More barley and OSR sown at the expense of wheat for harvest 23: Grain market daily

Thursday, 27 July 2023

Market commentary

- Most global grain futures fell yesterday due to improved weather forecasts for the US and technical trading. Rain is forecast for parts of the US Midwest, which is the main maize and soyabean growing region. But other areas of the Midwest continue to suffer from a heatwave.

- An annual crop tour in North Dakota reported better-than-expected spring wheat yield prospects in some parts of the US state. The market is now questioning if yield prospects might be better than forecast in other areas of the US affected by drought too. The tour concludes later today.

- Nov-23 UK feed wheat futures fell £6.90/t yesterday to £207.10/t, while the Nov-24 contract lost £4.65/t to close at £207.85/t.

- Paris rapeseed futures also fell yesterday, likely influenced by a dip in palm oil and crude oil futures. The Nov-23 contract lost €3.00/t to close at €475.50/t, while the Nov-24 contract fell €2.50/t to €479.00/t.

- Between 17 July and 26 July, Russian air strikes damaged 26 port infrastructure facilities in Ukraine. This is according to Ukraine’s Deputy Prime Minister who also reported damage to five civilian vessels. More port infrastructure was hit by submarine missiles last night in the Odesa area.

- NATO is increasing its surveillance in the Black Sea. It also condemned the recent attacks on Ukrainian ports and Russia’s withdrawal from the Black Sea Initiative.

More barley and OSR sown at the expense of wheat for harvest 23

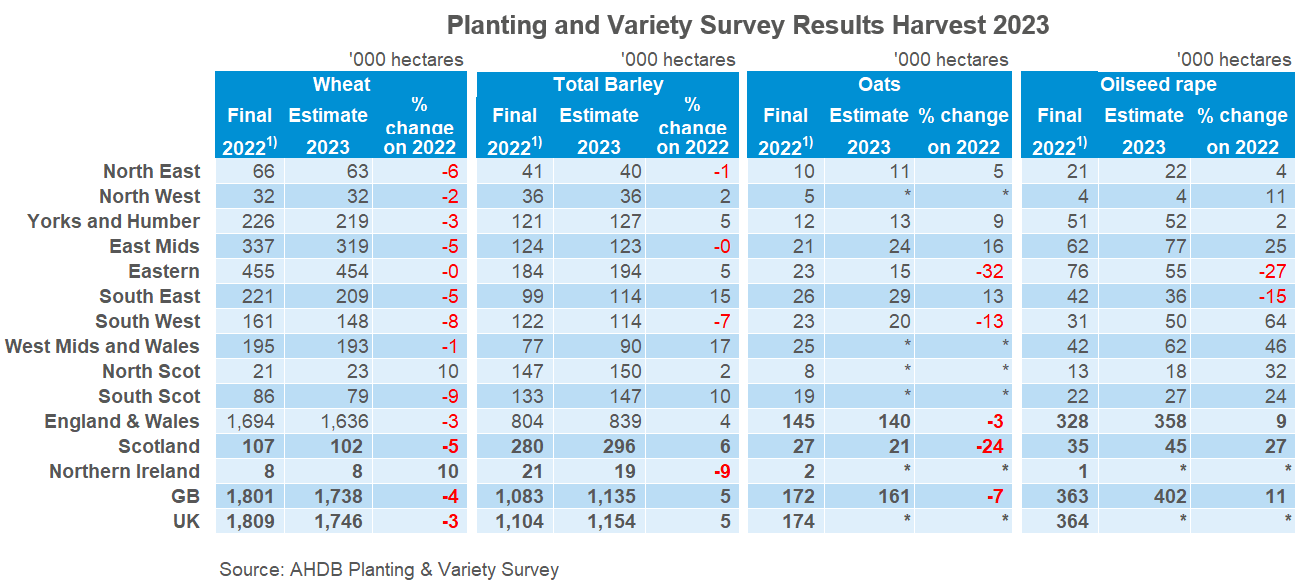

Today, the AHDB have released the 2023 Planting and Variety Survey results. This survey provides the planted area estimates for the upcoming harvest, with a regional breakdown. Broken down not only into crops but also by UK flour miller group and malting or non-malting approved barley.

It is estimated that 1,746 Kha of wheat has been planted for harvest 2023. The slight year-on-year decrease in wheat area has been at the expense of additional barley and oilseed rape (OSR) being sown.

The total UK barley area is estimated to increase by 5% on the year to 1,154 Kha, with an uptick in both winter and spring area. There is also an increase in the GB OSR area which is estimated to increase 11% year-on-year, as high prices in Spring 2022 offered growers the incentive to plant additional OSR. There seems to be a movement away from the alternative break crop oats, as the GB oat area is set to decrease by 7% year-on-year.

From these figures we have released today, we can start to formulate the supply picture for harvest 23, especially as we start to get insight and information from the harvest progression reports. The first report is provisionally set to be released tomorrow.

The key findings from this survey are listed below, however be sure to look at the Planting & Variety Survey webpage which has a whole host of information and analysis from this survey, including regional breakdowns of area and UK flour group.

The key findings of the survey are:

- In 2023 the total UK wheat area is estimated at 1,746 Kha, 3% down from 2022.

- The total UK barley area for harvest 2023 is estimated at 1,154Kha, up 5% on the year.

- The GB spring barley area is estimated at 702 Kha, up 7% year-on-year, while the GB winter barley area is estimated to be 2% higher at 434 Kha.

- The GB oat area is estimated at 161 Kha, this is 7% down year-on-year.

- The GB OSR area is estimated at 402 Kha, this is 11% higher than 2022 levels.

- For harvest 2023 KWS Extase is the most popular wheat variety, with 17% of the total GB wheat area. For barley, Laureate is the most popular variety, accounting for 32% of the total GB barley area.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.