Market conditions and weather can change US cropping intentions: Grain market daily

Tuesday, 23 February 2021

Market Commentary

- Old crop (May-21) UK wheat futures closed yesterday at £206.00/t, increasing by £0.50/t on Friday’s close. New crop (Nov-21) closed unchanged at £169.75/t.

- Cold weather throughout January and February in Europe caused limited damage, the EU’s crop monitoring service (MARS) announced yesterday. This was due to sufficient snow cover in the areas that were most affected.

- Brazil’s 2020/21 soyabean harvest advanced to 15% of the planted area by 18 February. This is down from 31% this time last year, and the slowest pace in 10 years, according to AgRural.

- Chicago soyabean futures (May-21) found support because of this harvest delay, closing $509.77/t. This is up $2.76/t on Friday’s close.

Market conditions and weather can change US cropping intentions

Attention turned towards the US soyabean and maize planting forecasts for harvest 2021 at the USDA Outlook Forum last week.

These US crops can shape global market sentiment for all grains and oilseeds. To put this into context, this marketing year the US is expected to produce 360.3Mt of maize and 112.6Mt of soyabeans. As a result, the US is expected to account for 36% of global exports for both commodities. Therefore, markets reacted to the 2021 planting news.

However, how do past Outlook Forum estimates compare to the final area figures?

What is the intended area?

At the Outlook Forum the preliminary estimate for the US maize area is 37.2Mha, increasing from 36.8Mha in 2020. Although the USDA forecast an increase in area and so production, it expects high domestic demand and high exports.

For soyabeans, the area may increase significantly to 36.4Mha, from 33.6Mha in 2020. Despite a large area increase, US stocks for next season may only slightly increase from 3.27Mt to 3.95Mt. This is because of low opening stocks and strong demand.

How accurate are previous outlooks?

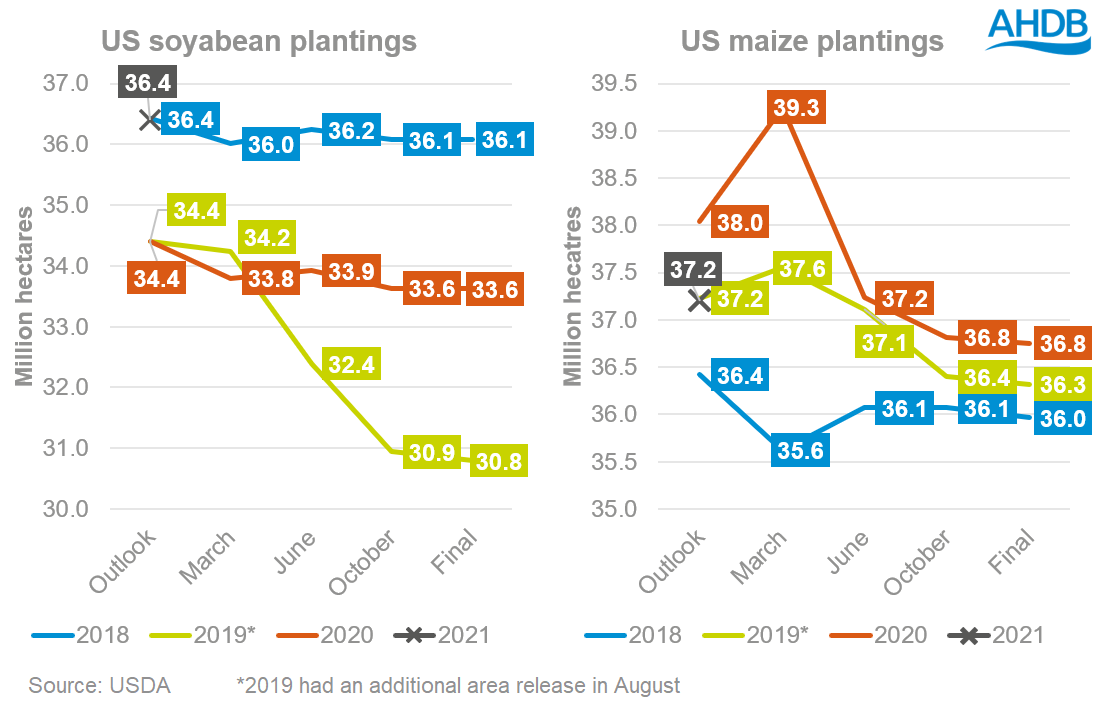

The USDA releases area estimates throughout the season (usually March, June, October) and then a final figure. Comparing the outlook estimates to these figures shows there is scope for change.

Market prices can change intentions, and a close watch point in the month of February is the price ratio of soy and maize for new crop futures. Currently, the average price (in February) of soyabean (Nov-21) is over 2.4x the price of maize (Dec-21). It costs around twice as much to grow soyabeans as maize. So these prices provide a large incentive for soyabean plantings to materialise.

Weather can also change planting intentions. In 2019 rain impacted the planting window and led to a reduction in both soyabean and maize areas.

The largest reduction of the past three years was in 2020, when March intentions for maize were at 39.3Mha but reduced by 2.5Mha in the final estimate. This was due to the coronavirus pandemic reducing the need for US maize as the bio-ethanol market slowed significantly.

Changes to estimates could impact prices

These outlooks are only preliminary estimates of the US soyabean and maize areas and are likely to change. Up until planting, the prices for both crops will impact planting intentions. But once planting commences, weather will dictate what is planted. Maize planting usually starts in April, and soyabean planting usually starts in May.

If areas for both commodities increase in the next estimates released by the USDA on Wednesday 31 March, we could see global prices pressured. However, if areas decrease, we could see further support for global prices, as US stocks next year could get even tighter.

US plantings will drive the sentiment for global markets, thus filtering down to what you receive at the farm gate for your crops.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.