Oat ending stocks highest on digital record: Grain Market daily

Friday, 29 November 2019

Market Commentary

- Paris milling wheat futures (Dec-19) closed yesterday at €183.25/t, having risen €5.25/t since the start of the month. Issues sowing new crop has incentivised farmers to hold on to stock which has meant the physical premium prices have remained firm. Furthermore, the percentage of the sown French wheat crop rated as “good-excellent” fell for a second week from 75%, down three percentage points.

- UK wheat futures (May-20) closed yesterday at £150.25/t, down £0.50/t. Nov-20 wheat futures closed at £156.50/t, down £0.05/t.

- Malaysian palm oil futures (Feb-20) closed higher yesterday. This was after Indonesia announced its B30 bio diesel programme would reduce fossil fuel use by 165,000 barrels per day.

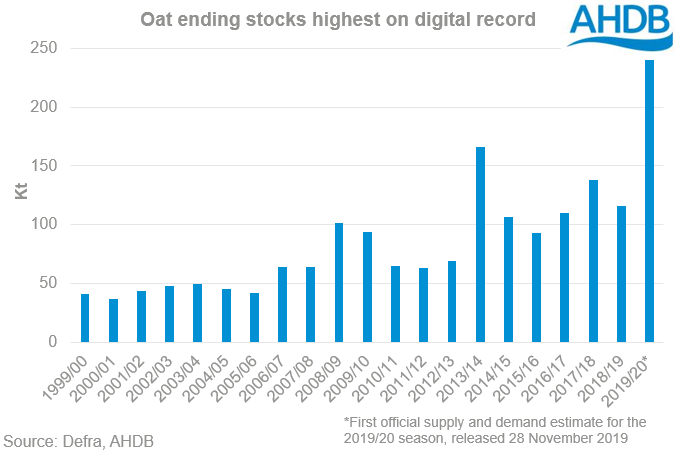

Oat ending stocks highest on digital record

Yesterday AHDB release the first official supply and demand estimates for the 2019/20 season. The surplus available for export or free stock for both wheat and barley are estimated at the highest since 2015/16, on the back of this season’s bumper production.

For oats, production peaked at 1,082Kt, the highest levels since the 1970’s, which has raised questions over where this season’s surplus will end up?

- Wheat surplus* estimated at 2,979Kt, up 50% on the five year average. Accounting for what has been exported so far (Jul-Sep) this would leave 2,565Kt to be exported or carried over to next season.

- Barley surplus* estimated at 2,328Kt, up 32% on the five-year average. Accounting for what has been exported so far (Jul-Sep) this would leave 1,657Kt to be exported or carried over to next season.

- Oat ending stocks estimated at 240Kt, the highest on digital records going back to the 1999/00 season.

*Surplus available for export or free stock

Domestic consumption for this season’s oat crop is expected to rise slightly (905Kt, +4% yoy), driven by increase animal feed usage (345Kt, +14% yoy). Human and industrial demand is fairly steady on the season and most of the excess production this year is likely to be feed grade. With the ample supplies of wheat and barley there appears to be little incentive to significantly increase oat usage in feed production. Equally while exports are expected to rise to 70Kt, this is nowhere near enough to eat into the sizeable oat crop which will need find a home.

With limited options for the surplus we are likely to see large volumes carried through to next season. This will add further weight to a market which is likely to see pressure from a large area increase in spring oats. Currently the Early Bird Survey of planting intentions, released Monday 25, estimated that we could see the oat area rise by 10% to 200Kha.

We will be releasing a detailed look at the full impacts of this and what it could mean for oat prices on 12 December.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.