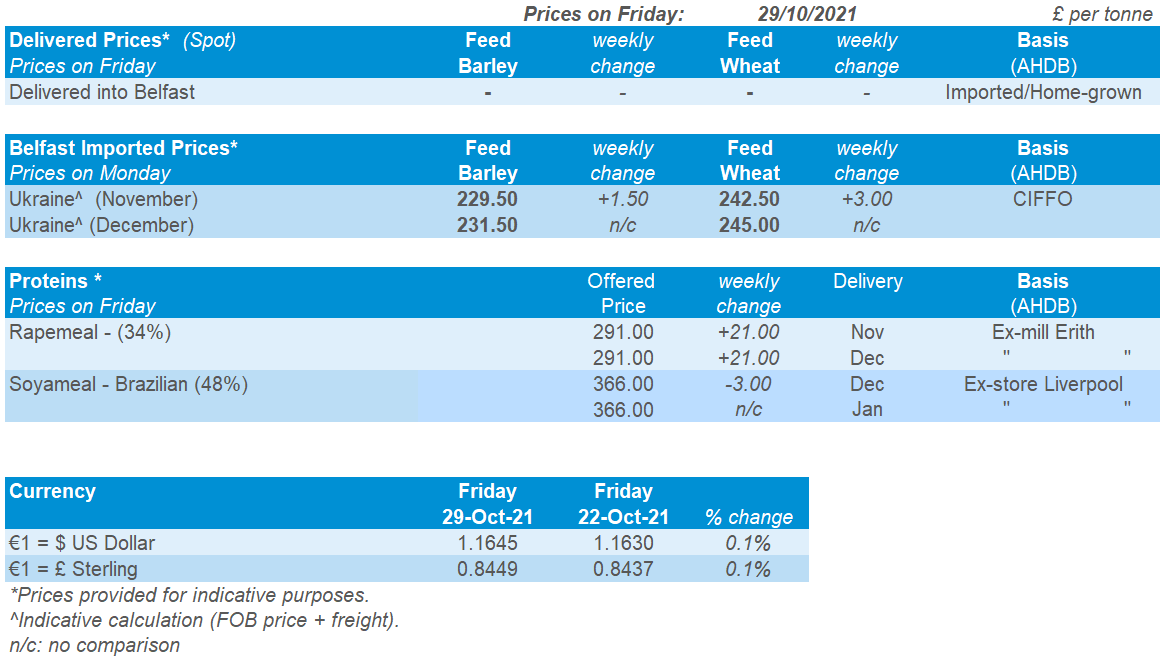

Market Report - 01 November 2021

Monday, 1 November 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

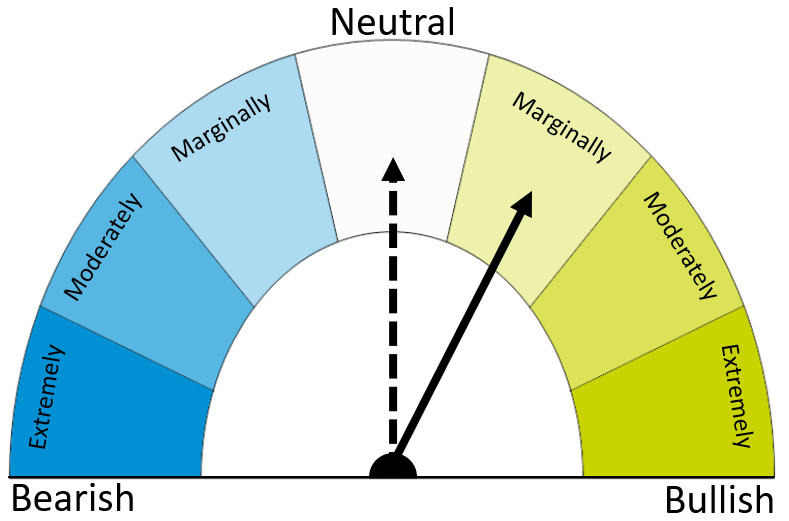

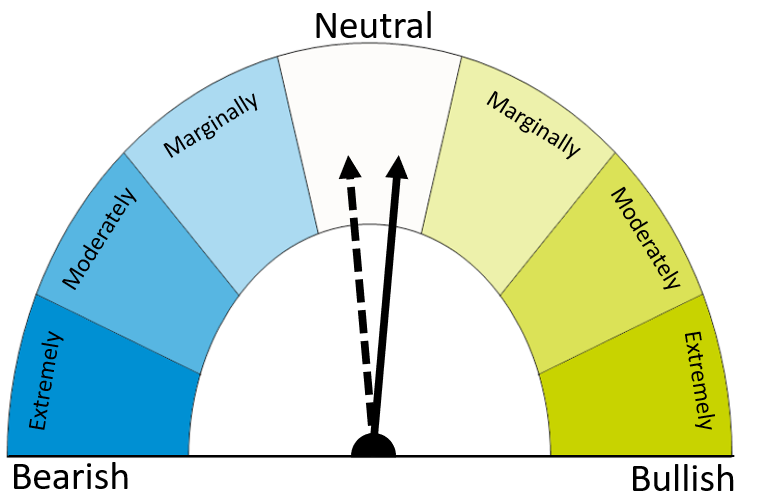

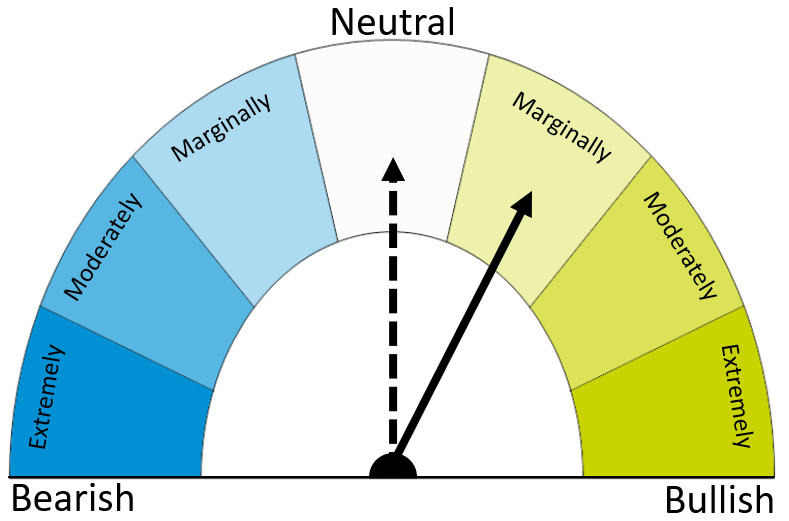

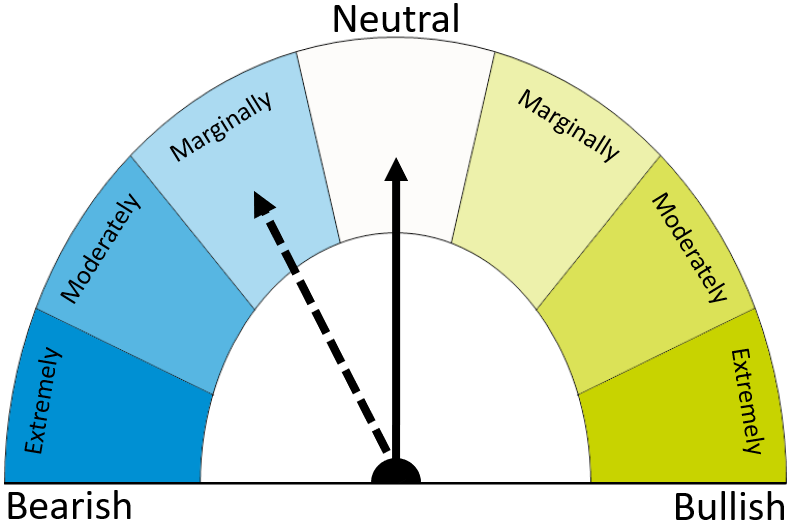

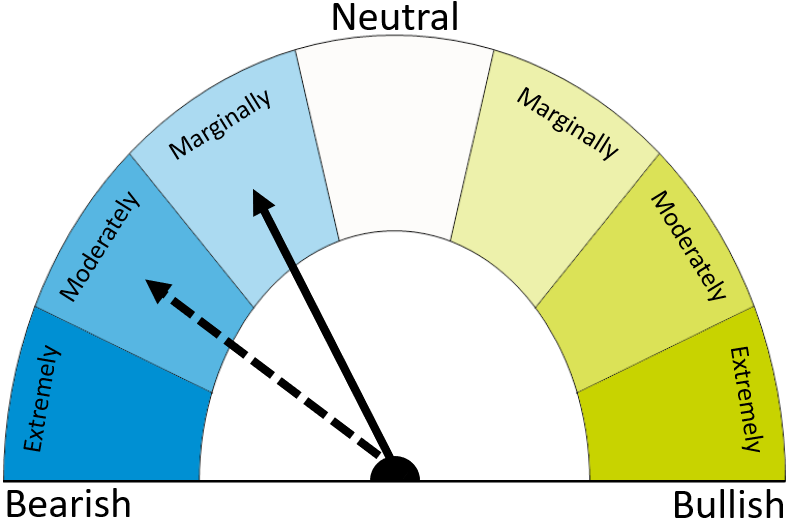

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat

Tight wheat supplies continue to support prices in the short term. The Australian harvest could offer some pressure in the medium term, but the longer-term outlook depends on maize.

Maize

Stronger ethanol demand in the US is now supporting markets. South American maize yields are critical to the world market longer-term, with little room for error.

Barley

Barley continues to track wheat markets. With a tight outlook, barley cannot afford a larger price gap to wheat.

Global grain markets

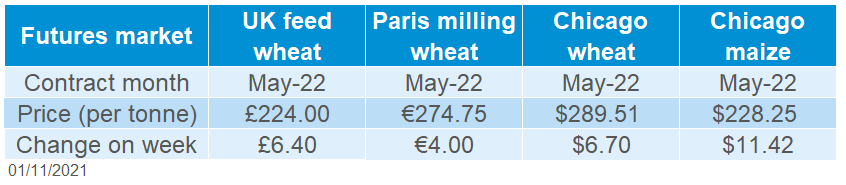

Global grain futures

Global wheat prices rose again last week, pushed up by continued tight supplies. International demand remains strong, with last week’s tenders including the world’s top importer, Egypt.

Russia’s export tax is set to rise again from 10 November to $69.90/t. The tax is calculated from export prices and is a factor slowing exports from the country. Slower exports from Russia are contributing to the squeeze in wheat availability. Last year, Russia was the world’s top exporter of wheat.

US maize prices also rose, due to rain delaying harvest of the 2021 crop and another week of high ethanol production. Weekly ethanol production was the second highest on record, while stocks also fell. If sustained, this trend could tighten the US and so global market. More wet weather is also expected this week, which could also bring short-term support.

The Australian harvest is underway in Queensland and New South Wales, with some localised harvest pressure starting to be seen. This could pick up as the harvest moves south.

Planting of 2022/23 winter crops in Europe has progressed well (MARS report). However, dry conditions are causing early concerns in both the US and Black Sea region.

Weather for the 2021/22 South American maize crops remains a key driver. Rain this week will be welcome but the forward outlook is uncertain, with La Niña reported to now be in force by the Rosario Grain Exchange.

UK focus

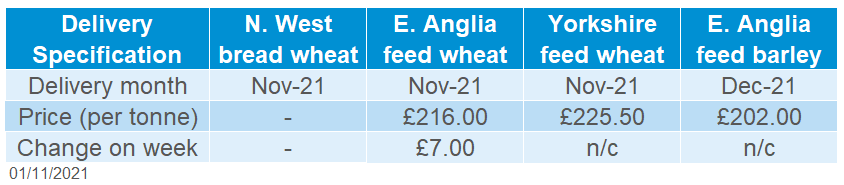

Delivered cereals

UK feed wheat futures followed the global market higher last week (Friday – Friday). The May-22 contract closed at its highest price yet, on several days during the week and again on Friday.

UK wheat supply and demand is again relatively tight in 2021/22, despite a larger crop. A 14% rise in demand year on year offsets the greater supply. AHDB forecasts both higher animal feed demand and increased human and industrial (H&I) demand, including from the bioethanol sector.

AHDB also estimates the UK barley balance to be 11% tighter than last season at 2.0Mt, due to the smaller crop. This is despite a drop in animal feed demand, linked to the smaller price discount to wheat. Feed barley delivered to East Anglia in December was quoted at £202.00/t last week, just £15.00/t less than feed wheat for the same delivery.

We were unable to publish delivered bread wheat prices last week. The variability in the quotes we received meant it was not possible to produce a representative price. Prices are being impacted by changes in the global market and ongoing domestic logistical issues.

Oilseeds

Rapeseed

With inelastic demand, rapeseed continues to hold a premium in the oilseed complex. Prices are supported by tight global supply and demand. Harvest of the Australian crop is in early stages at present.

Soyabeans

US harvest is progressing, and South American crops are forecasted to be large in 2022. However, La Niña (weather) remains a watchpoint, especially in a dry Argentina.

Global oilseed markets

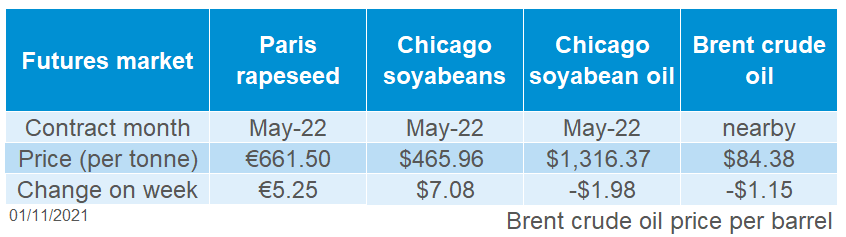

Global oilseed futures

Chicago soyabean futures (Nov-21) gained $5.60/t last week, to close on Friday at $454.01/t.

US export demand continues, with flash sales for US soyabeans reported last week on Tuesday and Friday, totalling 679.1Kt. However, US net export sales for the week ending 21 October came in below market expectation totalling 1.18Mt. China accounted for 1.08Mt of these, though this included 515Kt switched from unknown and Hong Kong destinations. Total net exports for the week were below trade expectations (1.25Mt to 2.00Mt) and brings the year total to date at 30.45Mt. This is behind last year by 35%.

The US soyabean harvest is progressing quickly, with the USDA reporting 73% harvested as at 24 October. This is up 13 percentage points (pp) from the week before and 3pp ahead of the 5-year average (2016-2020).

Some rain may be heading for Brazil this week, at a time of soyabean planting in South America, this is beneficial. However, Argentina continues to look dry. Another La Niña remains a key watchpoint for supply, as news emerges this weather front is now in force.

Vegetable oil prices have been a key factor in oilseed market movements this week. Specifically, palm oil futures found price strength last week, as news on rainy weather and labour shortages causes supply concerns. Malaysian production forecasts for 2021 have been cut by 0.7Mt, to 18.4Mt. The Dec-21 Malaysian futures contract closed at a contract high on Friday.

However, some weakness was seen in vegetable oils on Wednesday following a fall in crude oil prices due to higher US inventories.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed (Feb-22) gained €8.50/t last week, to close at €678.25/t (£573.05/t) on Friday. Paris rapeseed gained support from rising palm oil prices.

Winnipeg canola futures (Nov-21) rallied last week as this contract comes to delivery. On Friday, the contract closed above the CAN$1,000/t mark. This may also be providing support to the Paris rapeseed contract.

Unfortunately, no UK delivered prices could be published last week due to insufficient quotes. Reportedly, physical trade is quiet.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.