over past five years

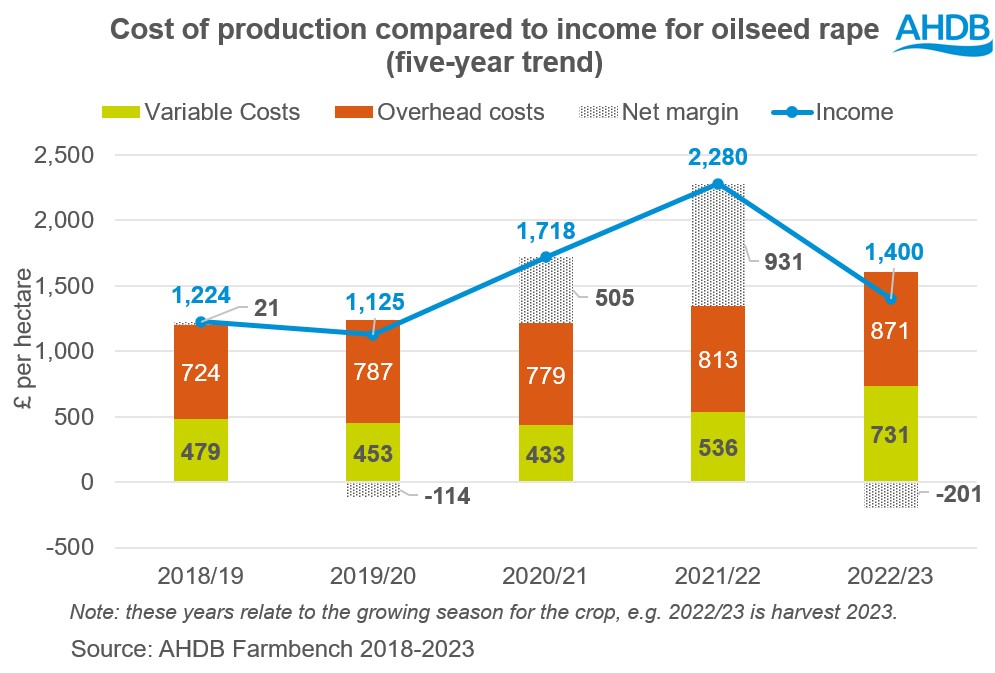

With significant price fluctuations over the last few years, increasing costs and variable yields, net margins for UK oilseed rape (OSR) farmers have fluctuated considerably.

The graph below shows the average variable cost, overhead cost, income and net margin per hectare over the past five production years for OSR crops. Please note that these years relate to the growing season for the crop and not the marketing season, e.g. 2022/23 is the production year for crops harvested in 2023.

The data is taken from Farmbench, AHDB’s benchmarking tool, and each year is calculated from a minimum of 200 OSR enterprises from across the UK.

The graph shows that income per hectare has been highly variable over the last five years. A strong market price was the main driver of higher net margins in both 2020/21 (harvest 2021) and 2021/22 (harvest 2022). Outside of these years, the net margin has been tight or even negative, with an average £100 loss per hectare. Reduced yields were a contributing factor to the low margins in 2019/20 (harvest 2020); Farmbench data shows that yields were down 12% compared to the five-year average. However, a larger yield drop of 22% was reported by Defra, suggesting net margins might have fluctuated even more for some farmers. Increasing costs also played a role in 2022/23 (harvest 2023) returning a loss.

By far the biggest factor affecting the variable costs has been rising fertiliser prices, which made up 64% of the total variable costs in 2022/23 (harvest 23). Previously they have typically been less than 50% of the total, with the remainder made up of crop protection costs, seed costs, and other variable costs. Spot fertiliser prices have eased over the past 12 months, although they remain above the levels seen before the Ukrainian war.

Overhead costs have also been rising, in a steadier way, over the last five years. Machinery and equipment costs make up the biggest percentage of overhead costs, along with labour and property and energy costs. These all saw notable increases in 2022/23 (harvest 2023) compared to the previous five years, by an average of 15%. It is important to note here that the figures shown in the graph represent the full economic net margin, which includes imputed costs, such as family labour and rental equivalent on owned land.

Value in knowing production costs

Against this cost backdrop, knowing your full cost of production is more important than ever for evaluating net margins. It may also help make decisions about schemes, such as the Sustainable Farming Incentive (SFI) in England. AHDB analysis indicates that despite the challenges, financially OSR still represents a reasonable break crop compared to the legume fallow or herbal ley SFI actions, depending on your farming system and rotation.

Analysing your business and knowing what it costs to grow each crop in your rotation can also help when marketing your crop. It is difficult to know what a ‘good sale price’ is without knowing the true cost of production.

Using Farmbench, you can compare your variable and overhead costs to similar business and identify your strengths and weaknesses. This can enable you to target cost reduction strategies to areas with the greatest opportunities for improvement. For example, would you benefit most from reviewing your fertiliser application strategy, or consider the costs of using contractors versus your own machinery or machinery sharing?

For information or to get involved, contact our team of Farmbench Managers.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.