Market Report - 08 March 2021

Monday, 8 March 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

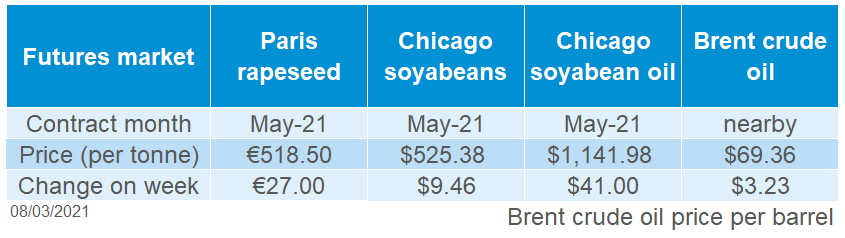

Paris rapeseed future closed on Friday at €518.50/t, gaining €27.00/t across the week. ICE canola futures (May-21) gained CAD$46.60/t across the week, to close at CAD$785.80/t. Short-term supply in oilseed markets continued to support prices.

Existing supplies of canola are tight. Traders are increasingly concerned by low soil moisture in the Canadian prairies, with spring planting typically starting in May.

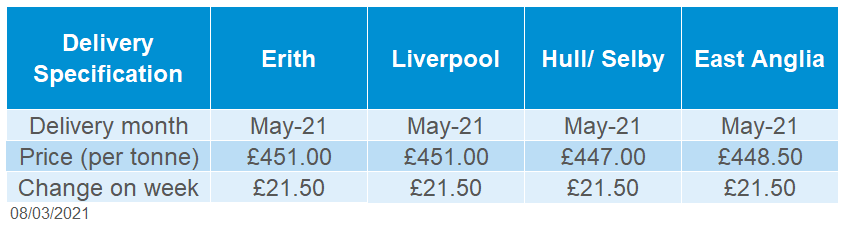

Delivered rapeseed (May-21, Erith) was quoted at £451.00/t on Friday, up £21.50/t on last week. Gains in the domestic market were limited as sterling strengthened (+0.66%) against the Euro, closing on Friday at £1 = €1.1615.

Wheat

Little has changed in the fundamental picture since last week. Crop conditions will be a key watch point as crops come out of dormancy in the Northern Hemisphere.

Global grain markets

Maize

Progress remains limited for South American safrinha crop plantings. However, weather is expected to be in a more “normal” range in the coming weeks.

Global grain futures

Barley

Barley remains at a strong discount to feed wheat, which will prompt continued inclusion in rations. However, price support remains limited owing to large crops.

UK focus

Delivered cereals

Old crop grain prices spent most of last week tracking lower. The recent bullish drivers; slow South American planting and strong Chinese purchases of US corn, eased. Old crop maize prices made a strong recovery at the end of the week and in early trading today.

Planting of the second maize crop (safrinha) in Brazil remains behind last year’s pace. In the week ending 26 February 31.6% of the safrinha crop was planted, compared to 62.8% in 2020. Rainfall levels are forecast to be near normal in the coming fortnight. This would suggest planting will continue to progress at a normal pace, albeit dependent on the soyabean harvest progress.

Export demand for maize was once again sluggish last week. USDA weekly export sales data showed just 116Kt of net sales for the current marketing year, in the week ending 25 February. There was a large origin switch shown for “unknown origins”, with more than 1Mt being declared as Chinese trade. January exports of maize by the US reached record levels.

Looking ahead, this week sees a number of key bits of information released. Most notable is the USDA supply and demand estimates, due tomorrow. Pre-report polls by Refinitiv point to tighter maize stocks once more, with wheat stocks expected to grow marginally.

Oilseeds

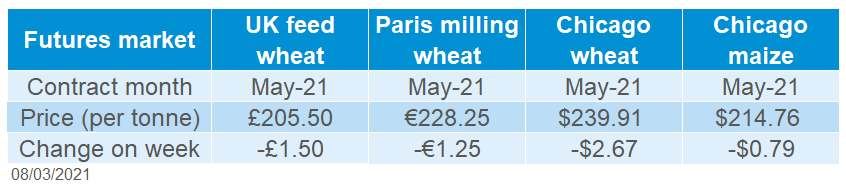

UK markets moved in opposite directions last week, cutting the gap from old crop to new crop further. On Friday, the spread between the May-21 and Nov-21 UK feed wheat futures contracts stood at £34.00/t.

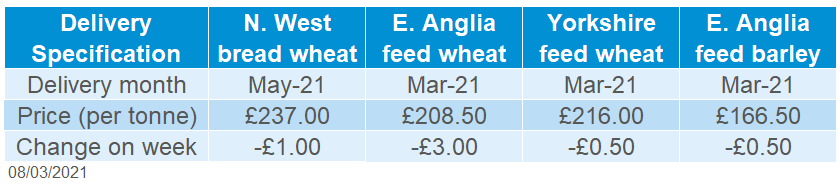

UK delivered grain prices generally followed UK feed wheat futures lower (Thurs-Thurs). That said, there was a general narrowing of basis across feed wheat. Since the 7 January, the basis of feed wheat delivered, East Anglia (May-21), has narrowed from £8.00/t over May-21 futures to £5.50/t. This reflects some of the weaker demand for wheat across this period, with contracts being rolled by many consumers. That said, demand is reportedly seen slightly firmer for March.

Weak demand in the milling sector has also eroded the delivered basis. Milling wheat delivered into the North West (May-21) has gone from a £39.50/t premium over futures on 7 January, to £31.50/t on Thursday 4 March. Over the same period, the basis for Nov-21 feed wheat delivered, Yorkshire (North Humberside), has grown by £3.50/t, to £9.00/t on Thursday 4 March.

Rapeseed

Tightening continental supplies, combined with support in crude oil markets and the greater oilseed complex, provides support in the short-term for rapeseed.

Global oilseed markets

Soyabeans

Weather worries in South America ignite concerns over the supply of soyabeans to the global market. These are causing dryness in Argentina and harvest delays in Brazil.

Global oilseed futures

Rapeseed focus

UK delivered oilseed prices

Chicago soyabeans (May-21) closed on Friday at $525.44/t, gaining $9.46/t across the week.

Weather concerns in South America once again are the backbone to supporting greater oilseed markets.

Concerns over Argentina’s soyabean crop continue as dry weather persists. The conditions could lead to yield loss if rains continue to hold off. Commodity Weather Group suggest that if rains do not come in the next 10 days, this could lead to “severe yield loss for 30% of the soy belt”.

In Brazil, on-going wet weather is delaying the harvest of soyabeans. In states such as Mato Grosso and Goiás, harvest progress is behind year-on-year.

There was further price support, with OPEC+ choosing to maintain supply curbs into April, even as the global economy pulls out of its pandemic-driven slump. Brent crude oil (nearby) closed on Friday, at $69.36/barrel, up $3.23/barrel on the week.

This support in crude oil has provided greater support in vegetable oils. Chicago soya oil futures (May-21) gained $41.01/t across the week.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.