Market Report – 15 February 2021

Monday, 15 February 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

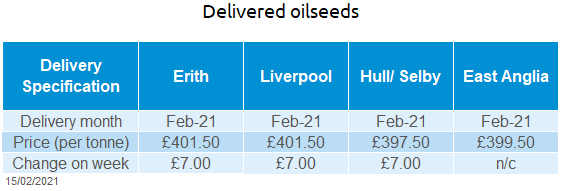

UK delivered rapeseed (Feb, Erith) gained £7.00/t on the week, quoted as £401.50/t on Friday. New-crop UK rapeseed benefitted even further, gaining £9.50/t on the week to be quoted at £370.50/t for November on Friday.

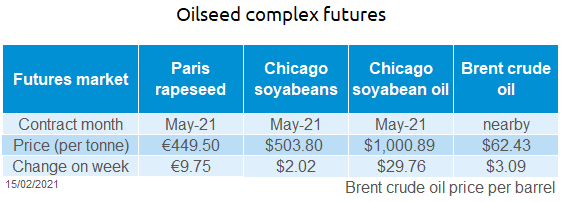

Last week’s gains in UK delivered prices were, in most part, due to rising Paris rapeseed futures. Paris rapeseed (May-21) gained €9.75/t Friday-to-Friday, to close at €449.50/t. Still, some gains were curbed by strength sterling against the euro.; Friday-Friday, sterling strengthened by 0.3% (£1=€1.1393 to £1=€1.1427).

Wheat

Global grain markets

Maize

Global grain futures

Barley

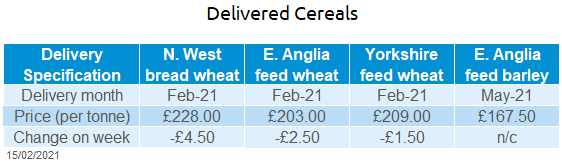

Old crop markets are largely neutral with no fresh news at present to continue support. UK new crop sentiment has firmed with discussions around increased ethanol demand.

Demand is still the key driver for maize and is likely to be quieter this week. Lower usage in parts of Asia and Europe has been met with increased supply forecasts from Conab.

UK focus

Barley prices had been supported lately with increased demand for animal feed. However, prices may now have curtailed some demand as wheat falls, particularly with large supplies expected next season.

Delivered cereals

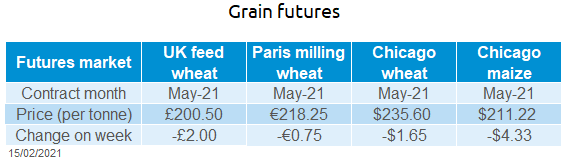

Grain market movements were mixed last week. The Chicago maize (May-21) market ended the week lower, but did recover a small amount of strength towards the end of the week. A bearish USDA world supply and demand estimate (WASDE) report, combined with a cancelation of unknown destination US exports, leave prices $4.33/t lower on the week.

The WASDE showed global maize ending stocks to have increased by 2.7Mt, owing to lower feed usage in Japan, South Korea, and the EU. Stocks excluding China were seen falling by 1.8Mt, with increases to US exports.

Maize production in South America was left unchanged, despite lower revisions to USDA post estimates. But, estimates of Brazilian maize production by Conab were increased; higher prices have clearly driven increased acreage.

This week could well be a quiet one for US export sales, which have been a key driver of price in recent weeks, with Chinese New Year being celebrated.

For wheat, the market tightened in Tuesday’s WASDE, with feed consumption increased for many countries. This was most notable for India, where domestic consumption was raised by 3.5Mt. Feed consumption was raised by 5Mt in China.

Going forward, the shape of grain demand will be key for prices and continues to support values at present. We also need to monitor crop conditions in South America as we move through planting, and North America as we move into the fight for acres. Dryness is a watch point for both regions.

Oilseeds

For the UK, prices dropped to the £200/t support level in the middle of last week, and then hovered around that level. Sterling has continued to gain against the euro and is back up to levels seen last April. This has capped support for grain prices.

New crop values have seen more support than old crop. Shifts in the tax relief available on wheat usage in renewable fuels and the potential for introduction of E10 fuel are supporting the new crop sentiment.

Old crop delivered feed wheat values lost further ground last week in line with futures prices. We can see a further squeeze on premiums for some regions. Lacking demand for milling wheat persists, and premiums fell again on Thursday. The premium for new crop delivered feed wheat (Nov-21) into North Humberside, extended by £1.00/t to £6.50/t over Nov-21 futures week-on-week.

Rapeseed

Ongoing support for soyabeans boosts both Matif rapeseed and as a result, UK delivered prices. Tight UK and European supply continues’ to provide support to rapeseed prices.

Global oilseed markets

Soyabeans

Brazilian crop cuts and increased US exports are providing continued support for soyabean prices, in addition to record US crush levels.

Global oilseed futures

Rapeseed focus

UK delivered oilseed prices

The release of February’s USDA world supply and demand estimates (WASDE) saw an increase in world exports by 590Kt to 169.69Mt. In addition, and as predicted by the polls, a reduction in world ending stocks by 950Kt to 83.36Mt was also recorded. Without China, world ending stocks are estimated as 54.76Mt; this is the lowest since 2013/14.

Ending stocks were reduced due to lower US and Brazilian stocks, offsetting increases in Argentinian stock. January rains eased dryness concerns, leading to Argentina’s Bolsa de Comercio de Rosario Grain Exchange increasing their soyabean crop estimate by 2Mt. However, the dry weather looks set to continue. Rain has slowed the Brazilian harvest, which combined with planting in drought, has meant January’s soyabean exports (totalling 49.5Kt) were 28 times smaller than January 2020. Whereas the US inspected 8.9Mt in January: the highest on record.

In response to last week’s WASDE, Chicago soyabean futures (May-21) rose $12.12/t to $513.90/t on Tuesday, from the previous Friday. Prices then eased back mid-week, to close $2.02/t up, at $503.80/t on Friday. The end of the week was the start of Chinese New Year, quietening trade.

Ahead of the NOPA crush report released on 16th Feb, analysts peg the US’s January crush to be within 180-186.3Mbu, with an average 183.1Mbu: close to December’s crush and if realised, the largest January crush on record.

Tension in the Middle East has resulted in crude oil prices rising to their highest value in over a year. As a result, palm oil demand for biodiesel lead to Malaysian palm oil futures gaining over 2% today. Chicago soya oil rose 0.9% on Friday.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.