The latest WASDE revisions and market movers: Grain market daily

Thursday, 10 November 2022

Market commentary

- US grain markets closed down yesterday, following the latest USDA report – see below for more detail. Domestic and European futures also closed down yesterday, but losses were capped somewhat by renewed uncertainty surrounding the future of the Black Sea grain deal.

- UK feed wheat futures (May-23) closed yesterday at £276.75/t, down £0.45/t on Tuesday’s close. Nov-23 futures fell £0.90/t over the same period, closing at £259.10/t.

- Chicago wheat futures felt pressure yesterday with the Dec-22 contract losing $7.81/t on the day to close at $296.31/t. Chicago maize futures (Dec-22) fell by $1.18/t from Tuesday, settling at $261.61/t yesterday.

- Paris rapeseed futures (May-23) closed at €642.00/t, up €3.25/t from Tuesday’s close.

- The U.N. will meet with Russia tomorrow to discuss the extension of the Black Sea grain deal, with Russia expected to use exports of grain and fertiliser as a bargaining tool. This remains a key watchpoint for markets.

The latest WASDE revisions and market movers

Global grain markets were pressured yesterday whilst oilseed markets were supported following the release of the USDA’s latest World Agricultural Supply and Demand Estimates (WASDE).

Wheat

Global wheat production was revised up slightly (980Kt) from October’s estimate to 782.68Mt. Wheat production in Argentina was revised down by 2Mt to 15.5Mt compared to October’s projections, with drought negatively impacting yields. The EU also saw output lowered to 134.30Mt (-450Kt). However, this was offset by increases to the UK (+800Kt), Australia (+1.5Mt) and Kazakhstan (+1.0Mt).

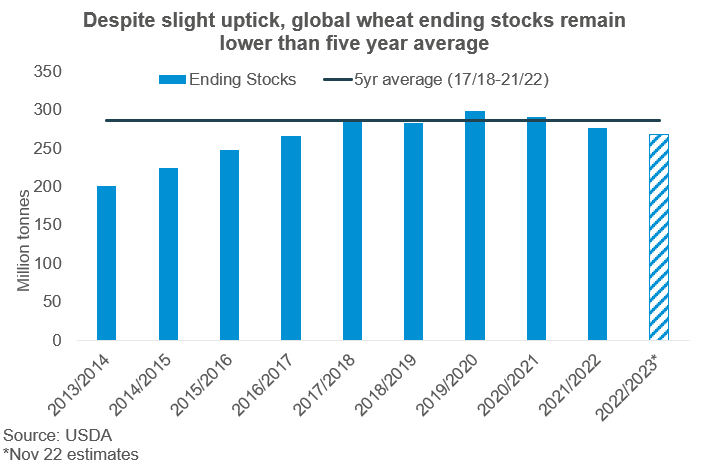

World wheat ending stocks were increased to 267.82Mt (+280Kt), with the rise in supply outweighing a rise in demand. This differed from the average trade estimate from the pre report Refinitiv poll, which projected a slight decrease from October.

While the latest USDA estimates point to larger global output and larger ending stocks for 2022/23, this could change. In its latest forecasts the Rosario Grains Exchange cut Argentinian wheat production for the season to 11.8Mt, which is considerably lower than the latest USDA estimate. If Argentinian wheat production was to come in nearer the lower estimate, then the global wheat supply picture would look different.

Maize

Global maize production is pegged down slightly (-350Kt) on October’s estimate, at 1,168.39Mt for 2022/23. This comes after South African, South East Asian and EU production was reduced, outweighing a slight rise in US output.

Trader estimates for global ending stocks were largely in-line with USDA estimates of 300.76Mt for 2022/23. Global ending stocks were slightly down on October’s estimates, following an increase in total domestic consumption and the fall in global production.

US 2022/23 production projections were revised upwards to 353.84Mt (+890Kt), contrasting average trader expectations of a revision downwards to 352.73Mt according to a Refinitiv pre-report poll.

Soyabeans

Global soyabean production was revised down slightly by 460Kt from October to 390.53Mt, mainly driven by a reduction in output from Argentina on the back of a smaller harvested area.

Despite a rise in US production leading to a slight uptick in stocks, at 6.0Mt, US ending stocks remain the lowest since 2015/16.

Alongside relatively tight US stocks and hopes of improved Chinese demand, this led to support for soyabean markets yesterday.

However, its worth noting the long term outlook for soyabeans remains relatively bearish, with global production pegged at record levels and ending stocks forecasted at a four year high.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.