Nitrogen fertiliser prices fell in March: Grain market daily

Thursday, 11 April 2024

Market commentary

- UK feed wheat futures (May-24) closed at £171.00/t yesterday, up £0.75/t from Tuesday’s close. The Nov-24 contract gained £0.95/t over the same period, ending yesterday’s session at £194.50/t.

- Domestic wheat futures followed European and US wheat markets up yesterday, as the latest Russian strikes in southern Ukraine kept the market focus on Black Sea trade. Investors also adjusted positions ahead of the release of US inflation data (LSEG).

- May-24 Paris rapeseed futures closed yesterday at €453.25/t, up €5.00/t from Tuesday’s close. The Nov-24 contract was also up €5.00/t, closing at €466.75/t.

- Despite losses in the US soyabean market yesterday, concerns over dryness in the Canadian Prairies ahead of canola plantings supported rapeseed markets.

Nitrogen fertiliser prices fell in March

Spot prices for nitrogen fertiliser fell in March, according to the latest GB fertiliser prices from AHDB. Imported AN (34.5%) for spot delivery in March averaged £342/t, down from £347/t a month earlier. This remains well above pre-Ukraine war and energy crisis levels. Between 2017-2021 spot delivery of imported AN in March averaged £243/t. UK produced ammonium nitrate (AN, 34.5%) averaged £339/t in March for spot delivery, down from £384/t in November (the last available price), and down from £465/t a year earlier, but again historically remains high.

MOP and DAP prices also saw monthly declines, averaging £370/t and £571/t respectively for spot delivery. On the other hand, TSP saw a slight (£1/t) increase in March compared to February.

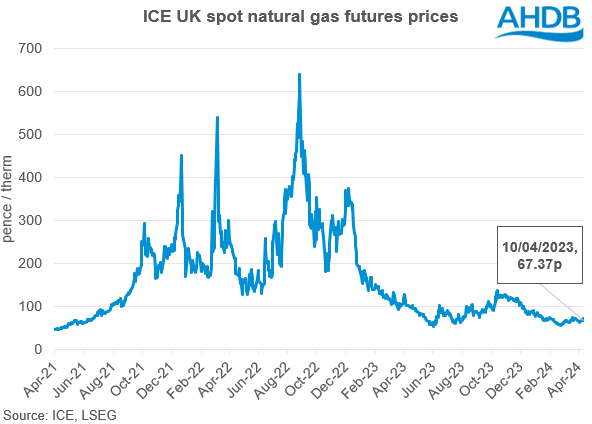

UK natural gas prices have edged downwards since the start of the new year, with a mild winter leaving European natural gas stocks at record high levels (Gas Infrastructure Europe). Campaigns to reduce energy use, as well as industrial closures across Europe have also contributed to the high stocks.

European availability has continued to be supported by ample LNG supplies over the last six months. Demand from industry has also remained relatively sluggish following the energy crisis.

This morning, National Gas has published forecasts for British gas demand over the summer period (April-September). Total UK gas demand was forecast at 29 billion cubic metres, in line with last year. The company also reported that Britain has enough gas stored to cover demand this summer.

Having said this, conflict in the Black Sea region, as well as in the Middle East remain watchpoints for global natural gas prices. Ukraine’s national oil and gas firm Naftogaz reported this morning that Russian strikes had hit two underground storage facilities overnight (LSEG).

What does this mean moving forward?

With ample domestic gas supplies to cover demand, natural gas futures, in the short-term at least, look to remain pressured. However, global markets remain reactive to news on the conflict in the Black Sea and Middle East.

As could be expected, lower natural gas prices have filtered through to GB AN fertiliser prices. As such, if natural gas futures remain subdued, it’s likely that nitrogen fertiliser prices will follow. However, the UK remains exposed to global price movement, meaning any support globally could be felt in domestic markets.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.