Oat exports starting to slow? Grain market daily

Wednesday, 17 April 2024

Market commentary

- UK feed wheat futures (May-24) closed at £172.20/t yesterday, down £0.35/t from Mondays close. The Nov-24 contract was up over the same period by £0.10/t, to end yesterday’s session at £195.20/t.

- EU wheat markets also saw little price movement yesterday. This follows news of a fall in Ukraine’s total grain harvest estimate, declining to 52 Mt, compared to last years figure of 58 Mt (Ukrainian Farm Ministry). However, weighing on this support was cheaper Russian wheat, with news that European wheat is losing it’s place in markets in North Africa, sub-Saharan Africa and the Middle East due to highly competitive Russian wheat prices.

- May-24 Paris rapeseed futures closed yesterday at €453.00/t, dropping €7.00/t over the session. The Nov-24 contract closed at €459.25/t, down €5.00/t over the same period.

- European rapeseed prices were down again yesterday, following Chicago soybeans which are currently seeing pressure from ample, cheap supplies from South America.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Oat exports starting to slow?

The latest UK trade data includes figures relating to exports and imports of grain up until the end of February 2024.

Oats

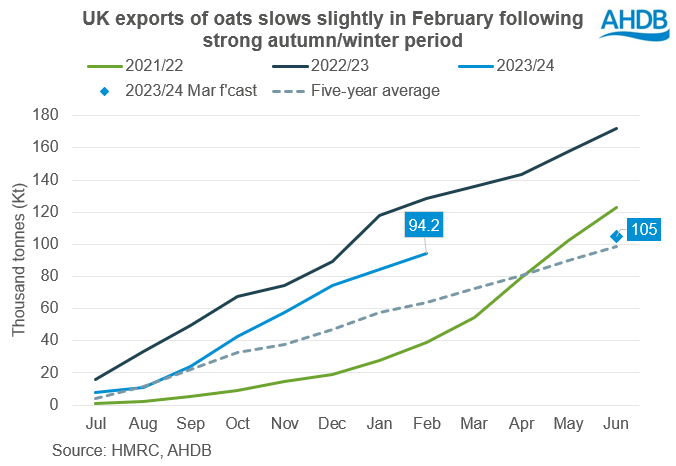

Following a strong pace over the autumn/winter period for UK oat exports, movements appear to have slowed slightly. According to HMRC, imports of oats this season to date (Jul -Feb) totalled 94.2 Kt. This sits 48% above the five-year average (63.8 Kt) for this period, but 27% below the same point last season (128.6 Kt).

This historically firm pace comes despite opening stocks and production both seeing a yearly decline. Export demand remained high mainly driven by the EU. Exports to the EU totalled 86.2 Kt this season so far (Jul – Feb). The main destinations for oat exports were Belgium (37.8 Kt), Spain (19.8 Kt) and the Netherlands (15.4 Kt). However, according to the EU commission, total oat exports this season to the EU from the UK as at 01 April sat at 98.9 Kt, suggesting pace has slowed further in recent months.

AHDB’s UK cereals supply and demand estimates made in March 2024, forecast UK oat exports this season to reach 105 Kt. To reach this figure we would have to export just 2.7 Kt of oats each month for the remainder of the season. As such, it is expected that due to the tight domestic outlook of oats this season, export pace will slow considerably from where we were up to February.

Wheat

So far this season (Jul-Feb) UK wheat exports totalled 175.5 Kt, 81% below the same period last season. According to AHDB’s March UK supply and demand estimates, total wheat exports for the 2023/24 season are forecast at 270 Kt, down 83% on the year.

Imports of wheat this season to date (Jul-Feb) have totalled 1.43 Mt, up 57% from the same period last year. The majority of imports are likely to be high protein milling wheat, due to the lack of high-quality wheat available domestically. Concerns over the new crop, due to poor weather during winter planting has also contributed to increased reliance on imports. With smaller crop estimates for next season, it’s likely imports for the next marketing year will remain firm.

Barley

Barley exports this season to date (Jul – Feb) have totalled 539.2 Kt, down 31% from the same period last year. This is due to a tighter year-on-year balance, driven by decreased availability and greater consumption domestically.

Imports of barley totalled 119.8 Kt so far this season, more than double than at the same period last season. Despite some higher quality barley imports coming in earlier in the season, the majority of imports are now expected to be of feed quality, largely going into Northern Ireland.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.