Market Report - 04 October 2021

Monday, 4 October 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

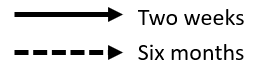

Legend:

Wheat

Maize

Barley

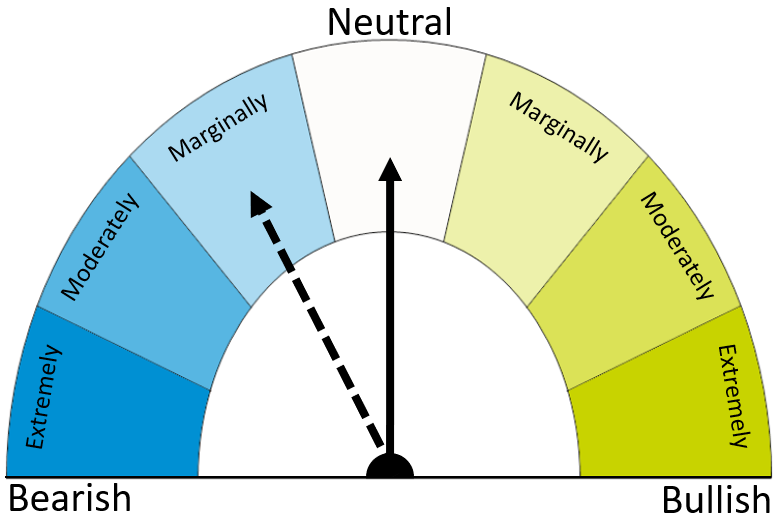

Short-term, wheat markets are supported. Bullish USDA quarterly stocks data, released last week, added to this and tightness remains. Longer-term, higher prices could support an area growth, although the reports from Refinitiv state that Russian winter wheat area could be back this year, a function of dry weather and export taxes.

Maize markets follow the general positive trend of wheat currently, but US harvest progress caps gains. In the long-term, the market is anticipating a record maize crop from Brazil. However, that is largely weather dependant.

Barley prices in the short-term will follow the general grains complex. In the longer-term prices will largely depend on the general direction of grain markets and demand and will need to maintain competitiveness to remain in feed rations.

Global grain markets

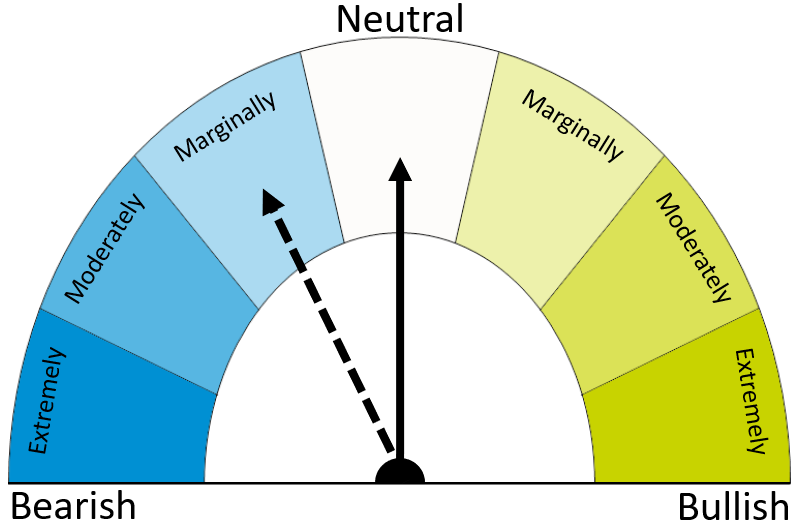

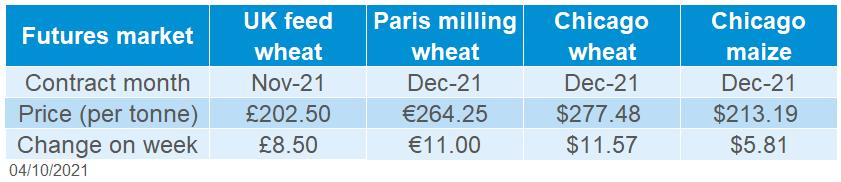

Global grain futures

There has been a rally of support for global wheat markets in the last week. Chicago wheat futures (Dec-21) gained 4.4% across the week to close Friday at a 6-week high.

A key driver was the announcement of 14-year low US wheat stocks estimated in the USDA September quarterly grain stocks report, released last Thursday.

The USDA estimated wheat stocks, as a September 1, at 48.4Mt. This was below the analysts’ estimate of 50.4Mt in a Reuters Poll.

In this report, 2021 US wheat production was revised down 1.4Mt from the September World Agricultural Supply & Demand Estimate. This information meant commodity funds were largely net-buyers of wheat on Thursday and Friday last week.

On Thursday, the EU Commission raised common wheat production up 3.8Mt on the month to 131.0Mt. Exports remained unchanged at 30.0Mt.

Despite this, Paris milling wheat (Dec-21) gained 4.3% across the week, due to the USDA report, to close at a contract high of €264.25/t. Brisk global demand in nearby markets and a weaker euro against the dollar across the week (-1.02%), further supported prices.

The Chicago maize market followed wheats general trend higher. However, maize quarterly stocks were pegged at 31.4Mt, higher than the Reuters poll estimate of 29.3Mt.

Further to that, maize prices were limited by US harvest pressure. As of 26 September, harvest progress was at 18%, above the 5-year-average of 15%. Further updates will be published tonight.

In other maize news, FrenchAgriMer estimated just 2% of French maize was harvested at September 27. This was an advancement of 1% on the week, but way behind the same time last year (31%).

Moreover, Brazilian first maize crop production has been revised up to 30.1Mt from 29.8Mt (StoneX), while other associations such as Abramilho are pegging estimates at 32.0Mt. Brazil is currently planting their full-season (smaller) maize crop.

UK focus

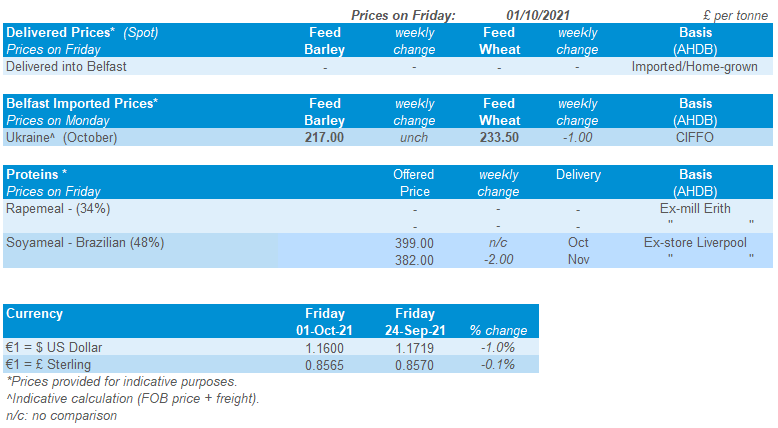

Delivered cereals

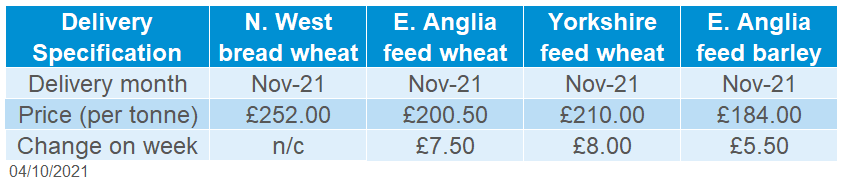

UK wheat futures (Nov-21) followed global markets, gaining £8.50/t across the week, to close Friday at £202.50/t.

Delivered values followed this trend. Feed wheat (delivered into East Anglia, Nov-21) was quoted at £200.50/t, gaining £7.50/t Thursday to Thursday. Delivered feed barley into the East was quoted at £184.00/t, gaining £5.50 for the same period. This saw barley’s discount to feed wheat stretch further; to £16.50/t.

Delivered milling wheat (North-West, Nov-21) was quoted at £252.00/t on Thursday, a premium of £51.50/t over UK futures.

Oilseeds

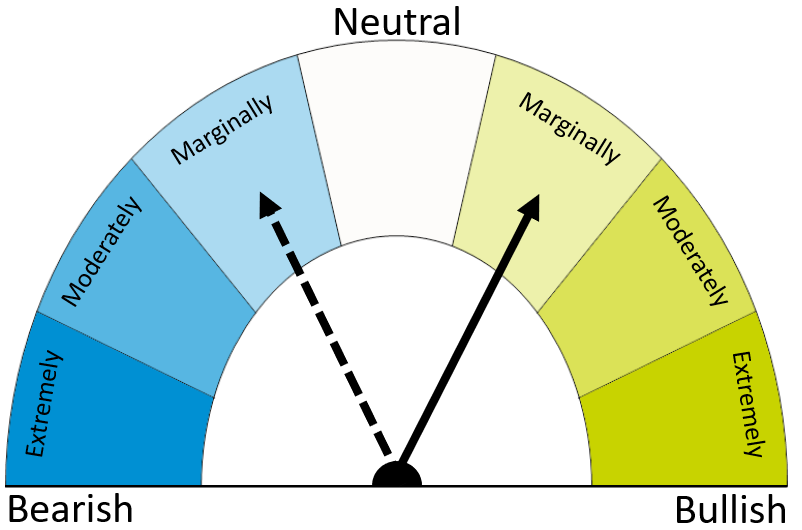

Legend:

Rapeseed

Soyabeans

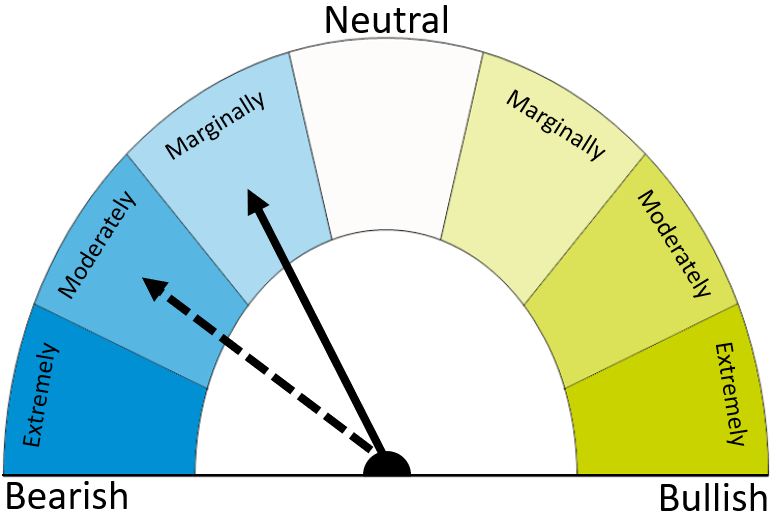

Global rapeseed remains supported, but could contract highs soon reach a ceiling? Longer-term outlook turns to Australian production, estimated at record highs and could bring pressure to wider oilseed markets if realised.

US soybean stocks, harvest and demand somewhat weigh on markets. Longer-term the market awaits plantings in South America, where Brazilian production is anticipated to reach record levels.

Global oilseed markets

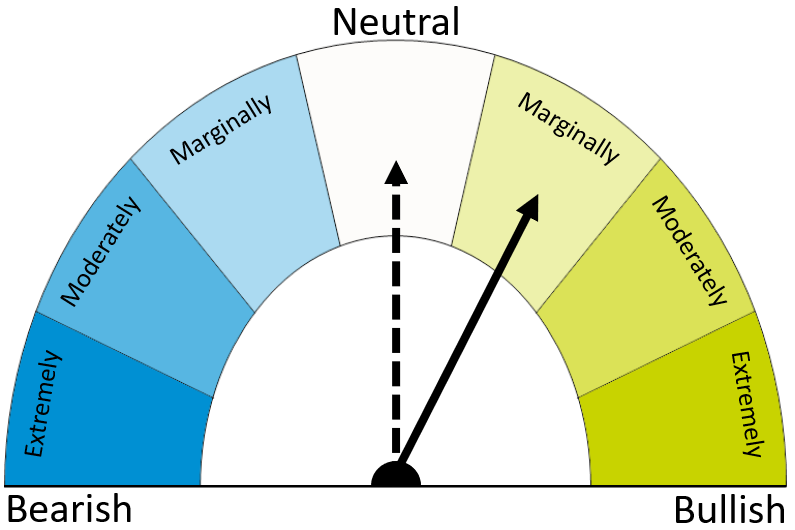

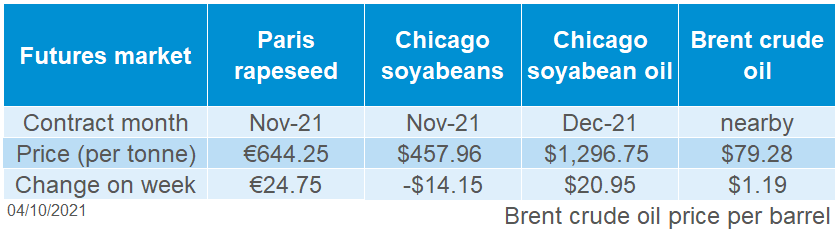

Global oilseed futures

Chicago soybeans (Nov-21) closed the week at $457.96/t, down $14.15/t on the week, its lowest point since March 2021.

Pressure comes from higher than anticipated US soybean stocks, as at 1 September. Although pegged at a five-year low, 6.97Mt was well above expectations (4.68Mt). US harvest also seems to be progressing well with another update due out tonight. Since Friday’s close, US soybean crushing’s have been pegged below trade expectations for August too.

2021/22 Brazilian soybean production also weighs on the market. The USDA estimate it to reach record levels of 144Mt. However, this is yet to be planted, and current yield estimates are 3% above the 5-year average. Currently key growing regions are forecast rain in the next seven days, but this will need to continue longer term to alleviate dry ground and avoid downwards revisions to yield.

What could support soybeans though, is rapeseed (see below) and oil markets. Malaysian palm oil (nearby) and soyoil (nearby) both gained over the week. September’s exports of Malaysian palm oil saw a jump from August, but the market awaits supply and demand polls and full-month production figures.

Rapeseed focus

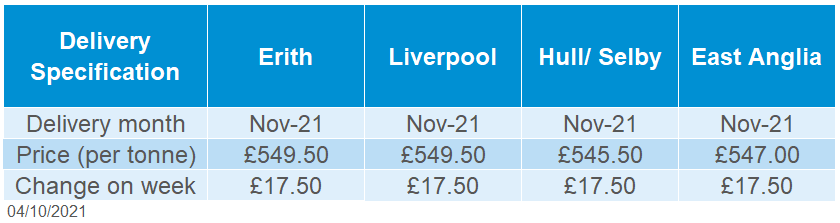

UK delivered oilseed prices

Rapeseed markets continued their upward march last week. Nov-21 Paris rapeseed futures gained €24.75/t across the week to close Friday at €644.25/t. Thursday saw record levels of €651.00/t reached. Winnipeg canola (Nov-21) also climbed reaching the highest point since August on Thursday. This contract closed the week at CA$903.10/t, up CA$15.20/t on the week.

UK delivered rapeseed (Nov-21 delivery, into Erith) was quoted at £549.50/t, up a further £17.50/t from the previous Friday. UK physical prices continue to track Paris futures.

From our delivered oilseeds survey, prices for delivered rapeseed into Erith, in November 2021, have gained £79.00/t since 2 July (start of the marketing year) and £184.00/t since they were first quoted on 8 January 2021.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.