Manic or mundane Monday? – USDA report incoming: Grain Market Daily

Friday, 9 August 2019

Market Commentary

- UK feed wheat futures ticked up yesterday, following six days of declines. Nov-19 feed wheat futures gained £0.80/t to close at £144.00/t.

- Paris rapeseed futures (Nov-19) also jumped back yesterday, gaining €2.00/t, to close at €375.25/t. The move higher for rapeseed has been partially driven by a price hike for soyabean oil futures (Dec-19) which closed at a more than 3-month high.

- The uptick in Chicago soyabean oil futures follows a large lift in Chinese Dalian soyabean oil futures on supply concerns, as trade tensions between the US and China continue to escalate.

Manic or mundane Monday? – USDA report incoming

- USDA WASDE and updated planting estimates due on monday at 5pm.

- Pre-report estimates unsurprisingly expecting decline in planted and harvested acreage estimates.

- The reaction will heavily depend on the degree to which the report differs from trade expectations.

Monday could signal the end of the recent spate of maize led volatility, or could kick it into a whole other gear. Over the last three and a bit month’s global grain volatility has been heavily dictated by uncertainty over the US maize production number.

The USDA June survey of plantings pegged maize area at 37.1Mha, above industry expectations at the time. Monday’s report which will include updated planting estimates for maize and soyabeans. The reaction will heavily depend on the degree to which the report differs from trade expectations.

The average estimate of analysts in a pre-report Reuters’ poll pegs the area at 35.6Mha, 1.5Mha lower than the June forecast. This would suggest that for the maize market to move higher on Monday the cut would have to be greater.

What about harvested acreage?

The planted acreage can only tell us so much about the maize market. A prime example of this is with EU rapeseed plantings where crop prospects have steadily got worse, limiting production estimates and raising prices.

This is true for the US corn area. While plantings may have fallen to a lesser degree, the USDA planting survey doesn’t reference intentions for the crop. With some crops having had a poor start to growing, there could be a significant volume not harvested for grain, this could firm the US market further.

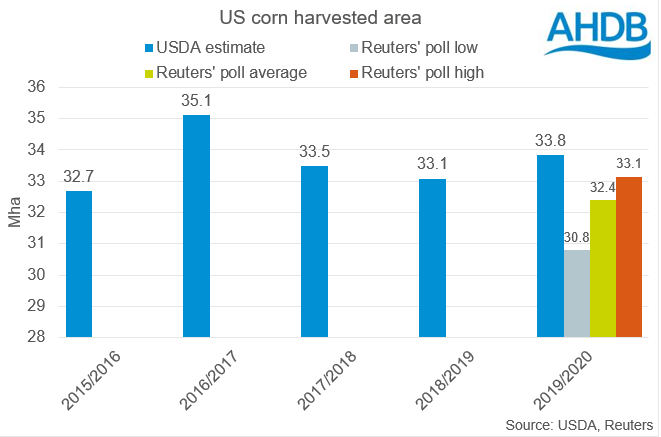

The USDA currently peg corn harvested acreage at 33.8Mha. Meanwhile, the average of analysts’ estimates for Monday’s report stands 1.4Mha lower at 32.4Mha.

Yield uncertainty

Having covered planted and harvested acreage we need to pay some attention to yield as well. Monday’s WASDE will use a different methodology for calculating yields than in previous August WASDE reports, this could drive further uncertainty.

Come release time at 5pm Monday all will be answered. UK markets will have some time to react but Tuesday morning is when we’ll likely see the real fallout.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.