No-deal Brexit could push American pork onto British plates

Wednesday, 27 March 2019

Last week, the government announced the proposed tariff regime that would apply under a no-deal Brexit. Looking at the product mix for UK pig meat imports last year, the average tariff would add around €0.10/kg (around 9p/kg) to the price of pig meat imports.

This represents an increase in the cost of importing from Europe, as this product is currently tariff-free. EU imports account for 60% of pig meat consumption in the UK.

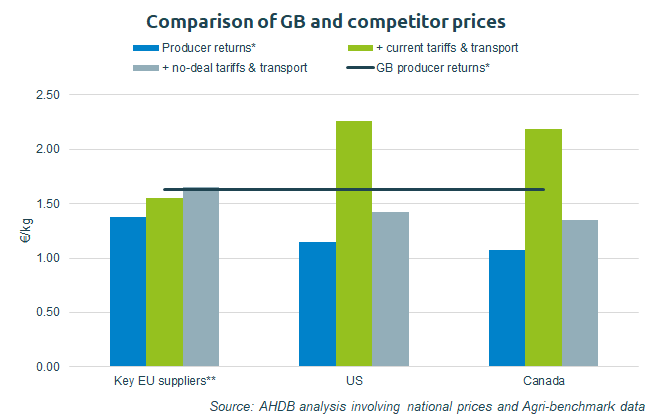

EU pork is typically cheaper than British product. British pork attracts a premium, as it is relatively more desirable, with a number of supermarkets only selling fresh pork from the UK. In addition, unlike in Europe, around 40% of British production is outdoor-bred and this attracts a higher price. At farmgate level, estimates suggest British producers received around €0.25/kg* (22p/kg) more than producers our key EU suppliers** last year. In the no-deal tariff regime, this might be expected to reduce to €0.15/kg* (13p/kg), assuming British prices remain the same.

Therefore, while EU pork becomes more expensive to the UK importers, other global suppliers will become more price competitive. The EU, and so the UK, currently impose tariffs in the region of €0.94/kg (~81p/kg) on pig meat imports from non-EU countries (out of quota). Right now, this effectively eliminates competition from the rest of the world but, under a no-deal Brexit, key global suppliers would face the same average €0.10/kg tariff as our current EU suppliers.

The US, Canada and Chile are currently listed as able to supply raw pig meat to the EU and it is expected that these licenses would roll over to the UK post-Brexit. While a large exporter, Brazil is not listed.

Pig prices in the US and Canada are typically lower than British prices, because of lower production costs. Last year prices were particularly weak, averaging around €1.14/kg (99p/kg) in the US and around €1.07/kg (92p/kg) in Canada. These returns are €0.48/kg (43p/kg) and €0.55/kg (47p/kg) below GB*.

The current EU tariff levels still effectively make US and Canadian pig prices around €0.40/kg (35p/kg) more expensive than British. In contrast, the new UK average tariff of €0.10/kg would leave US prices last year €0.38/kg (33p/kg) lower than British prices, and Canadian prices €0.45/kg (39p/kg) lower*.

Counterintuitively, estimates suggest shipping product from the EU to the UK is not significantly cheaper than transport from North America. Estimated prices are in the region of €0.17-0.18/kg (16p/kg). This means that on average, EU prices would be above British prices and therefore uncompetitive, and US and Canadian pork would be even more price competitive than EU pork is now.

Of course, the above analysis is a simplification. In reality, trade flows will depend on the price of individual cuts as well as product suitability. Producers in both the US and Canada can use Ractopamine in pig production (although not all do), and this pork could not be imported into the UK. Product

It is unlikely that very much is going to change overnight, and the tariff themselves are designed to be temporary. Logistically, importers are also unlikely to switch suppliers immediately in the event of a no-deal Brexit. However, if in the longer-term there is still no deal, this increases GB exposure to the global pork market, meaning British pig prices could be more volatile, and generally lower, in the future.

*Farmgate prices adjusted to take account of deductions and bonuses, estimated using Agri-benchmark data for 2013-2017

** Germany, Denmark, the Netherlands and Ireland

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.