Arable Market Report - 30 May 2022

Monday, 30 May 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

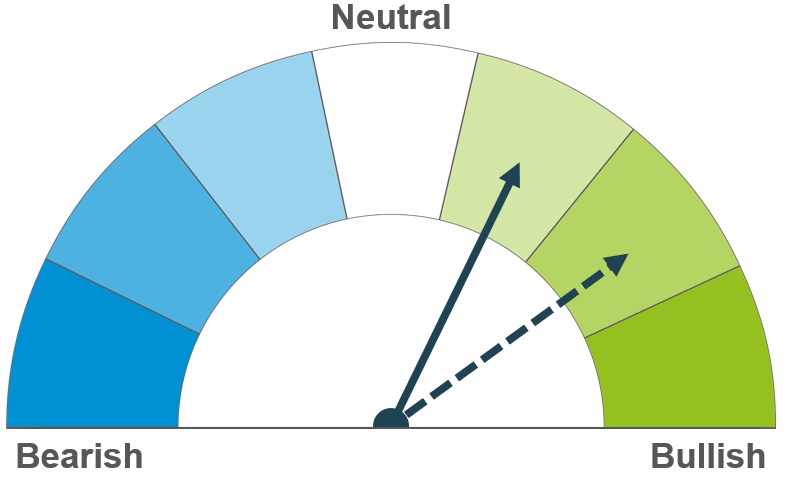

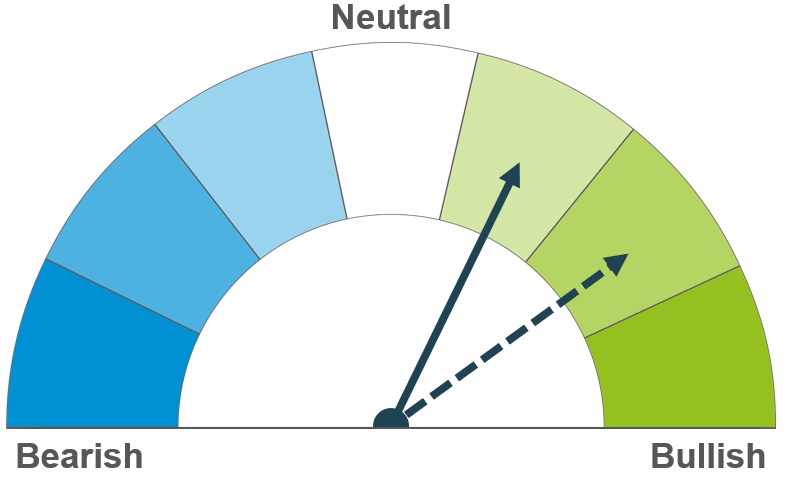

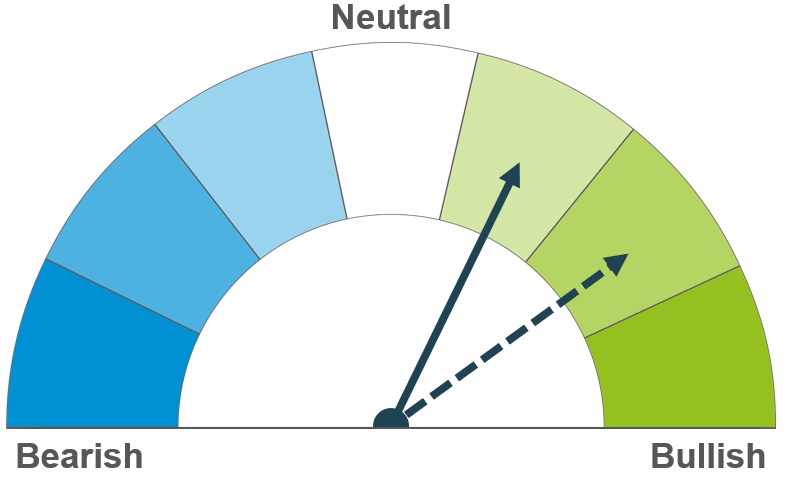

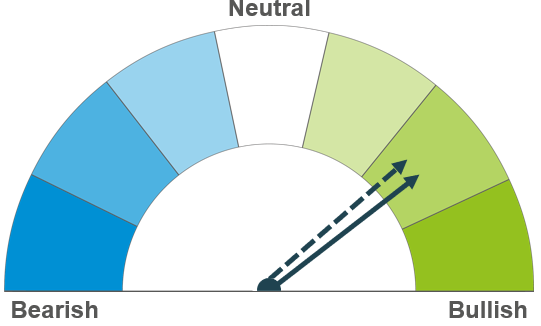

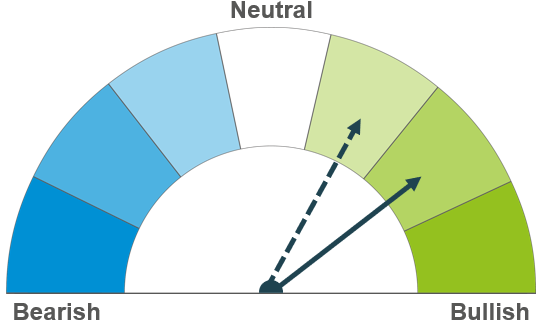

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat

Optimism over prospects for reopening some Ukrainian grain shipments offers some pressure in the short term. However, continued weather impacted supply concerns remain on the table.

Maize

Potential for some Black Sea shipments offers some pressure, but underlying support remains on supply concerns from global exporters.

Barley

Tight global supply & demand ensures barley markets continue to track global wheat movements closely.

Global grain markets

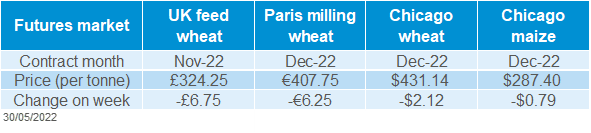

Global grain futures

Global wheat prices softened over the course of last week. Optimism over talks with Russia to open “grain corridors” drove much of this movement. The Chicago wheat (Dec-22) contract fell $2.12/t Fri-Fri, closing at $431.14/t. Paris wheat (Dec-22) followed the same trend, down €6.25/t over the same period, closing Friday at €407.75/t. However, both contracts bounced back on Friday, reversing some of the week’s losses. US markets were consolidating some of their positions ahead of today’s Memorial Day public holiday in the US, and further bullish news was added following the latest French wheat condition scores.

Data from FranceAgriMer on Friday showed a deterioration of the French wheat crop for the third successive week. Spring’s dry conditions, coupled with the recent hot weather, has resulted in 69% of the crop being rated good to excellent, down from 73% the week before. Last year at this point, 80% of the wheat crop was rated good to excellent.

The Ukrainian Agricultural Ministry reported on Friday that spring sowing was almost complete, but with the area 22% down on the year earlier. Official data showed growers had drilled 189Kha of spring wheat, 928Kha of spring barley and 4.4Mha of maize. The ministry stated earlier in the season that planned spring cropping area was 14.2Mha this year, down from 16.9Mha in 2021.

Concerns in the US remain over the planting of the last 5-10% of the maize crop. The weather forecast for these regions is not currently favourable, and there are fears that the crop won’t be planted until June, if at all. If realised, this could have a significant impact on US maize supply.

UK focus

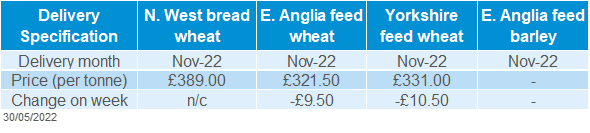

Delivered cereals

Nearby UK feed wheat futures (Jul-22) closed Friday at £314.75/t, a drop of £19.95/t on the previous week. The new crop contract (Nov-22) was down £6.75/t over the same period, closing at £324.25/t on Friday. Both contracts followed global grain prices down, on the news that a deal could be struck with Russia to allow grain exports out of Ukraine.

UK delivered prices followed suit. Feed wheat into East Anglia (Nov-22 delivery) fell £9.50/t last week (Thurs-Thurs) to £321.50/t. Bread wheat prices into the North West, for November delivery were pegged at £389.00/t, with no weekly comparison available.

Last week’s latest UK supply and demand estimates pointed to closing wheat stocks revised upwards, following stronger import pace, coupled with relatively stable demand and exports. However, carry out stocks for barley are set to be the lowest level for nearly a decade, with tight domestic availability, combined with stronger domestic consumption and exports factoring. Read the full release here.

The latest AHDB crop condition report, released on Friday, showed promising yield prospects for winter crops, following welcome rains in May. Spring cropping prospects remain weather dependant, although May rains have facilitated nitrogen uptake. The full report can be read here.

Oilseeds

Rapeseed

Short-term, old crop rapeseed prices will remain supported until Northern Hemisphere harvests. It’s reported that there is satisfactory flower of oilseed rape crops in the EU despite lack of rainfall (Stratégie Grains). Longer-term sentiment is dependant on export capacity out of the Black Sea for the 2022/23 marketing year.

Soyabeans

Constrained exports of other oilseeds in the short term will increase demand for soyabeans. Long-term focus is currently on US plantings, which over the next week may be delayed from forecast rains in key regions.

Global oilseed markets

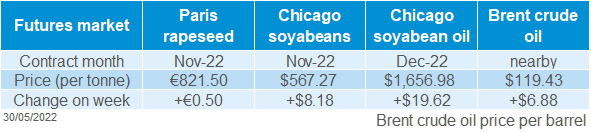

Global oilseed futures

Support was felt across the week for Chicago soyabean futures (Nov-22), the contract closing at $567.27/t. This was a gain of 1.5% across the week, closing at a contract high on Thursday (26 May).

The main supporting factor this week are the forecast rains in the U.S, which are expected to pose delays on the tail end of U.S. soyabean plantings. Rains are forecast over the next 7 days over much of the U.S. Midwest and Northern Plains.

Malaysian palm oil futures (Aug-22) posed a weekly gain of near 4%. Although exports of Indonesian palm oil have been allowed to resume, there is a clause that domestic obligation has to be fulfilled. The sales volumes will be based on refining capacity and local demand (Refinitiv).

Russia will not be removing its ban on exports of sunflower seeds at the end of August (Interfax). The ban was supposed start on April 1 and expire on August 31. However, there are plans to raise sunflower oil export quota by 400Kt up until 31 August (Refinitiv).

However, the latest Stratégie Grains oilseeds report has raised its monthly forecast for this year’s EU sunflower seed harvest to 10.9Mt, up from 10.7Mt reported in the previous month. An increase in production is a reflection of the increase in area, which is up 8.9% year-on-year.

Rapeseed focus

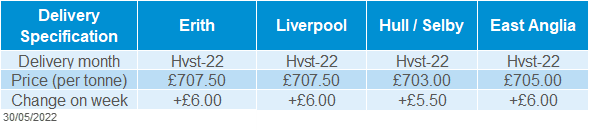

UK delivered oilseed prices

Paris rapeseed futures (Nov-22) closed at €821.50/t on Friday, up €0.50/t from the week before.

Delivered rapeseed into Erith (Hvst-22) was quoted at £707.50/t on Friday, up £6.00/t across the week.

Although continental prices remain relatively unchanged, domestic prices gained slightly more across the week. Currency changes drove much of this, as sterling weakened against the Euro (-0.4%) across the week, to close Friday at £1 = €1.1768.

Results of the latest AHDB crop condition report show that 70% of winter oilseed rape is rated good to excellent, a slight decrease from the 71% estimated in April. The report cited that while cleavers, thistles and wild oats are present in the crop, the thick crop canopy is providing effective competition. The full report can be read here.

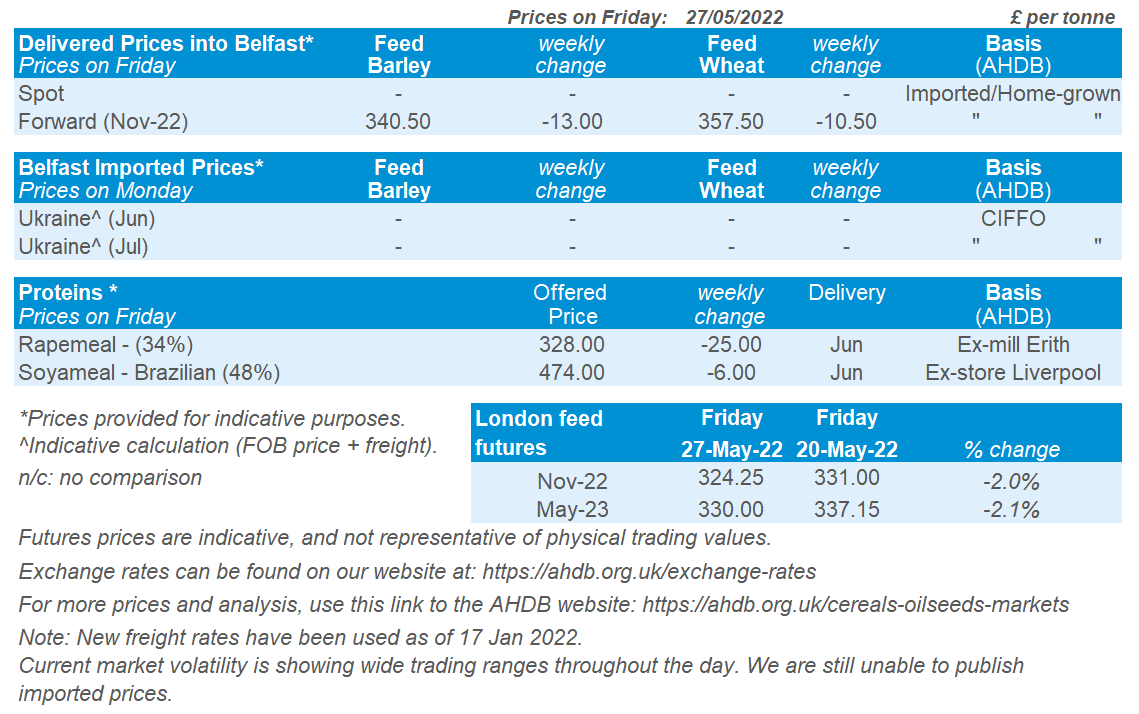

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.