New year, same challenges for UK pork trade

Wednesday, 16 March 2022

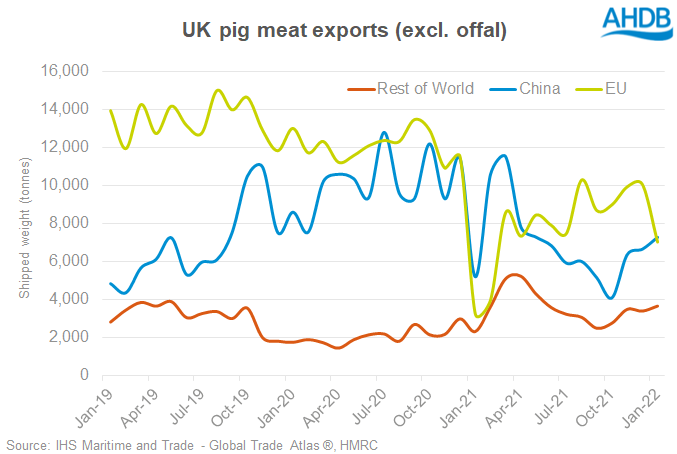

The UK exported 18,000 tonnes of pig meat product in January, 67% more than were shipped a year ago according to data from HMRC. This increase shows the immediate impact on trade of Brexit as much as anything. Exports in January were 11% lower than in December. Although exporters have continued to adapt to the administrative burdens of life outside the EU, the wider export environment itself has been challenging. Recovery in the Chinese pig herd and oversupply of pork in the EU (itself a key exporter to China), have both weighed on volumes for the second half of 2021.

Volumes to China have been increasing in recent months, although from a low base compared to 2020 and in January 2022 7,300 tonnes was exported there. This was 40% of total UK exports, down from 48% a year ago, but up from 33% in December. There are still three processing facilities that do not have access to the Chinese market following self-suspension in the wake of Coronavirus outbreaks. The EU was the destination for 39% of UK exports in January, down from 50% in December.

In January the UK exported 8,100 tonnes of pig offal, 20% more than a year ago but 23% less than in December.

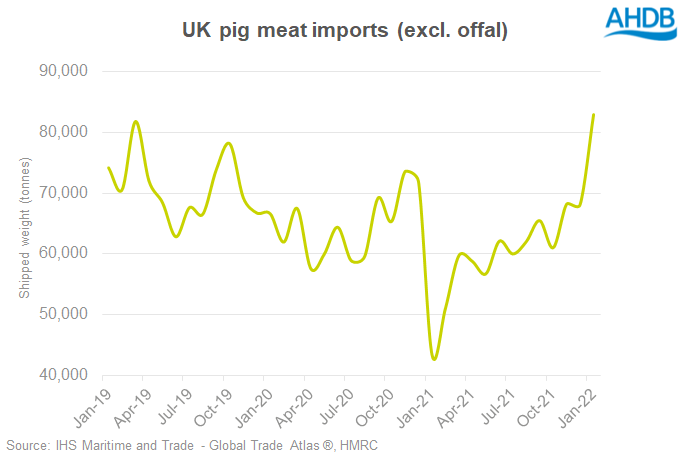

Weakness in the EU market has meant a plentiful supply of competitively priced product. Combined with the continued re-opening of the foodservice market here, this meant that import demand in January picked up. 83,000 tonnes of pig meat products were imported in January, nearly twice that imported a year ago and 22% more than was imported in December. Imports of bacon, a key foodservice staple, rose to 27,000 tonnes in January compared with 9,500 tonnes a year ago and 17,500 tonnes in December.

It is not clear that this rapid increase in imports will be sustained. Prices for pigs on the continent have risen sharply in the past few weeks, as a shortage of slaughter ready pigs has appeared. It may also be that more “finished” products were temporarily imported (such as bacon), as the ability to process imported loins for example, could have been curtailed by a shortage of processing capacity here. Weekly contributions paid by processors in the UK are reported to have increased too, which will feed into contract prices and then into the SPP, reducing the price competitiveness of European pigs.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.