Backwardation supporting long positions: Grain Market Daily

Friday, 15 January 2021

Market Commentary

- UK wheat futures (May-21) closed yesterday at £210.00/t, gaining £0.50/t on Wednesday’s close. While new crop futures (Nov-21) were unchanged and closed at £167.50/t.

- Global wheat markets this morning are further supported as there are plans for Russia to impose a higher export tax on wheat from March 1st, according to its economy ministers. This means that the export tax for wheat would increase from €25.00/t to €50.00/t from March if the proposal is actioned.

- On-going strong demand for maize is supporting a market where future demand is thinning. Nearby Chicago maize futures closed yesterday at $210.33/t, gaining $3.84/t on Wednesday’s close.

Market backwardation supporting long positions in futures markets

There has been a surge in support for agricultural commodities. Chicago wheat, soyabeans and maize futures contracts have gained exponentially since the start of June 2020.

Countries throughout Asia and North Africa have increased their purchasing of grains in recent months, supporting agricultural commodity markets. The need for increased purchasing has been driven by the use of strategic reserves in these countries at the start of the coronavirus pandemic, in an effort to dampen domestic food prices.

This demand on a global scale and other macro factors, such as a weaker dollar and inflation, has led to a positive roll on agricultural futures contracts, as the market currently is anticipated to be well supported for 2021. This support is beneficial for investors who hold a long position on a market.

Backwardation for this marketing year

Due to the recent support in global markets, some commodities have moved towards backwardation. This is when a futures price curve is on a descending slope, and the current value right now exceeds the futures price of a commodity.

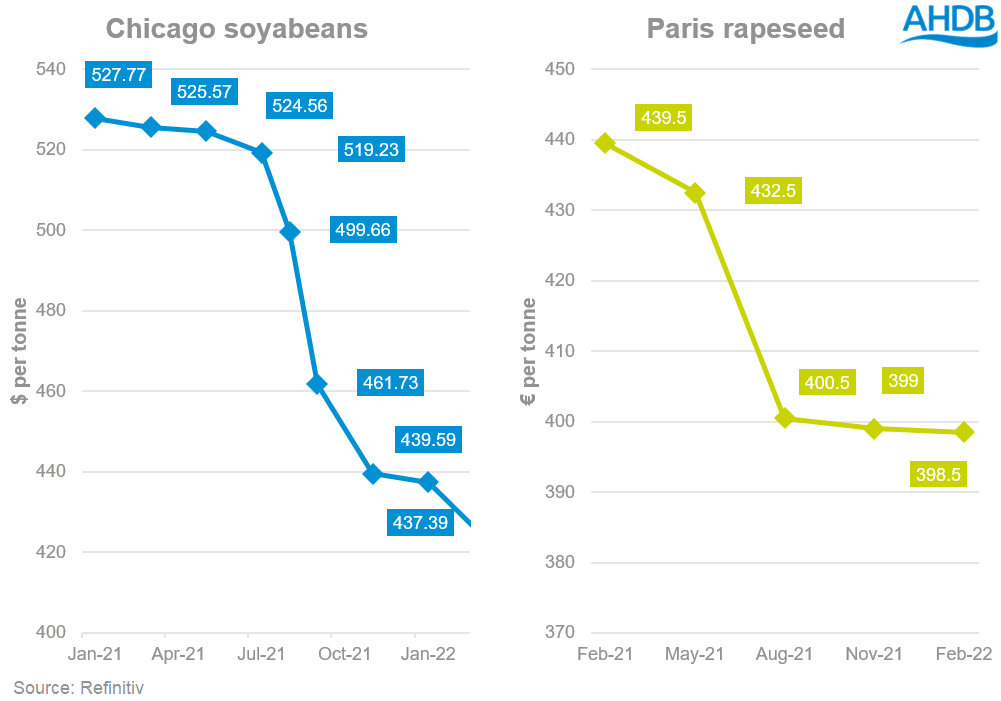

As you can see in the graph above, the price of soyabeans and rapeseed pre-harvest are less than the current spot price.

This backwardation is due to underlying conditions in a market getting tighter. There is currently an increased near-term demand for agricultural commodities, which isn’t being met with a supply.

Further to that, spot markets are reacting to potential future supplies too. With on-going weather issues in South America, supplies for both soyabeans and maize could be less than anticipated.

Beneficial for investors?

Holding a futures position when the market is in backwardation means that the value of the futures contract will rise to meet the spot price. This will achieve a positive roll; this is when you gain from selling one futures contract and buying another.

This positive roll increases the incentive for investors to hold a longer position in a commodity market.

With the UK currently trading at import parity, we are encapsulating these global gains. However, this could change if domestic production rebounds next year, potentially moving the UK to an export parity position.

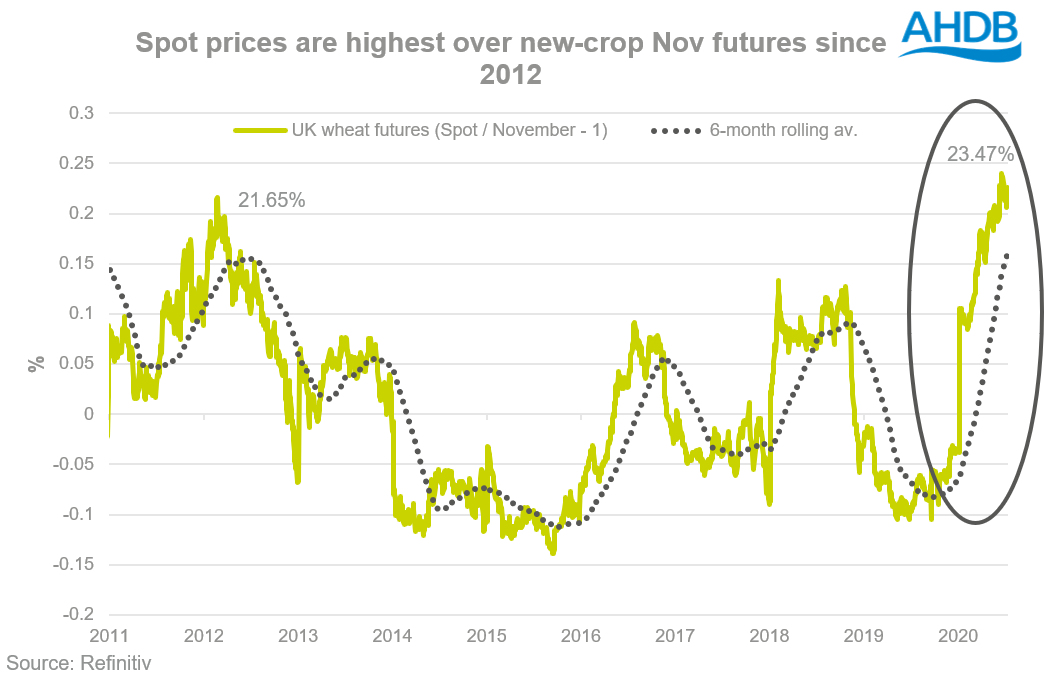

There is currently a discount for new crop UK wheat futures as a larger crop is expected. Our spot prices are currently over 23% above the new crop futures (Nov). This is greater than values seen in 2012.

Global weather and crop development in the Northern Hemisphere throughout spring will determine new crop prices. We could see technical support in our new crop prices and rise to meet spot prices if crop development issues ensue, but equally reduce if crops develop well.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.