Market Report - 25 January 2021

Monday, 25 January 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Paris rapeseed futures (May-21) closed on Friday at €422.75/t, down €3.50/t from Thursday’s close and €3.25/t lower on the week.

Falls on the Paris market and easing concerns over South American weather were also carried into delivered prices last week. Delivered rapeseed (Feb-21) into Erith, fell £8.00/t on the week, quoted at £384.00/t on Friday.

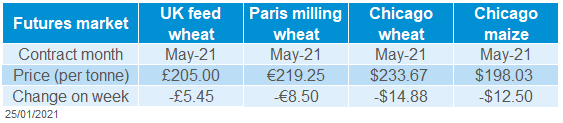

Global grain markets

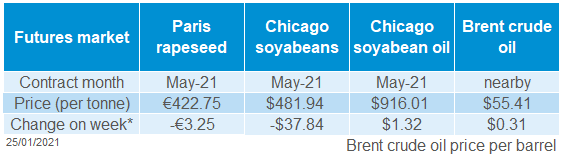

Global grain futures

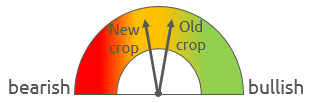

The outlook for old crop wheat has softened but remains supported by the tight supplies of old crop maize. The potential for the European crop to recover is weighing on the new crop outlook.

UK focus

Rain has lessened concerns for the 2020/21 South American maize crop. Demand is still expected to exceed global supply currently, keeping an underlying support for now.

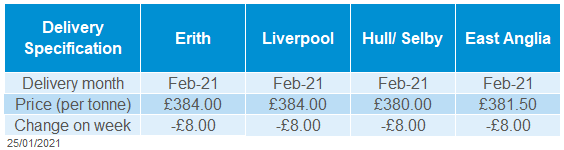

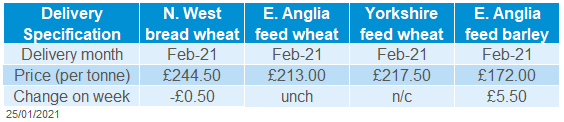

Delivered cereals

Strong animal feed demand for barley is supporting prices currently. Barley looked attractive after a large gap opened between the price of barley and other grains.

US maize futures recorded their first week-on-week decline for six weeks, which also pulled global wheat futures down. Significant rain over the past two weeks in South America has benefited maize crops.

The rain came too late for some crops, with 4% of the first maize crop in Brazil harvested by 15 Jan (Conab). Soil moisture reserves are still lower than ideal in some areas, but overall, they’re much improved from the start of the year. Plus, the biggest maize crop of the continent, the Brazilian Safrinha maize crop, is only just starting to be planted.

There are worries that demand could slow in response to the higher prices. The increase in cases of COVID-19 in China is also causing some concern, though China again bought large volumes of grain from the US last week.

Speculative traders are heavily bought into the US futures markets. If prices continue to slip, it could trigger them to sell and exacerbate a decline.

Recent heavy snowfall in Russia is expected to boost soil moisture conditions come spring. Sovecon increased its forecast for the 2021 wheat crop by 0.9Mt to 77.7Mt. This is 7.6Mt less than 2020 (USDA) but in line with the 5-year average. The Russian government expects the total 2021 grain crop to reach 131Mt, just 2Mt below 2020.

Oilseeds

UK futures (May-21) recorded their first weekly decline (Fri-Fri) since mid-December last week, due to global grain prices falling. Most UK delivered wheat prices fell Thursday-Thursday.

The premium for delivered bread wheat over futures is being squeezed in some locations. Thursday-Thursday, the price for bread wheat delivered to North-West (May) fell by £0.50/t, the same as May-21 futures. But, the May-21 price for Northamptonshire delivery fell by £2.50/t.

In contrast to wheat, delivered feed barley prices rose last week (Fri-Fri). Demand from the animal feed sector is robust. The current cold weather could potentially add demand, if it increases the need for supplemental feeding.

Global oilseed markets

Global oilseed futures

With the easing of supply concerns for soyabeans and crude oil stock highs, rapeseed prices are following the overall trend of easing oilseed prices.

Rapeseed focus

Rains in South America have eased some supply concerns for soyabean crops. Brazil’s 2021 soyabean crop is estimated at a record level, but there is still some time to go until figures are final.

UK delivered oilseed prices

Chicago soyabean futures (May-21) fell $37.84/t on the week, to close at $481.94/t on Friday. Last week, rains in South America eased concerns for tight global supplies, resulting in losses to oilseed futures on the week.

Despite delayed planting, analysts’ forecasts for Brazilian soyabean production are at a new record level. In a poll by Refinitiv, an average crop of 132.2Mt from 38.41Mha was determined from a range of forecasts, with production estimated up 5.9% year-on-year.

With easing supply concerns, speculative traders (managed money) cut their net long position in soyabeans. Net positions held by managed money as a percentage of open interest fell 1.5% percentage points on the week to 14.6%.

For the wider oil complex, nearby Brent crude oil futures saw small increases on the week. But, prices fell for May delivery onwards. US crude stockpiles rose by 4.4M barrels last week, but capacity utilisation increased. This means more demand is expected in the short term. That said, recent reports highlight that "Big Oil" slowed their search for new fossil fuels last year.