Market Report - 09 August 2021

Monday, 9 August 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

US, Canadian and Russian crop concerns tighten the supply and demand picture for global 2021/22 wheat. Thursday’s WASDE is expected to give more detail on forecast production.

= US weather looks more favourable. Drought conditions persisting are arguably priced in, now trade looks to Thursday’s WASDE for price direction. If supply and demand look tighter, sentiment could change.

UK harvest may be restricting gains following futures rises last week, but barley is expected to benefit from wheat gains. A strong discount to wheat is expected for 2021/22, keeping feed demand strong.

Global grain markets

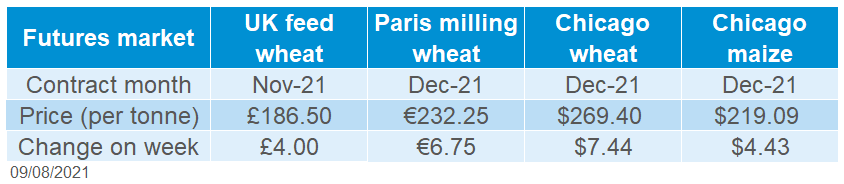

Global grain futures

Gains were made across both maize and wheat futures, last week.

Chicago maize (Dec-21) futures gained $4.43/t to close on Friday at $219.09/t. Demand supported prices, new US maize export net sales totalled 830.2Kt for 2021/22 (week ending 29 July), up 57% from the week before. However, prices continue to trade within the past 3 week’s range, with improved US weather.

Global wheat supply concerns continue to strengthen prices, with concerns for the Russian, US, Canadian and EU harvests. SoveEcon reduced their Russian wheat production estimate by 5.9Mt last week to 76.4Mt. As of 6 August, 47.0Mt of wheat and 10.6Mt of barley had been harvested.

The Canadian harvest has now started, as heat dries crops. According to the Saskatchewan government, winter wheat was 19% harvested with 34% ready to be combined, to 2 August. This brings total provincial harvest to 3% complete, above the 5-year average of less than 1%.

Ukraine have now harvested 23.4Mt of wheat (72% of the area) and 8.05Mt of barley (79% of the area), aided by favourable weather. Total grain production is forecast at 76Mt, up 11Mt from 2020.

In France, rain has been delaying harvest. To 2 August, 66% of soft wheat had been harvested, down from 97% the same time last year and 11 days behind the 5-year average pace.

The market now looks to Thursday’s USDA world supply and demand estimates (WASDE) for global grains price direction.

UK focus

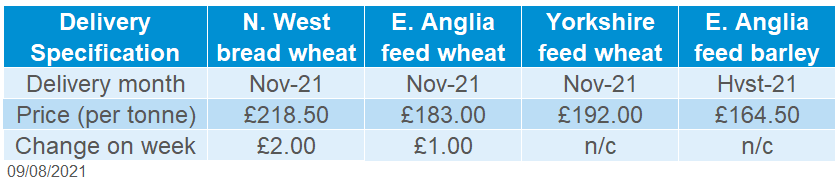

Delivered cereals

Following global contracts, UK feed wheat futures (Nov-21) gained £4.00/t on the week, closing on Friday at £186.50/t.

UK physical prices followed the pattern of futures contracts (Thurs-Thurs), last week. The Milling wheat premium to futures (Nov-21) remained at £35.00/t (Delivered November, North West). Though, feed wheat (East Anglia, Nov-21) gained slightly less than futures, quoted £3.50/t higher on the week.

Last week, we saw the release of the full animal feed and human and industrial (H&I) usage figures for 2020/21. Animal feed figures showed wheat usage down. Barley usage is likely to remain strong for 2021/22.

For H&I, cereal usage too was down across the board. Though with barley usage rebounded to near pre-covid 5-year average levels in the final months of 2020/21 for brewers, maltsters and distillers, total barley demand may keep barley tight in 2021/22.

Oilseeds

Rapeseed

Soyabeans

Lower EU demand is forecast as high prices cause demand destruction. Canadian drought is still driving the bullish move in the rapeseed market with exports in Canada revised down.

Rains in key US regions for soyabeans is bearing on the market. The market could be pressured further if Chinese purchasing is lacklustre for the 2021/22 marketing year.

Global oilseed markets

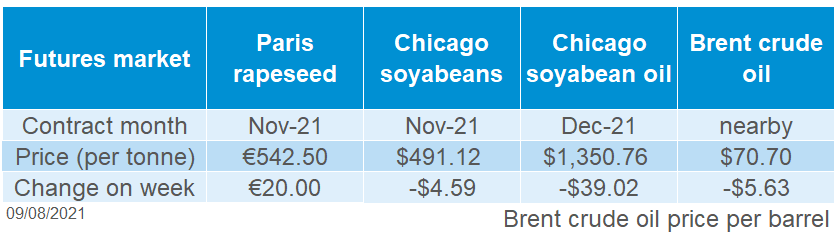

Global oilseed futures

Chicago soyabeans futures (Nov-21) were down 0.93% across the week. The contract dropped to a week low on Tuesday, before slowly recovering throughout the week.

Fuelling this marginal recovery was Chinese demand for soyabeans. The USDA reported two consecutive days of soyabean sales (5 and 6 Aug) totalling 431Kt. China accounted for 131Kt of these sales , with a further 300Kt to unknown destinations.

Chinese demand will be key, as their imports of soyabeans dropped by 14.1% in July, year-on-year, estimated at 8.67Mt (General Administration of Customs). Narrowing hog margins are reported to be reducing demand for soymeal in China.

Another factor capping gains in oilseed markets were pockets of rain experienced across the U.S. Midwest. Forecast temperature is warmer than usually for many states for the coming week, with limited rains which is a watchpoint with soyabeans flowering.

Brent crude oil futures (nearby) were down 7.38% across the week, closing Friday at $70.70/barrel. The pressure in energy markets is down to a strengthening US dollar and potential covid lockdowns in Asia.

Rapeseed focus

UK delivered oilseed prices

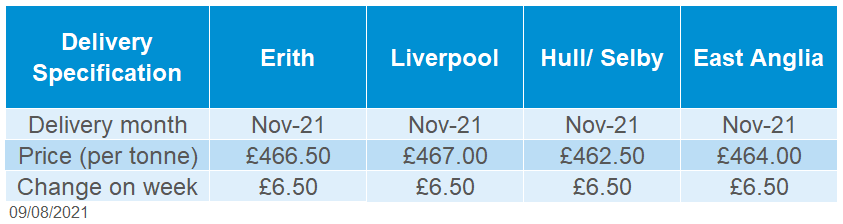

Paris rapeseed futures (Nov-21) closed on Friday at €542.50/t, gaining €20.00/t across the week. Delivered rapeseed (into Erith, Nov-21) was quoted on Friday at £466.50/t, gaining £6.50/t across the week.

Gains were limited on the domestic market as Sterling strengthened (+0.62%) against the Euro to close on Friday at £1 = €1.1786.

Driving the rapeseed market is the drought in Canada, which is pushing ICE canola futures higher. However, a lot of this price climb is due to speculators and funds. Commercials are driving prices by covering short positions (Refinitiv).

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.