Market Report - 22 November 2021

Monday, 22 November 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

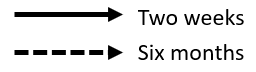

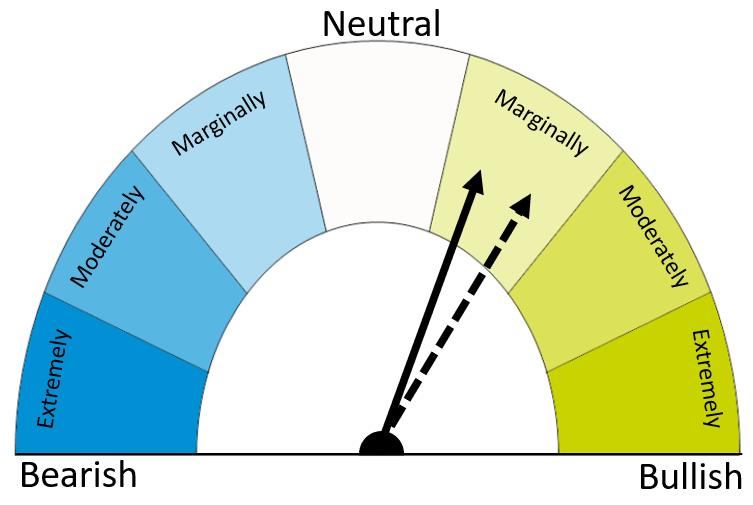

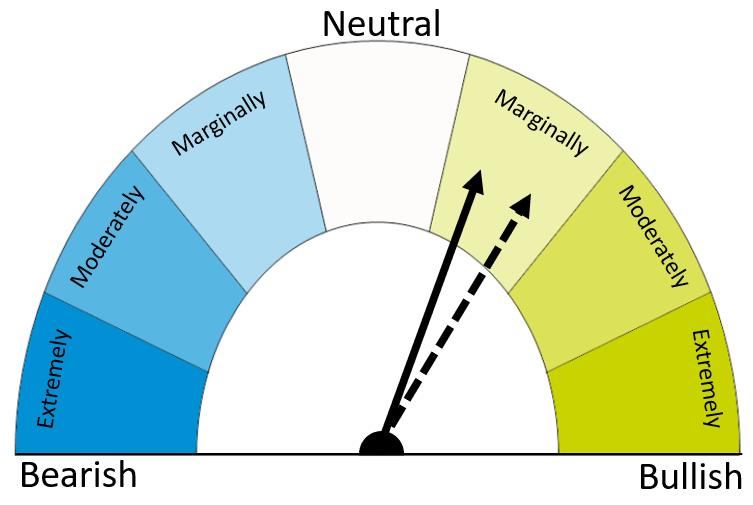

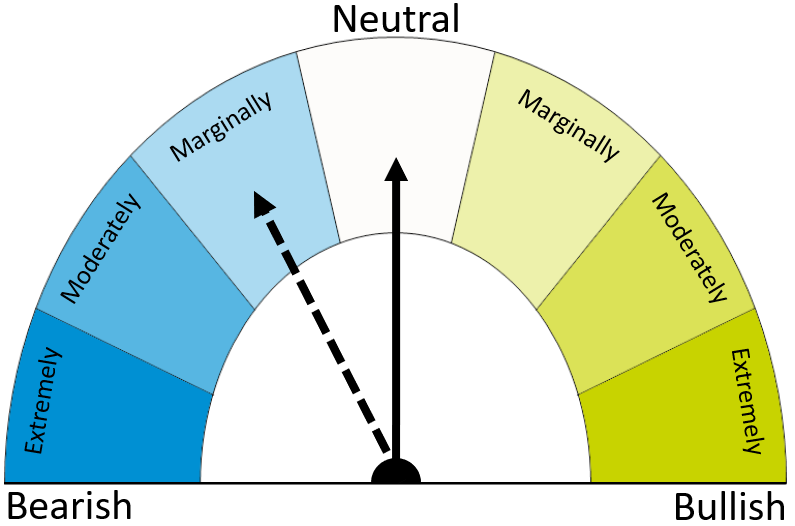

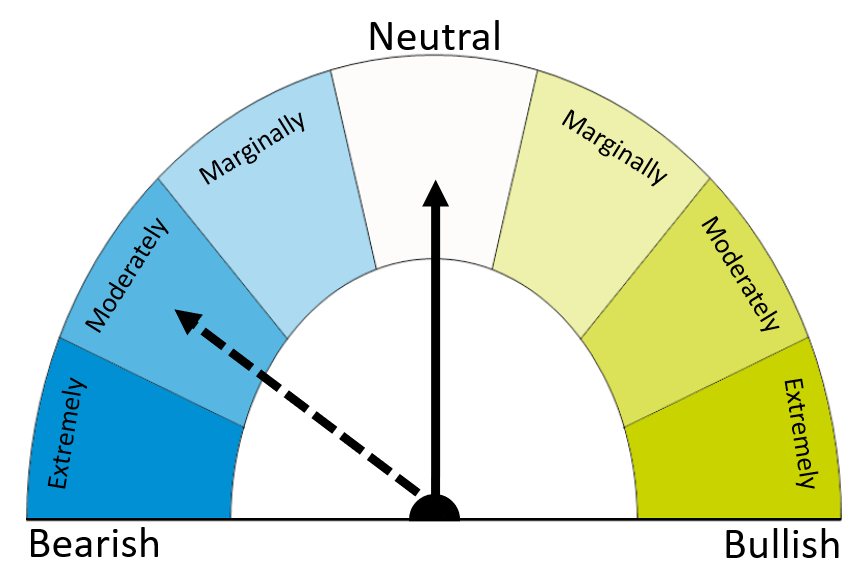

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat

Maize

Barley

Global markets continue to find strength on tight global supplies. The market awaits the Australian crop which is on track for bumper volumes although is seemingly lacking quality, particularly protein content.

South American output could be realised at a record level with favourable weather in Argentina and southern Brazil currently. Prospects for optimal planting of the safrinha crop are hopeful.

Barley follows wheat markets as global supply will likely remain tight through to the next marketing year.

Global grain markets

Global grain futures

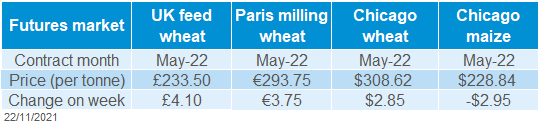

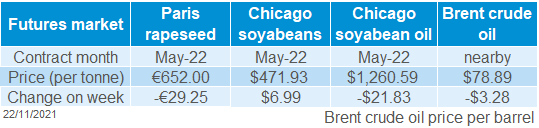

Global wheat markets continued to strengthen last week, despite a slight blip on Tuesday. Paris wheat, old-crop (May-22) and new-crop (Dec-22), gained on the week closing at €293.75/t and €264.00/t respectively. This, once again, sets records.

Chicago wheat did similar closing Friday at $308.62/t for old-crop (May-22) and $305.03/t for new-crop (Dec-22), both up on the week.

The anticipated bumper crop in Australia is becoming questionable from a quality point of view. Rain in the Eastern states has hampered some harvest progress and although there is finer weather in Western Australia, quality is still uncertain. The spread between Australian Standard White (ASW) and Australia Premium White (APW) has widened to AU$30/t, the widest since Platts began reporting in October 2019. Rain during harvest has negative effects on quality and sources suggest harvest so far is of large volumes of lower protein wheat.

In Southern Brazil and Argentina, wetter weather has also been apparent, but this is good news for the region. This will assist the first maize crop and soyabeans. If the soyabean harvest occurs in good time, it will allow for the safrinha maize crop to be planted within the optimum window, helping realise the anticipated record crops.

On the other hand, demand remains relatively strong, particularly from the US ethanol sector. Latest production figures show, to week ending 12 November, 1.06M barrels per day were produced.

UK focus

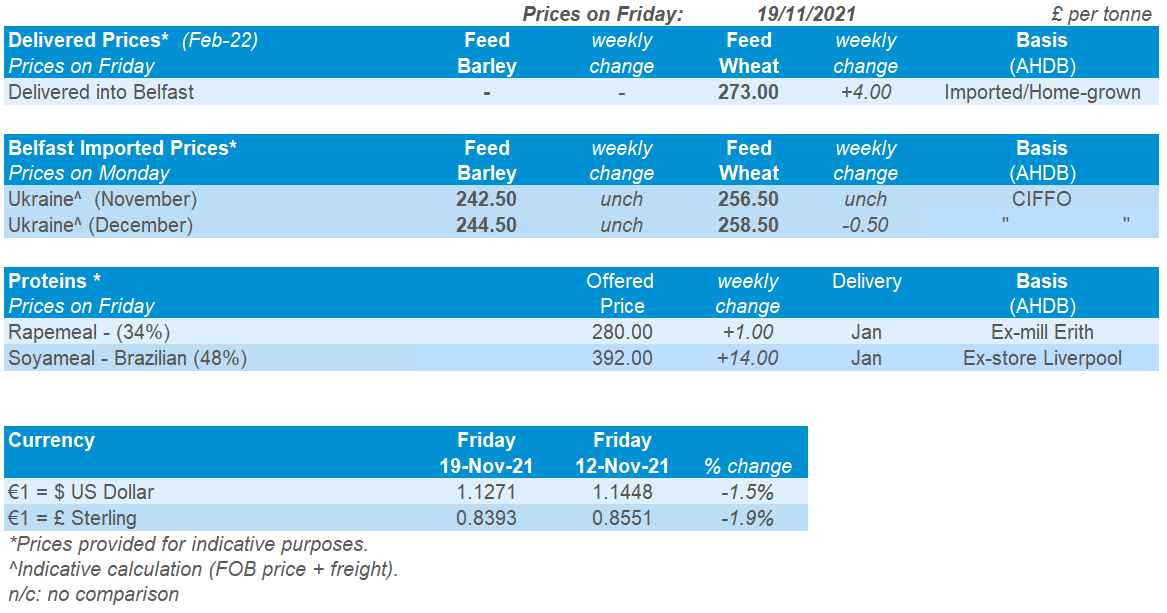

Delivered cereals

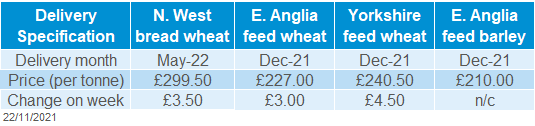

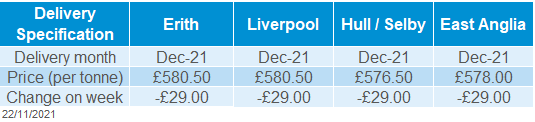

UK feed wheat prices have been strong in recent weeks; with new-crop (Nov-22) closing Friday at another contract high (£205.00/t). Old-crop (May-22) also reached new highs on Friday closing at £233.50/t, up another £4.10/t on the week. This is a record high for all ICE UK feed wheat futures contracts, not just for the May-22 contract.

AHDB’s Early Bird Survey of plantings and planting intentions gives a first insight into harvest 2022. Unsurprisingly intentions suggest a strong continuation of winter cropping, with wheat exceeding the ten-year average planted area at 1.81Mha.

The intended total barley area for harvest-22 is 1.10Mha. This is marginally down from 2021 harvest and sees a further swing back towards winter barley. The current reduction in spring barley area could change when spring planting begins. If strong prices continue, coupled with relatively low fertiliser requirements, intentions may shift to a larger than initially intended area.

The oat area is also anticipated to drop back (5%) to 189Kha, just above the five-year average.

AHDB

AHDB

Oilseeds

Rapeseed

Despite last week’s price falls, global rapeseed supplies remain tight. Plus, there is still underlying support from wider vegetable oil prices. A potential recovery in palm oil output and large South American soyabean crops in 2022 make the longer-term outlook more bearish.

Soyabeans

International demand is again supporting prices in the near term. But, prospects so far remain positive for South American crops, which seems set to weigh on markets further ahead.

Global oilseed markets

Global oilseed futures

Chicago soyabean futures rose last week due to strong demand for US soyabeans in export markets. This included a sale of 132Kt by private exporters to China. There was some profit-taking at the end of the week, but the market still closed higher.

Malaysian palm oil prices also rose, due to strong exports and worries about a slowdown in Malaysian production. Production could ease as the season peak passes and monsoon rains increase. Higher palm oil prices have supported global rapeseed prices over recent months.

Malaysian palm oil exports are up so far in November. Cargo surveyors report 1-20 November exports are between 9% and 18% higher than the same period in October, depending on the reporter.

However, old crop Paris rapeseed futures dropped sharply last week. This was partly due to technical factors after the market set new records on 12 November. A decline in crude oil prices added to the fall. Crude oil prices fell on worries rising COVID-19 cases in Europe could weaken demand and a rise in the US dollar against most currencies.

Rapeseed focus

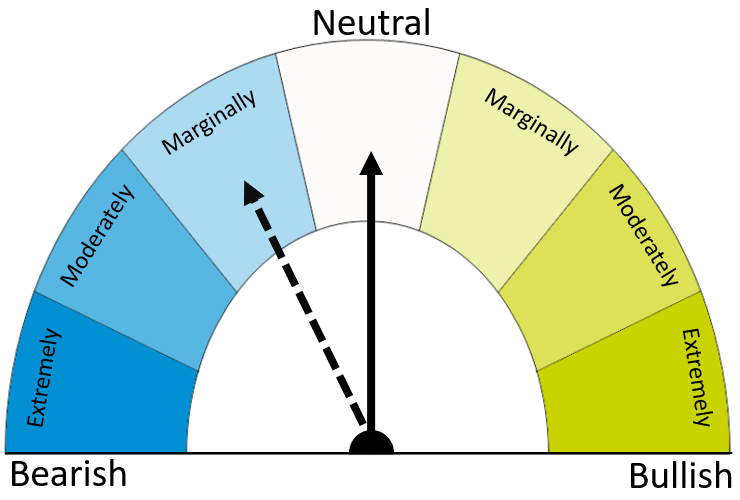

UK delivered oilseed prices

UK delivered rapeseed prices fell sharply last week following the fall in Paris rapeseed futures and a rise in sterling against the euro. Last week, sterling rose 1.6% against the euro to £1 = €1.1909, the highest level since February 2020 (Refinitiv).

AHDB’s Early Bird Survey showed the UK rapeseed area could rise to 345Kha for harvest 2022. This is up 13% from 2021, likely incentivised by current strong prices. But, this increase is not as big as many may have expected. It is still the second lowest OSR area since 1989 (last year being the lowest). This is most likely a reflection of both high input costs and the ongoing battle against Cabbage Stem Flea Beetle.

The German winter rapeseed area could rise 4-9% for 2022, according to the industry association UFOP. At 1.03 -1.08 Mha, the area would be the biggest since 2018. A larger area for Europe’s top rapeseed grower gives more confidence that global production will recover for 2022/23.

Northern Ireland

AHDB

AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.