Mixed movements in Brazil pig meat trade and production

Thursday, 1 September 2022

In the first seven months of 2022, Brazilian exporters sent 649,000 tonnes of pig meat to export markets. This is a decline of 5% compared with a year earlier. Brazil has not been immune to developments in China, with exports to that market falling by 127,000 tonnes (-38%) in the seven-month period. Despite this, China remained its main destination, taking nearly a third of Brazil’s pig meat exports so far this year, down from half last year. This is only a part of the story.

As with so many other exporters who sent significant quantities of animal protein to China over the past couple of years, diversification has been the order of the day. Brazil’s pig meat exports to other Asian countries, and those closer to home, have grown markedly. Volumes to the Philippines reached 46,000 tonnes in the first seven months of the year, over four times what they were a year ago. Exports to Thailand also saw considerable growth, up by almost 15,000 tonnes.

Notable volume increase to other markets include Singapore (+36%), Venezuela (+44%), and Argentina (+66%).

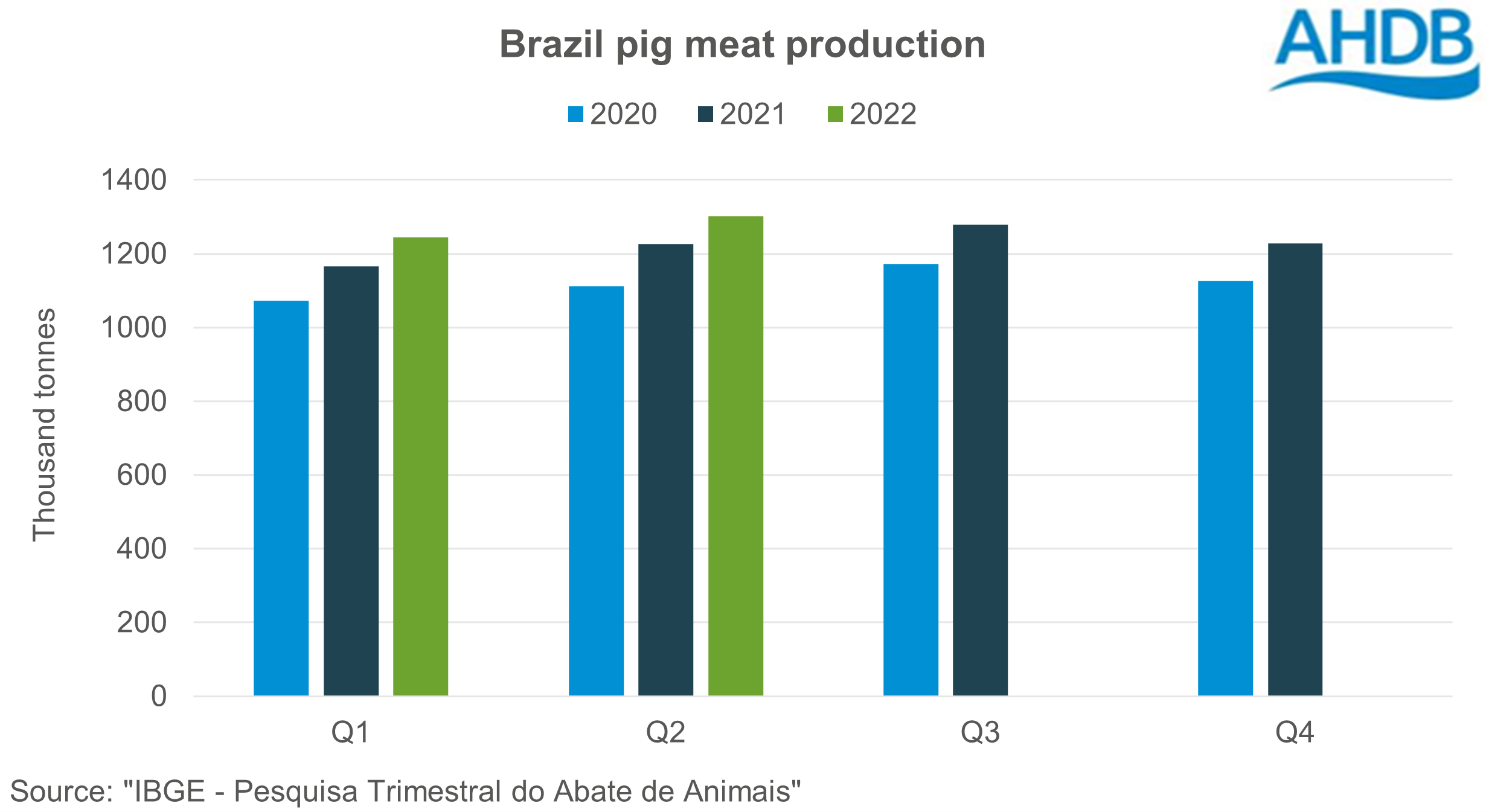

Pig meat production in the first half of the year was over 2.5 million tonnes, 6% higher than a year ago. With export volumes lower over this period, this suggests more Brazilian pig meat is being consumed domestically. With quarterly production of around 1.2 million tonnes, and exports of just 275,000 tonnes on average, it is easy to see the importance of the domestic market.

Export volumes can therefore be sensitive to Brazil’s own economic fortunes. The Brazilian real had been particularly weak for much of 2020 and 2021, as the country struggled with the pandemic, but in 2022 it has gained strength. This would reduce the competitiveness of Brazilian pig meat exports on global markets, and along with the recovery of the domestic economy, might explain lower shipped volumes.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.