Natural gas prices ease to pre-war levels: Grain market daily

Tuesday, 17 January 2023

Market commentary

- UK feed wheat futures (May-23) fell £0.60/t yesterday, closing at £232.05/t. The new crop contract (Nov-23) closed at £226.30/t, down £1.35/t over the same period.

- European prices continue to be pressured by competitive Russian wheat, as prices fall further on competitive global supply.

- Analysts have said a cold snap in Russia will have limited impact on the country’s winter wheat crop, despite previous concerns (Refinitiv).

- Paris rapeseed (May-23) futures closed yesterday at €566.75/t, down €4.00/t from Friday’s close. The Nov-23 contract closed at €567.50/t, down €3.50/t over the same period.

- Rapeseed markets followed the wider vegetable oil complex down over yesterday’s session, with plentiful supply and global economic concerns pressuring markets.

Natural gas prices ease to pre-war levels

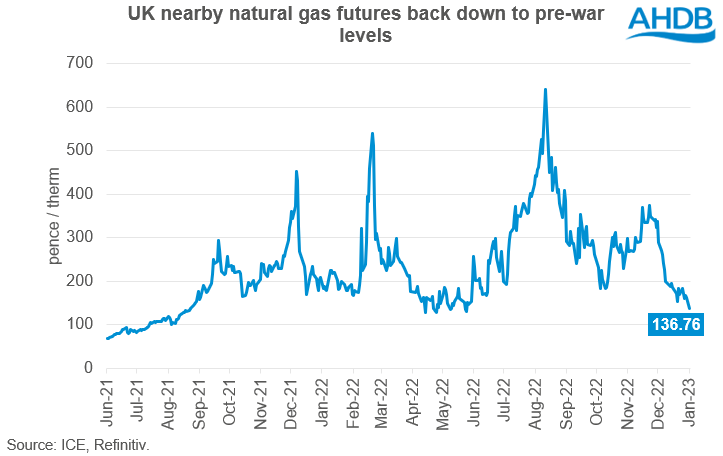

UK natural gas prices have been steadily declining since their peak at the end of August. Over the last month, prices have fallen sharply but remain volatile and reactive to news surrounding the war in Ukraine.

Generally, prices over the last few weeks have been pressured by recent warmer weather trimming some demand, strong alternative sources of energy, and increased EU gas storage. Yesterday, nearby ICE UK natural gas futures closed at 136.76 pence/therm, down 151.66 pence/therm (53%) from this point last month (16 Dec) when prices were elevated due to colder weather.

At the beginning of January, the UK became the fourth country to officially ban Russian liquefied natural gas imports. Instead, the UK has been looking to ship more liquified natural gas (LNG) from producers such as the US and Qatar, agreeing to double imports of US gas over the next year from 2021 levels (Financial Times).

A growing domestic source of energy is wind power. Due to blustery conditions and an increasing number of turbines. Britain set a new record for wind generation on 30 December, totalling 20.91 gigawatts (GW), topping the 19.9GW record set in May. The Electricity System Operator (ESO) also reported a record share of electricity on the grid was coming from renewables and nuclear on that day, supplying 87.2% of total power. European prices have also eased as French nuclear generators have come back online following maintenance.

Sufficient gas storage has also helped ease prices. At the end of December, 83.2% of EU gas storage was filled (Gas Infrastructure Europe), above the target of 80% set in May, but below its peak of 95% in mid-November.

Looking ahead

Looking forward, Europe still has several months of cold weather and strong heating demand ahead. Chinese demand is also viewed as a key driver in gas prices in 2023, as the country’s COVID-19 restrictions ease, but case numbers remain high. However, traders are also having to consider global recessionary fears, which could impact energy demand and pressure prices.

On Friday, HSBC cut it’s 2023 gas price forecast by around 30% and forecast for 2024 by 20%, but suggested that prices will remain elevated. HSBC added that conditions will likely only normalise by 2026 when newly built LNG facilities are due to open in Europe (The Guardian).

What does this mean for fertiliser prices?

The spot delivered price for imported AN delivered to farm was £700/t in December, according to the latest AHDB GB fertiliser prices. This price is down £41/t from November’s price, but £68/t higher than December 2021. It is also more than three times the price recorded in December 2020.

While it’s looking likely that the worst of Europe’s gas crisis and peak in prices is over, prices are still expected to stay elevated and volatile, especially when refilling storage for next winter. With natural gas making up around 60-80% of fertiliser production costs, it’s unlikely that imported fertiliser prices will come down significantly in the short to mid-term considering ongoing market volatility. However, fertiliser prices will likely ease somewhat if natural gas prices remain lower.

AHDB have several resources to help growers assess fertiliser applications, including a GB fertiliser dashboard, the nitrogen fertiliser adjustment calculator and analysis on different application strategies.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.