Market Report - 06 September 2021

Monday, 6 September 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

Tight global supply continues to support price levels, but current news may now be factored in. Slow news on row crops pressures prices as markets await USDA report.

US weather looks improved, but we may learn more on US yield and area in Friday’s USDA report. Chances of a 2021/22 La Niña across South America remains an ongoing concern.

The discount to wheat is likely to remain relatively strong this season, with domestic demand staying prominent too. Barley continues to benefit from tight global wheat supply.

Global grain markets

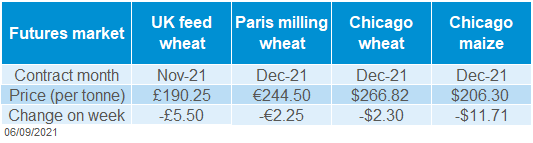

Global grain futures

Global grain futures eased back last week for most contracts.

Prices were taking lead from the news of Hurricane Ida, which damaged US grains export facilities. Disruption to the Gulf Coast, which accounts for around 60% of US exports, included power outages, sunken barges and boats in the lower Mississippi river, and obstructed navigation.

However, some support was provided on Thursday by strong US export sales. For the week ending 26 August, net maize sales for 2021/22 totalled 1.16Mt. Net sales of wheat for 2021/22 totalled 295.30Kt, up 15% from the previous 4-week average. This said, news emerged on Friday of China cancelling barley shipments due to positive news on domestic maize production.

The latest AMIS crop monitoring report was released last week. For maize, the US, parts of Northeast China and Southeast Europe were watch points, though Chinese maize conditions look positive overall. For wheat, Russian, Canadian, and US crops continue to be highlighted as poor. In contrast, Australia’s crop looks to be experiencing ‘favourable to exceptional’ conditions.

Russia’s Sovecon cut their wheat forecast by 800Kt to 75.4Mt last week. Whereas in Argentina, widespread rain (30-50mm in key areas) boosted the 2021/22 wheat harvest outlook. The Argentinian wheat harvest, due to begin in November, is forecast at 19.0Mt by the Bolsa de Cereales (+2.0Mt from 2020/21).

Grains will now await price direction from the USDA world agricultural supply and demand estimates (WASDE). For the report, US maize production is a key watch point. Weather in the Midwest has been favourable recently, though yield estimates are varying. US maize area figures are offered one month ahead of last year due to data availability. On the wheat front, changes to Russian production as well as the other major exporters will be interesting. The WASDE report is due on Friday.

UK focus

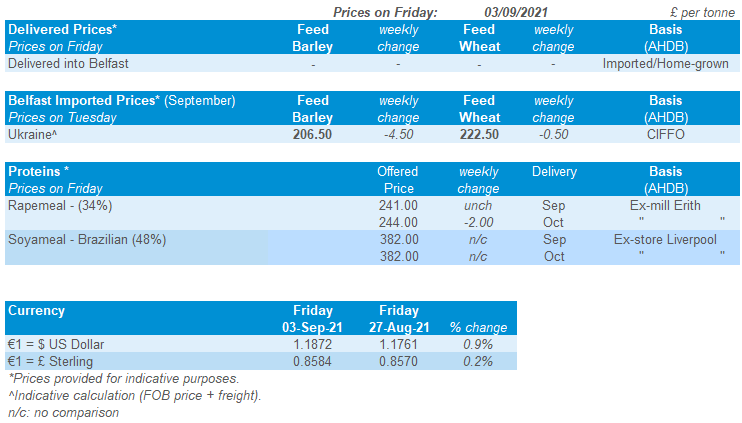

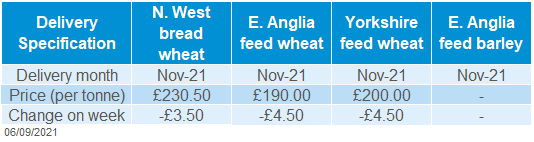

Delivered cereals

UK feed wheat futures (Nov-21) fell £5.50/t last week (Fri-Fri), to close on Friday at £190.25/t.

UK delivered cereal prices tracked losses on the UK Nov-21 feed wheat futures (Thurs-Thurs). Feed wheat delivered (East Anglia, Nov-21) fell £4.50/t to £190.00/t. Milling wheat fell slightly less, with bread wheat delivered (North-West, Nov-21) falling £3.50/t to £230.50/t.

Updated usage figures were released last week for GB animal feed and UK human and industrial usage. Animal feed cereal usage for July 21 was up 1.2% from last year. For brewers, maltsters and distillers, barley usage was up 22.8% in July 21 from last year, as England’s restrictions eased.

The next AHDB GB harvest report is due on 10 September.

Oilseeds

Rapeseed

Soyabeans

The global picture will remain tight for rapeseed. Season-to-date EU imports are back 29% from a year earlier. This comes as some major exporters choose non-EU destinations, adding to supply tightness.

Storm Ida continued to disrupt major US ports, somewhat weighing on the market. However, strong demand helped to ease the fall. The market now awaits the USDA report due this Friday.

Global oilseed markets

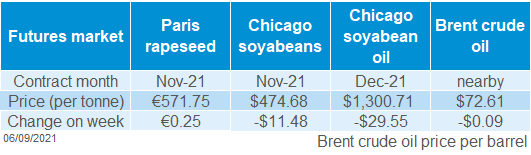

Global oilseed futures

Storm Ida weighed on oilseed markets last week as major US export facilities were unable to function. The Chicago soyabeans Nov-21 contract closed Friday at $474.68/t, down $11.48/t (Friday-Friday). Mid-week, the contract closed at its lowest level since 25 June 2021 following continued disruption. A slight lift towards the end of the week was led by traders covering their short positions ahead of the long weekend in the US.

Despite disruption, export demand of US soyabeans is strong, particularly to China. The USDA reported weekly export sales of soyabeans totalling 2.13Mt for the marketing year 2021/22, to week ending 26 August 2021. This is up 21% from the same week last year and 22% from the previous week. Trade expectations ranged from 0.73-1.40Mt, which was well exceeded. This helped ease the pressure from storm Ida.

Trade awaits this month’s USDA world supply and demand estimates (WASDE) report, due out on Friday. This will include an update to the US soyabean acreage, one month earlier than usual.

South American soyabean supply is also under question as Brazilian farmers are described as “hoarding” their crops, apparently assuming increased prices are on the horizon. Along with this, there is a fear of a second La Niña, which would negatively affect the upcoming season.

Argentine soyabean sales are also behind a year before. The 2020/21 crop (harvested in June) is smaller than the previous year and sales reflect this. At 28.5Mt, sales are some 1.8Mt behind the same time last year.

Smaller Canadian canola crops were confirmed last week. We await further news of the Australian crop, with expectation for larger canola crops this season. The Australian crop report, due tomorrow, should help to shed some light on this.

Rapeseed focus

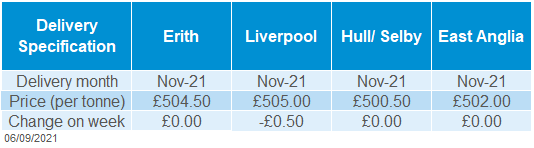

UK delivered oilseed prices

The Nov-21 Paris rapeseed futures contract was unsettled last week. The contract closed just €0.25/t higher on the week, at €571.75/t on Friday. This said, throughout the week, trade occurred within an €18.00/t range.

EU consultancy firm, Stratégie grains, trimmed their 2021 EU rapeseed production estimate on Friday to 16.9Mt, down from their previous estimate of 17.0Mt. This remains above 2020 production.

Similarly to European futures markets, UK physical prices (delivered Erith, Nov-21), remained the same week-on-week at £504.50/t. Rapeseed harvest is mostly finished in the UK, bringing with it slow physical trade. Planting of the 2022 crop is well underway, with many rapeseed crops breaking through the surface. Moisture levels have been good, and therefore the 2022 crop should get a good start to the growing season.

Paris new-crop futures (Nov-22) have seen a slight rise Friday-to-Friday of €3.25/t, to close the week at €481.50/t.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.