Analyst Insight: New crop wheat hitting the import ceiling?

Thursday, 7 November 2019

Market Commentary

- UK feed wheat futures (May-20) have continued to gain this week, closing at £149.70/t, up £1.20/t on the day and gaining £3.50/t from Friday 1 November. New crop feed wheat futures (Nov-20) have also continued to gain, closing at £157.05/t. The recent rise in UK feed wheat futures is driven by gains in both Chicago and Paris milling wheat futures.

- Paris rapeseed futures have also continued to gain, May-20 closing at €385.23/t yesterday, up €5.50/t from Friday 1 November. With minimal volatility in the value of the pound relative to the euro over the last three weeks, similar gains may be recorded in tomorrows delivered survey.

New crop wheat hitting the import ceiling?

With questions regarding the wheat supply for the UK next year, to what extent could a potential deficit support prices?

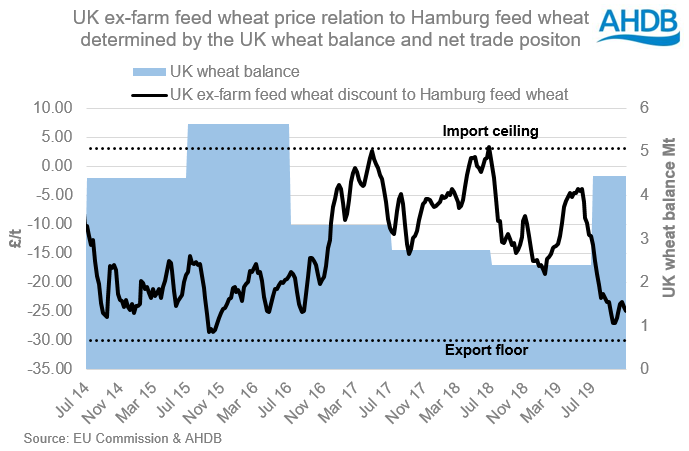

In years of wheat surplus, the UK needs to price below competitor nations in order to gain export sales, as has been the case so far this season. However, if plantings remain significantly delayed the chances of the UK facing a net import requirement increase for 2019/20. If realised, domestic prices will likely be moved above that of global markets once more.

The important question now is to what extent UK futures and physical prices can rise above other origins?

The degree to which farm sale prices can fall this year is being determined by competitiveness in export markets. We need to price in haulage and FOB cost to get grain onto a vessel and then the freight costs to importing nations in a globally competitive market place. This sets the export price floor to which UK markets fall to in years of surplus.

However, as the UK faces the possibility of returning to a net import position in 2020/21, this pricing relationship will likely change. In years of deficit, the point to which ex-farm prices can rise is determined by the cost of importing grain and the haulage to end users.

Looking at previous year’s net trade, 2014/15 and 2015/16 both represented years of net export at 288Kt and 1.34Mt, respectively. Although requiring different net export volumes, both priced toward the export floor level, unable to fall more than £30.00/t below European wheat (Hamburg feed wheat).

This pricing relationship is being seen again during 2019/20, with domestic prices prevented from falling below this export floor.

Conversely, 2016/17 and 2017/18 were both years of net import requirement, again to different extents, 417Kt and 1.35Mt, respectively. In both years prices rose to hit this import ceiling price cap and were unable to rise further.

2018/19 proved to be an exception, where prices were unable to reach this wheat import ceiling, but were instead capped by the historically large price discount of Black Sea maize.

With the pricing relationship relative to European origins determined by this somewhat binary net trade position, the actual size of the potential deficit is the less important factor for the direction of UK prices.

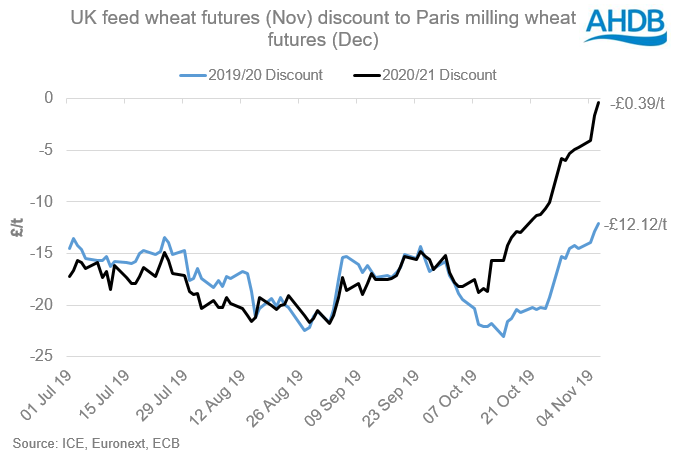

Due to this potential change to a net import pricing relationship, new-crop UK feed wheat futures have been rising sharply.

As the values of the new-crop Nov-20 feed wheat futures contract has risen, the discount to new crop Paris milling wheat futures, Dec-20 has narrowed. With Nov-20 at a discount of just £-0.39/t to Paris Dec-20 at yesterdays close, further gains relative to global markets may now be hard to justify before the import ceiling for Nov- 20 is reached.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.