Market Report – 23 August 2021

Monday, 23 August 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Globl supply continues to look tight in many key regions. Strong demand for European wheat is a key support factor for Paris, and so London, futures.

Maize

While global maize supply is expected to be tight, this season, strong yield expectations in parts of the US and weaker demand for ethanol may temper support.

Barley

Strong demand for animal feed and export markets is a key support factor for barley, although supply is expected to remain relatively strong.

Global grain markets

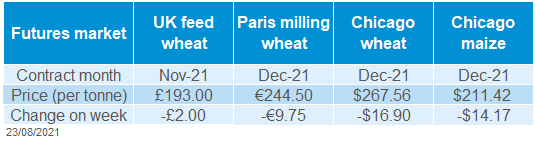

Global grain futures

Following strong gains in grain markets over the past few weeks, prices fell back last week. Chicago maize was a strong part of the price falls. The Pro Farmer tour of parts of the US maize region, known as the Corn Belt, found a mixed picture for yields. Yields in the top two producing states of Iowa and Illinois are seen up 4.5% and 6.5% on the three-year average, respectively.

Good yield potential is generally seen in the east of the Corn Belt, whilst western states have suffered from dry weather. The maize harvest typically takes place through September and October, so the weather can still improve or reduce yield potential. This potential for yield impact will be a key influencer of prices in the next few weeks.

Paris milling wheat prices, strengthened towards the end of last week, limiting losses Friday-Friday. Demand is a key driver of EU prices at present. Romania has been a top origin in recent Egyptian (GASC) tenders, which has in turn supported EU pricing.

Russian cash prices have also seen support. The key wheat exporter has seen prices move higher as supplies are slow to come forward, according to Refinitiv.

Finally, the US Environment Protection Agency is reportedly looking to reduce biofuel blending mandates through the remainder of 2021. This would pull some demand from maize in the short-term. That said, the EPA is also looking to up mandates in 2022, which offers some medium to long-term support.

UK focus

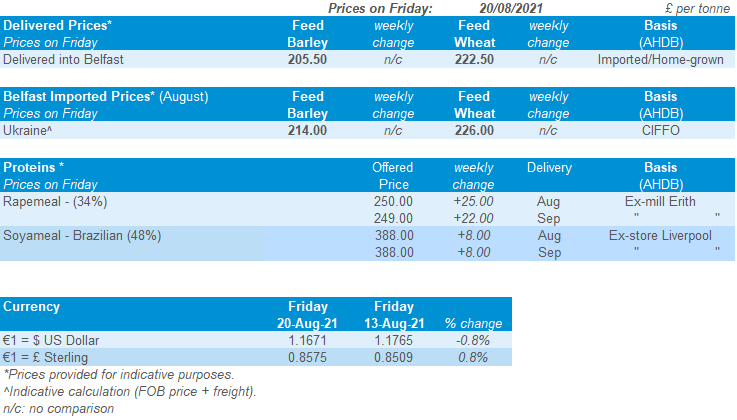

Delivered cereals

On Friday, we published our latest estimates of GB harvest progress. The GB wheat harvest was seen to be 20% complete in the week ending17 August. At 8.0-8.4 t/ha, early estimates of wheat yield are ahead of the average of the previous five years (2016-2020, 7.96 t/ha). It should be noted that this includes last year’s low yield. The 2015-2019 average yield for wheat was 8.37 t/ha. The full harvest report, contains further information on winter and spring barley and oats.

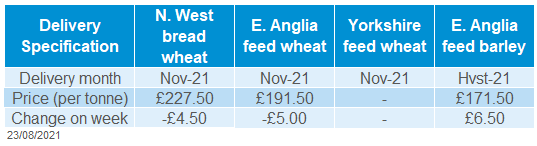

UK delivered wheat prices fell with futures prices last week. Feed wheat delivered East Anglia (Nov-21) was £5.00/t lower, at £191.50/t, on Thursday. UK feed wheat futures (Nov-21) fell £4.85/t Thursday to Thursday.

Milling wheat premiums continue to hold. North West delivered bread wheat (Nov-21), was quoted at a £36.50/t premium to UK Nov-21 feed wheat futures, on Thursday, down £0.50/t on the week.

Oilseeds

Rapeseed

Tight global supply of rapeseed and vegetable oils will continue to support prices this season. Though new news on the US biofuel blending mandate could restrict demand for vegetable oils.

Soyabeans

Global crop sizes are key to sentiment in soyabeans. With pod filling continuing in August for US crops, rains will be crucial in drought hit states.

Global oilseed markets

Global oilseed futures

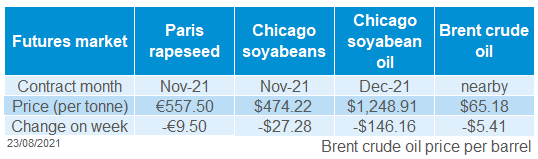

Chicago soyabean (Nov-21) fell $27.28/t last week, to close at $474.22/t on Friday.

On Friday, there was news that the US Environmental Protection Agency are recommending the 2021 biofuel blending mandates be below 2020 levels. This caused weakness in vegetable oil and oilseed prices. For 2022, mandates are to be higher than 2021 or 2020, though by how much is uncertain.

Improved weather forecasts for the US Midwest played a large part in a bearish sentiment mid-week. Rain is due in the north west of the Midwest. August is a critical pod fill month for soyabeans, so rain could boost yield potential for the US crop. Weather remains a key sentiment driver, with several top producing states, including the Dakotas and Iowa, still suffering drought conditions.

The Pro Farmer crop tour last week found positive soyabean yield prospects in Illinois, with pod counts estimated higher than last year and the three-year average. As with grains, the outlook was not as positive in the states further west, with more rain required to aid yield development.

Providing some support on Friday were strong US export sales. On Thursday, the US reported 2021/22 net sales of soyabeans (6-12 August) at 2.14Mt. Of the increase, 1.03Mt is to China and 841Kt to unknown destinations.

According to Refinitiv, Chinese soyabean imports from Brazil fell 3.7% in July 2021 (totalling 7.88Mt) from July 2020. This is due to poor crush margins from falling pork prices in China.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (Nov-21) closed €9.50/t lower week-on-week, at €557.50/t on Friday. This follows the news about US biofuel mandates and improving US yield prospects for soyabeans.

Global rapeseed supply and demand continues to look tight, with the global stocks to use ratio at 6.4%. This is the lowest since 2016/17.

Candian canola supply remains a concern, with yields expected to be the lowest since 2012 due to hot and dry conditions. Harvest has started in Saskatchewan ahead of last year, with 4% harvested as of 16 August.

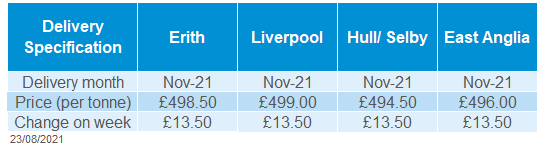

Delivered prices gained £13.50/t last week (Friday to Friday); delivered Erith (Nov-21) was worth £498.50/t. A weakening of sterling protected domestic markets last week and AHDB’s survey completed before the news about US biofuel mandates.

GB winter OSR harvest is reported to be 83% complete, as of 17 August. Yields are currently pegged between 3.3-3.5t/ha and oil content at 42-44%.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.