Market Report - 28 March 2022

Monday, 28 March 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

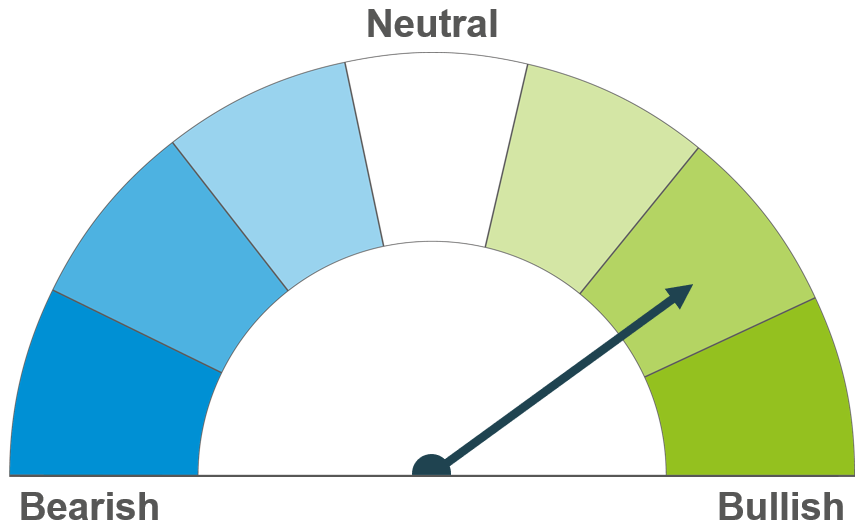

Due to the tight fundamental picture, global wheat prices are likely to remain elevated short-term. Although markets will stay volatile. US prospective plantings data will direct new crop markets at the end of the week.

Markets anticipate reduced US maize area in Thursday’s USDA report, though the data could also add further market volatility. US exports slowed but domestic demand could be strengthened in the bioethanol industry.

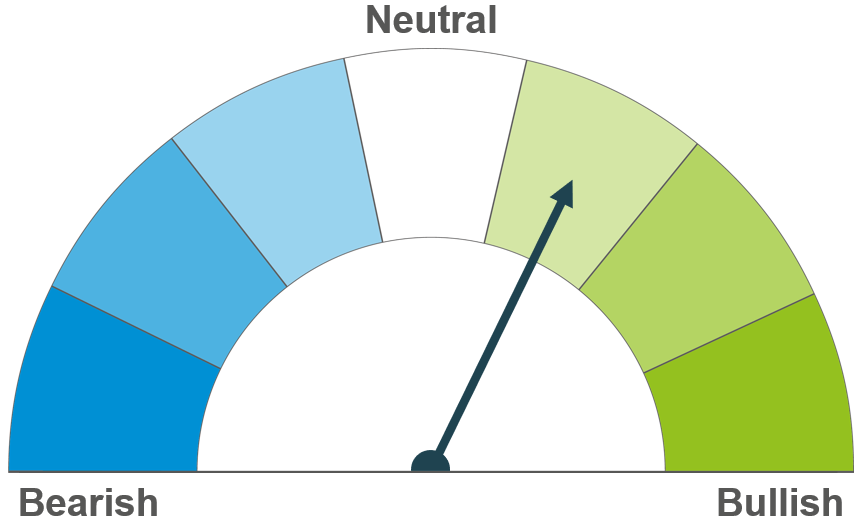

As barley supply is tight, there is little room for demand to shift from other grains. This allows barley to continue tracking wheat markets closely.

Global grain markets

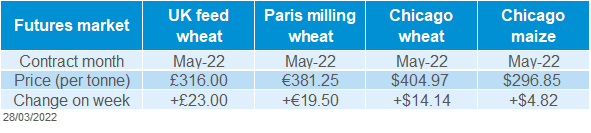

Global grain futures

Global grains moved higher again last week, although volatility remains a key feature of markets. 2021/22 global supply of wheat, maize and barley is tight, and the market stays sensitive to new news.

Markets await US stocks and prospective plantings data, due out on Thursday (31 Mar), to determine what future US supply may look like. Historically these reports can cause volatility but considering the tight supply and demand picture, and Black Sea disruption, this could be exacerbated. Expectation is for reduced maize acreage, but if trimmed further than anticipated, the market will likely push higher. Analysts currently expect an increased wheat area, but conditions are under question due to dryness. The first official US crop conditions report is due out next Monday (04 Apr).

Concerns remain regarding supply of old crop Ukrainian commodities despite rail movements. According to APK-Inform, the first rail-shipment of Ukrainian maize is heading to Europe. Due to the significantly reduced capacity of rail exports versus sea exports, the consultancy predicts only 1.0Mt of grain will be exported from March to June.

Last week, the UK agreed to lift the tariff on US maize imports from 1 June 2022, just as US export sales slowed. Net sales of 2021/22 US maize was down 47% from the previous week and 29% from the prior 4-week average. US wheat sales (2021/22) lifted slightly (up 7%) from a week previous but were also down from the prior 4-week average.

In other tariff news, last Wednesday Brazil lifted its tariff on US ethanol until the end of the year. This could result in increased domestic demand for US maize, to keep ethanol production maximised.

UK focus

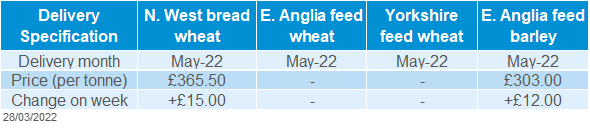

Delivered cereals

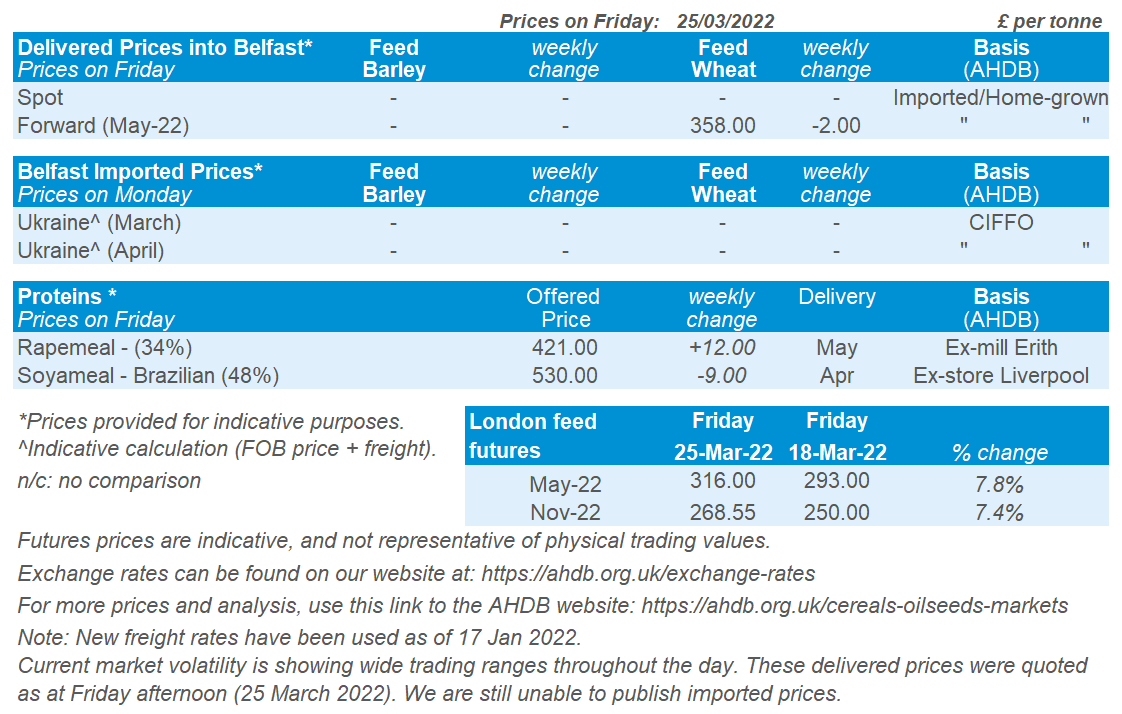

UK feed wheat futures continued their upwards trend. The May-22 contract settled at £316.00/t on Friday, up £23.00/t from the previous week and another record high. The Nov-22 contract also reached a new record settling at £268.55/t. It is key to note volumes traded remain relatively low.

Physical domestic prices also rose last week. Delivered feed wheat into Avonrange (May delivery) gained £11.50/t on the week, quoted at £316.00/t as at Thursdays close. This is up £115.00/t compared to the same time last year. Similarly, feed barley delivered into East Anglia (May delivery), quoted at £303.00/t is up £12.00/t on the week but £140.00/t higher than a year before.

The gains extended slightly for bread wheat. May delivery in the North West, bread wheat was quoted at £365.50/t (£55.00/t over futures), up £15.00/t from the week before.

Last week, AHDB 2021/22 UK cereals supply and demand updates were published. Despite an increase in the wheat balance estimate, it remains the third tightest on record. The barley balance is also tight. Currently estimated at 1.8Mt, this is expected to be the tightest barley balance since 2012/13.

Oilseeds

Rapeseed

Soyabeans

Global rapeseed supplies remain tight this season. Looking to next season, Ukrainian sunflower planting prospects will remain a watchpoint for global oilseed availability.

Brazilian harvest continues, boosting availability. Though strong US demand supports US prices. Longer term, US planting data (due on Thursday) will be key to determine the size of the northern hemisphere crop.

Global oilseed markets

Global oilseed futures

Volatility continued in global oilseed markets last week, led by the ongoing war between Russia and Ukraine and consequent trade disruption.

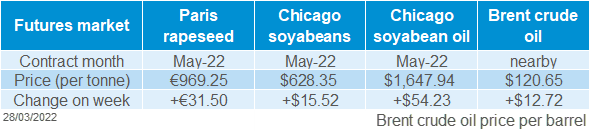

Brent crude oil (nearby) gained $12.72/barrel last week, to close at $120.65/barrel. This said, prices are set to fall today after China announced a nine-day lockdown in Shanghai for COVID-19 testing.

The Brazilian soyabean harvest is 70.6% complete as at 19 March (Conab). This is 10.5 percentage points (pp) ahead of this time last year, and up 7.5pp from the previous week.

Despite new South American supplies being available, US export sales for soyabeans remain strong due to their competitive pricing (Refinitiv). Last week, the USDA confirmed flash sales of US soyabeans for 2021/22 delivery totalling 690.2Kt, to China and unknown destinations. Strong demand and concern for the Ukrainian sunflower crop supported the soyabean complex across the board last week.

Key US data is due on Thursday (31 Mar) including March stocks and prospective planting intentions. US soyabean exports for 2021/22 have been strong in recent weeks. Can this continue this season? This depends on how much remains on farm. Stocks smaller than trade expectations may send US prices higher.

The trade is expecting US prospective planting to show a slight increase in area of soyabeans, at the expense of maize. Though how big this increase is, will be key for global supplies next season. Ahead of Thursday, markets are likely to remain quiet.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed (May-22) gained €31.50/t (3.4%) last week, to close at €969.25/t. Winnipeg canola (May-22) also gained last week, though to a lesser extent (up 1.3%).

The market remains very volatile. This is likely to continue as we move towards April, and markets focus on how much of the Ukrainian sunflower crop manages to be planted.

On Friday, we were unable to publish any delivered rapeseed prices due to insufficient quotes received. At a time with such price volatility, we are committed to providing both timely and accurate pricing information.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.