Markets await US stock figures: Grain market daily

Thursday, 30 September 2021

Market commentary

- UK feed wheat futures (Nov-21) closed yesterday at £197.25/t, a gain of £1.65/t. Yesterdays close represented the highest point for the contract, eclipsing the previous high on 26 August.

- UK feed wheat futures have tracked gains in wider grain markets of late. Yesterday saw similar gains in the Paris milling wheat markets, up €2.00/t, at €256.00/t.

- EU soft wheat exports are seen at 6.95Mt, in the week ending 26 September, exports are up just 156Kt on the week. That said, the pace is just 160Kt behind 2019/20, a year when EU soft wheat exports reached 34.8Mt.

Markets await US stock figures

As harvest progresses in the US, the price of both maize and soyabeans have waned. As of 26 September, the US maize harvest was 18% complete, three percentage points ahead of the five-year average. The soyabean harvest was 16% complete as of Sunday, also three percentage points ahead of the average.

In the case of both maize and soyabeans, markets appear to be lacking a little inspiration to move higher at present. One possible source of direction this week will be the publication of US grain and oilseed stock figures this evening, at 5PM.

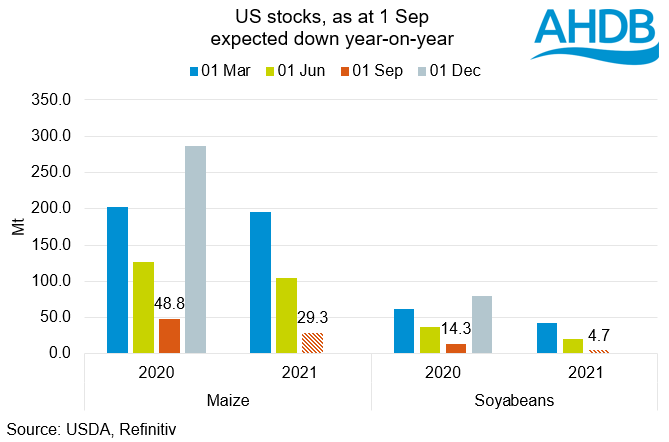

Stocks are expected to be tight. In a pre-report poll by Refinitiv, stocks of maize are expected to be 29.3Mt, down some 42% year-on-year. Soyabean stocks are seen at 4.7Mt, down 67% on the year.

With expectations of stocks so tight, it would require a significant drop on the June 2021 stock level to offer any fresh inspiration to pricing.

With inspiration seemingly lacking we need to look elsewhere for further support. As Ant highlighted yesterday, with La Niña currently on a “watch”, any developments could hamper Southern Hemisphere production.

Further, demand levels for both crops from China are a significant watch point. Margins for pig producers in China are negative at present, this could ration demand for grains and pull further support from grain and oilseed markets.

Adjustments made to English arable areas for 2021 harvest

This morning Defra has published the first results from it’s 2021 census of English agriculture. The latest results show a further increase in English wheat area, year-on-year, from 1.62Mha in the Defra June Survey, to 1.66Mha in the census.

This jump in English area, would add an additional 250Kt to 2021/22 production, using the average yield of 8.2t/ha from the AHDB harvest survey. The census had a 60% response rate, capturing data from more than 64,000 respondents.

The barley area was seen higher than in the previous release, pegged at 816Kha, up from 803Kha in the June Survey.

The AHDB Planting and Variety Survey pegged the wheat area in England at 1.63Kha and barley at 845Kha.

The oilseed rape figure in the Census, further highlights the challenge of growing the crop. The area was reduced by a further 5Kha from the June Survey to 268Kha.

The first official production estimates for wheat and barley, from Defra, will be published on 11 October.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.