Market Report - 11 October 2021

Monday, 11 October 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

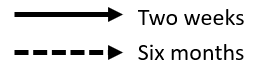

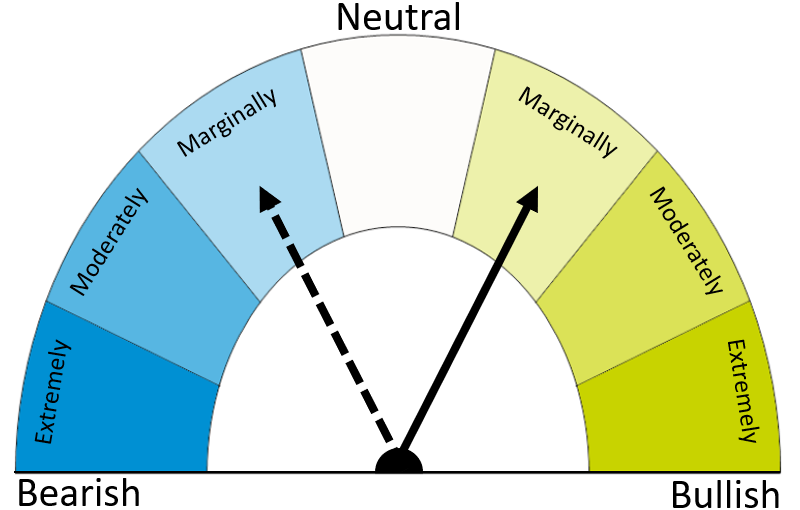

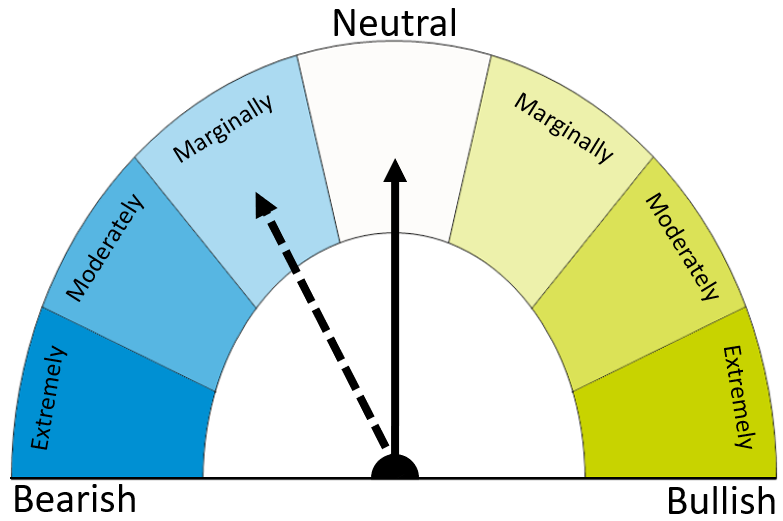

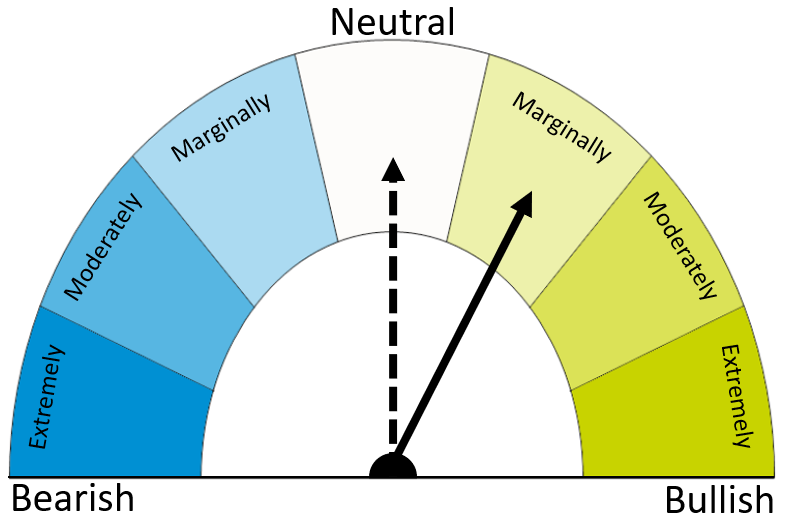

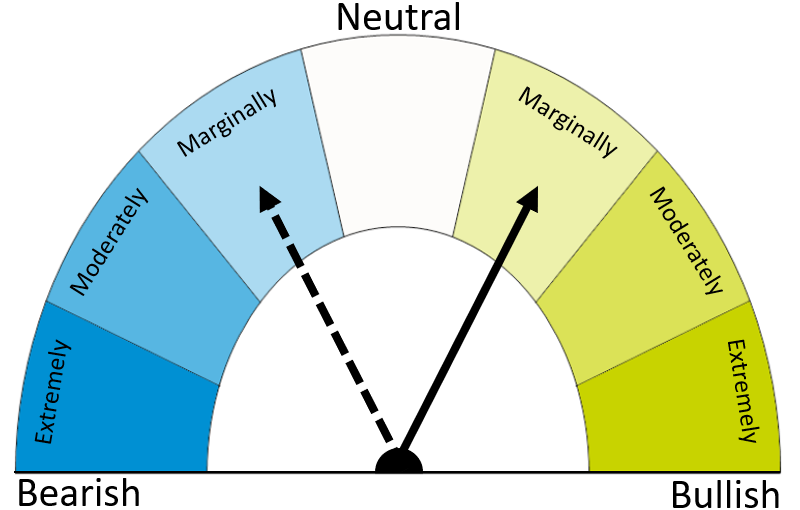

Following requested feedback earlier in the year, we have amended our dials. The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Legend:

Wheat

Maize

Barley

The global market is supported by importer demand. Further ahead, there could be some softening if we get large Southern Hemisphere grain crops, plus larger winter wheat areas for 2022/23.

The ongoing US harvest is currently keeping the market subdued, but all eyes are on tomorrow’s USDA report. Longer-term, a record Brazilian crop is expected, though good weather is required to make this happen.

The global barley markets remain firm. In the UK, the price gap between feed barley and other grains will be critical to reducing animal feed to compensate for the smaller crop.

Global grain markets

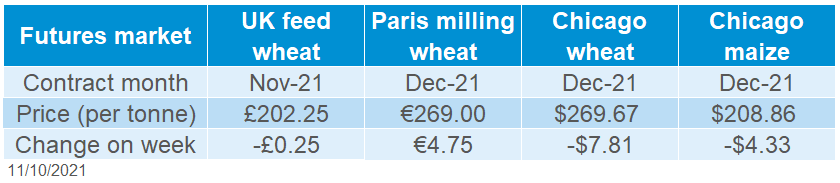

Global grain futures

European wheat prices rose last week, which in turn pushed up UK prices. Prices gained due to buying by importing countries and speculation that Russia could extend its export curbs. Also, EU exports are off to a rapid start. The EU-27 exported 8.1Mt by 3 October 2021, up from 5.6Mt by the same date in 2020/21 (EU Commission).

In contrast, US prices eased Friday-Friday. US wheat prices fell as the export pace remains the slowest since 2015/16. Meanwhile, favourable weather for the ongoing harvest pushed US maize prices down.

The market is now awaiting tomorrow night’s USDA report on global supply and demand. The expectation is that the USDA will trim the US maize yield but raise US stocks, according to a poll by Refinitiv. US and global wheat stocks are expected to be cut.

The first forecast for the Brazilian 2021/22 maize crop from Conab showed a crop of 116.3Mt, up 34% from last year’s drought-affected crop. This relies on a 5% area expansion and 28% rise in yields. The crop is slightly less than the USDA forecast in September (118.0Mt) but still a record.

In Ukraine, 46% of winter wheat was planted by 7 October, where the area is set to expand after dry weather last autumn (Ag Ministry). In France, the areas are expected to hold steady (Refintiv). Winter wheat planting was 4% complete and winter barley was 9% done by 4 October.

UK focus

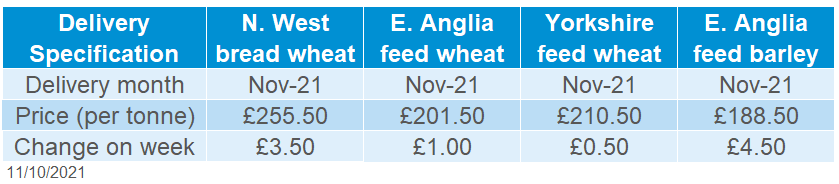

Delivered cereals

This morning, Defra estimated the 2021 UK wheat crop at 14.0Mt. This is a marked increase from the 9.7Mt harvested in 2020. This is below what many in industry, including AHDB, had expected. Looking at the provisional English area, yields would need to have fallen below the five-year average to give a crop of this size. This differs from industry information and AHDB’s harvest reports.

The barley crop is provisionally 7.1Mt, down from the 8.1Mt harvested last year.

Only the UK production numbers are currently available. Details of the UK area and yields, plus the size of the oat and rapeseed crops will be published on Thursday morning.

Bread wheat prices continued to rise last week. Full specification bread wheat (≥ 13% protein, 250s & 76kg/hl) delivered to the North West in November 2021 was quoted at £255.50/t, up £3.50/t from a week earlier. The latest price equates to a £53.00/t premium over Nov-21 futures. It is also the highest UK bread wheat price reported since late 2012.

Feed barley (delivered E. Anglia, Nov-21) was £188.50/t last week, up £4.50/t. This was £13.00/t below feed wheat (same delivery), compared to a £16.50/t discount on 30 September.

Oilseeds

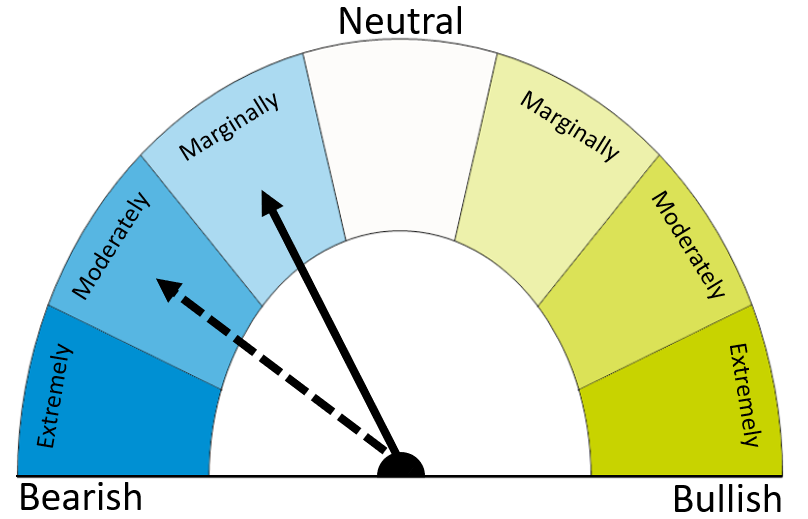

Legend:

Rapeseed

Soyabeans

Strong vegetable oil demand and a tight rapeseed market offer short term support. Beyond that, attention turns to an expected large Australian crop, and area increases for 2022/23 because of high prices

In the short term, the US harvest and this week’s WASDE could add pressure. Longer term, Brazilian production is still forecast at record levels, despite the outlook from Conab being lower than that of the USDA.

Global oilseed markets

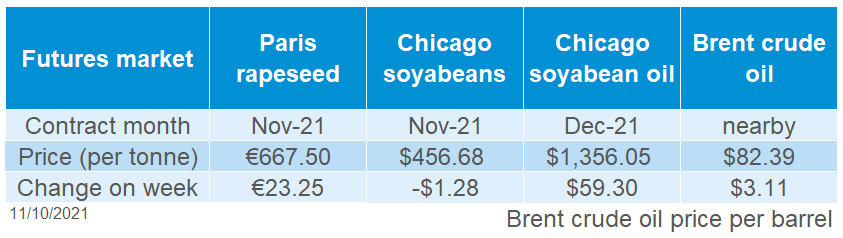

Global oilseed futures

Soyabean markets ended lower once more last week. The Nov-21 contract closed on Friday at $456.68/t, down $1.28/t on the week. US harvest has been a key pressuring factor for prices in recent weeks.

As of 3 October, the soyabean harvest in the US was 34% complete, 8 percentage points ahead of the five-year average (2016-2020). Today (11 October) is a US public holiday. So, the crop progress report, along with crop production and the latest USDA supply and demand estimates (WASDE), will be released tomorrow.

With a raft of data releases, tomorrow is key day for prices of all agricultural commodities. Pre-WASDE trade estimates are for increased stocks of soyabeans on the month, at both the US and world level. US soyabean production is also seen increasing on the month, owing to an improved yield outlook.

Last week, Conab released its first forecasts for the 2021/22 Brazilian soyabean crop. Production is forecast to rise 2.5% year-on-year, to a record 140.8Mt, following an increase in area by the same degree. The forecast production level is 3.2Mt lower than the September USDA forecast. It is worth noting that despite the forecast of a record crop, Conab flags the continued effects of La Niña and high input costs as a concern.

Rapeseed focus

UK delivered oilseed prices

Rapeseed prices continued to surge last week, supported by strong demand and the continued tight outlook. Paris rapeseed futures (Nov-21) gained €23.25/t, Friday to Friday, closing on 8 October at €676.50/t.

UK markets followed the trends seen in the European market, although trade remains exceedingly thin once more. Rapeseed delivered Erith (May-22) was quoted at £578.00/t, up £25.00/t on the previous week.

Strong fundamental support in vegetable oil market, is a key underlying feature of the rapeseed market.

With Northern Hemisphere crops tight, attention is on developments in the Southern Hemisphere. In the week to 6 October, conditions in Australia were positive with improved rainfall. Australia is forecast for a 5.0Mt crop, an 11% increase on the year.

For 2022/23, Stratégie Grains, estimate a 7% rise in planted area for the EU, to 5.6Mha. It is worth noting that this would be in line with the five-year average (5.6Mha).

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.