London Nov-20 wheat futures remain firm: Grain Market Daily

Tuesday, 22 September 2020

Market Commentary

- London wheat futures (Nov-20) closed £0.45/t down from Friday’s close at £178.80/t. May-21 is unchanged from Friday’s close at £180.75/t.

- Global grains were also down yesterday, with Chicago and Paris wheat futures (Dec-20) losing £4.63/t to £158.40/t and £0.58/t to £177.03/t respectively.

- Paris rapeseed futures (Nov-20) weakened by €4.00/t to close at €391.00/t, losing most of the gains made in the second half of last week.

London Nov-20 wheat futures remain firm

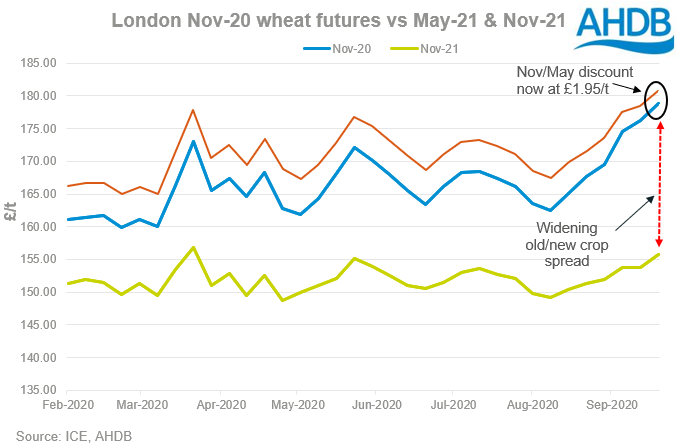

The London Nov-20 wheat futures contract has rallied in recent weeks to levels not seen since October 2018. This has been caused by a number of factors, including a small domestic crop and a weakening of sterling against both the US dollar and the euro. So, how have other contracts been behaving in relation to it?

May-21 premium to Nov-20

Since mid-October 2019, the Nov-20 discount to May-21 has been consistently £4-6/t. However, since the end of August 2020, the discount to November has been closing in as both contracts continue to firm. This said, the narrow premium has not translated into physical grain prices, with later delivery months still commanding a carry that could incentivise wheat storage to later in the season. AHDB’s UK delivered prices can be found here.

Prices are currently being quoted as a premium to Nov-20, rather than a discount to May-21, due to limited volumes being traded on the latter. This may be supporting the narrowing of discount currently shown between the two contracts. Pre-Christmas demand, and the sentiment that the market may well be supported by imports later in the season is driving much of this behaviour.

Nevertheless, while sales later in the season still have at least a £1.00/month carry from pre-Christmas movement, many farmers could still be incentivised to hold their wheat through the season. This might lead to a price risk if and when imports start to arrive to service domestic supply.

Nov-20 premium to Nov-21

The spread between Nov-20 and Nov-21 has been considerably more volatile. The Nov-20 price has ranged from a £6.64/t discount from Nov-21 to a £23.05/t premium recorded yesterday. Since January 2020, the Nov-21 discount has ranged between a £10-15/t discount to Nov-20. However, over the last month the spread between new and old crop has been widening as new crop prices have not been following the rally from the Nov-20 contract. This is likely due to not only a tightness in old crop supply, but also an increasing availability of new crop wheat. With the markets more relaxed about the new crop season, there is little motive to chase the old crop markets up.

With this in mind, new crop values still represent historically good ex-farm values and there is the potential for the return to an average sized crop in the 2021/22 season. Current old crop prices area also looking firm and at risk of imports pressuring prices later in the season.

As always, it is essential for growers to truly understand their cost of production when looking to sell, so volatility can be evened out by ensuring sales are made at profit, rather than purely looking for a rising market.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.