Market Report - 16 November 2020

Monday, 16 November 2020

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

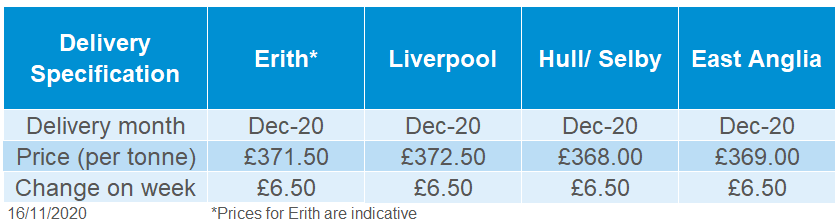

Rapeseed values followed the global rally in oilseeds, with May-21 Paris rapeseed futures closing on Friday at €407.00/t, a rise of €10.25/t on the week. Similar rises were seen in domestic rapeseed markets, with rapeseed delivered into Erith (Dec-20) quoted at £371.50/t. Following a prolonged shut down Erith is taking rapeseed again, although movement is reported to be sporadic.

Along with support from soyabeans, further support for the oilseed complex was seen driven by palm oil. Oilworld have reported that Indonesian palm oil output in 2020 is estimated at 42.2Mt, down 2.1Mt year-on-year (www.Oilworld.biz), meanwhile Malaysian palm oil stocks were reported at 1.8Mt in the year to October, down from 2.6Mt in 2019.

Wheat

The latest USDA WASDE increased opening stocks of global wheat by 1.4Mt compared with previous forecasts. Increases in consumption and exports capped global ending stocks, which were down 1Mt on the month, although they remain at a record high. Strong international demand continues which will support the market going forward.

Global grain markets

Maize

As Chinese purchasing continues, they are forecast to exceed their annual Tariff Rate Quota (TRQ) of 7.2Mt. This, combined with the latest USDA report forecasting US maize stocks at a seven year low, is currently supporting maize.

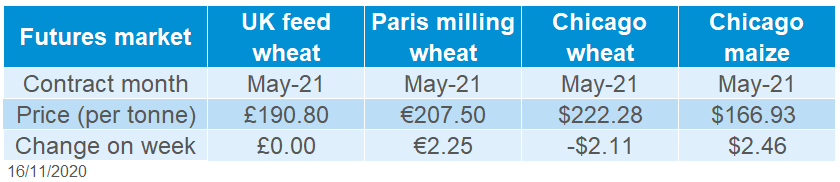

Global grain futures

Barley

Barley prices will fluctuate in line with other feed grains. The demand for malting has reduced from the latest lockdown measures but demand internationally for animal feed remains.

UK focus

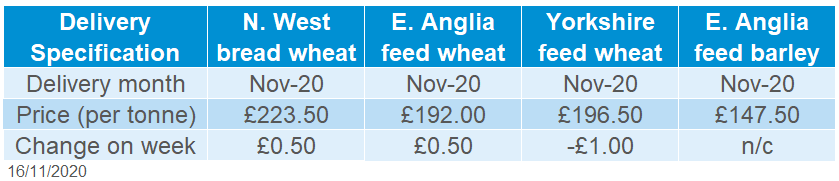

Delivered cereals

Chinese demand for agricultural commodities continues to support global prices, as Chicago maize encapsulated some annual highs mid-last week.

China’s imports of barley, maize, sorghum and wheat jumped 191% to 5.16Mt from July to September 2020 compared to the same period in 2019 (IHS Maritime & Trade – Global Trade Atlas® - China Customs).

The latest USDA world agricultural supply and demand estimates (WASDE) released on Tuesday painted a bullish picture for maize markets, with the Chinese maize import forecast revised up to 13Mt. However, this was still short of some market expectations.

US production of maize was revised down to 368.5Mt, while US exports were revised up by 8.3Mt, absorbing the loss from Ukrainian exports (revised down 8.0Mt, to 22.5Mt). US ending stocks are now forecast at 43.2Mt, the lowest since 2013/14.

The Russian agricultural ministry announced a limit (tariff rate quota) on the volume of grains that can be exported from 15 February until 30 June, of 15Mt. Markets didn’t react much to this news as it had been anticipated for some time. Chicago wheat (Dec-20) closed down by $3.12/t across the week, to close at $218.07/t.

SovEcon Agriculture announced that Russia’s November exports of wheat, barley and maize are estimated at 5.1Mt, up from 4.95Mt in October. If strong exports are seen in December and January, then the impact of the latest Russian wheat TRQ could be minimal.

There is a strong international demand for grains, with tenders issued last week from an array of key importers.

Despite demand from the Middle East, Paris milling futures (Dec-20) only gained marginally across the week, to close on Friday at €210.00/t. Globally, there is still a significant supply of wheat as a bumper Australian crop is expected to come online in the coming months.

Oilseeds

Domestically trade across the week was described as relatively quiet. Milling wheat delivered into the North West (Dec-20) was quoted at £225.00/t. A continuing trend this season has been the wide carry in prices from 2020 into 2021, compensating post-Brexit trade uncertainty. The carry for North West group 1 bread wheat from December to January was quoted at £4.00/t as at 12 November.

UK wheat futures (May-21) remained flat closing on Friday at the same value as the week before, £190.80/t. Sterling strengthened across the week (+0.56%), closing on Friday at £1=€1.1142. This led to gains in Paris Milling futures not being encapsulated in domestic markets.

Latest HMRC trade data released last week showed the UK imported 330.5Kt of wheat in September, with Canada (93.7Kt) and Germany (50.3Kt) accounting for c.44% of imports. Further to that, the UK imported 227.0kt of maize.

Rapeseed

With a tight global oilseeds market prices remain firm, while support is seen for oils from tight palm and soy oil markets. This looks set to continue whilst the South American crop size is determined.

Global oilseed markets

Soyabeans

Soyabean supply and demand was tightened further last week by the USDA, combined with strong export activity, this is keeping markets buoyant. Increases in Brazilian output forecasts may cap gains longer-term.

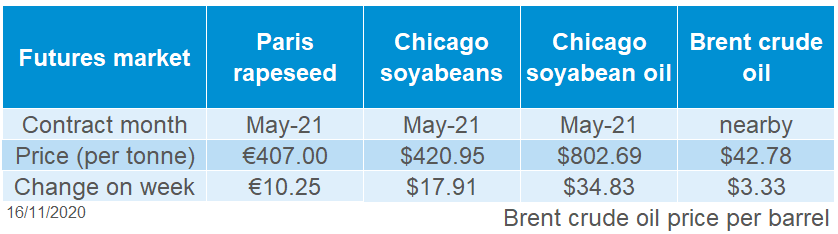

Global oilseed futures

Rapeseed focus

UK delivered oilseed prices

The oilseed complex continued to firm last week, driven by tightening in soyabean production forecasts in the US and Argentina, and a surge in value for palm oil. Chicago soyabean futures (May-20) closed the week 4.4% higher, Friday-Friday.

A key part of the move higher was the bullish USDA world supply and demand estimates (WASDE) released on Tuesday last week. The report cut 2.7Mt from 2020/21 US soybean production on lower yields, pegging output at 113.5Mt. The report also cut 2.5Mt from Argentinian soyabean production, owing to reduced area expansion in light of economic uncertainty.

In light of the cuts to US and Argentinian production, world ending stocks of soyabeans in 2020/21 were reduced by 2.2Mt to 86.5Mt, the lowest level since 2015/16.

Production cuts have not been seen everywhere, and although not reflected in last week’s WASDE, there has been an expansion in soyabean plantings in Brazil, according to Conab. This is expected to be off of the back of firmer soyabean prices due to a tighter world outlook. The area planted to soyabeans is seen up 372Kha on October’s forecast and up 1.3Mha year-on-year. Brazilian production is now forecast at 135.0Mt, up 10.1Mt on 2019/20.

Rainfall in South America has aided planting progress in some states. However, ongoing dryness and the impacts of this year’s La Niña are being felt, with weather remaining a key watch point for crop development.

Chinese buying of oilseeds remains a key component of the soyabean price rises of late. In the latest USDA export sales data, net sales of 746Kt of soyabeans to China were reported, with total outstanding sales to all destinations now standing at 30.1Mt.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.