Lamb market update: what's happening in Australia?

Wednesday, 22 May 2024

Key points:

- Australian production looks to set records in 2024, with slaughter boosted by a large flock

- Prices set to remain low, with higher supplies on the market

- Provided that existing global trading relationships continue, limited trade impact is expected for the UK as Australia focuses its export efforts on other countries

- Australian imports into the UK totalled 3,500 tonnes between Jan–March

Australian lamb production is set to hit record high levels in 2024, up 4% (21,500 t) from 2023, to reach 621,000 t. This is 20% higher than the 10-year average and marks the third year of record production. Lamb slaughter is also predicted to grow by 1.2 million head (5%), to 26.1 million head for 2024, making it the largest slaughter year on record. Further forward, lamb slaughter is predicted to fall but remain at historic highs, thanks to a large flock and improved productivity. The overall flock size is forecast to fall by 3% for 2024, following slight destocking towards the end of 2023, to 76.5 million head.

Data from the Australian Bureau of Statistics showed that lamb slaughter for the first quarter of 2024 reached just under 7 million head, up 32% year-on-year. Weekly slaughter exceeded the 500,000 head mark for the first time in March, with rates persisting at high levels since. Farmgate prices remain pressured generally, due to current supplies on the market, although have seen some resurgence in recent weeks, with Meat & Livestock Australia reporting that strong demand for quality heavy lambs has provided some growth.

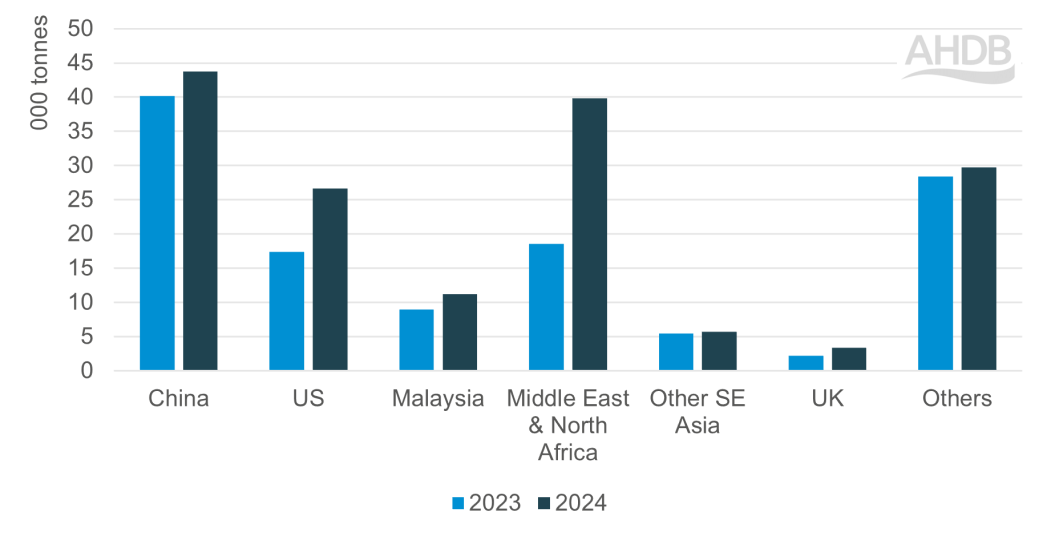

Looking into Australia’s export destinations, China, the USA, Malaysia and the Middle East remain the largest markets. Exports to China totalled 44,000 t in the year to date (Jan–Mar 2024), up by 3,600 tonnes from 2023. The USA took just under 27,000 t of Australian sheep meat in the year to date, with reports suggesting frenched racks of lamb are in high demand. The UK, in comparison, sits 12th in Australia’s markets for the year to date.

Australian exports of fresh and frozen sheep meat by destination, year to date Jan–Mar

Source: Australian Bureau of Statistics via Trade Data Monitor LLC

UK imports from Australia in the first quarter of 2024 totalled 3,500 t, which is growth of 1,400 t (+65%) from the same period in 2023. This is, however, still lower than volumes imported in 2022, indicating that the free trade agreement (FTA) enacted in May 2023 has had limited impact on volumes entering so far. The FTA allows 30,556 t of sheep meat to enter the UK under this year’s annual quota, which we expect is unlikely to be filled. This further demonstrates that Australia is focusing its export efforts into other markets besides the UK.

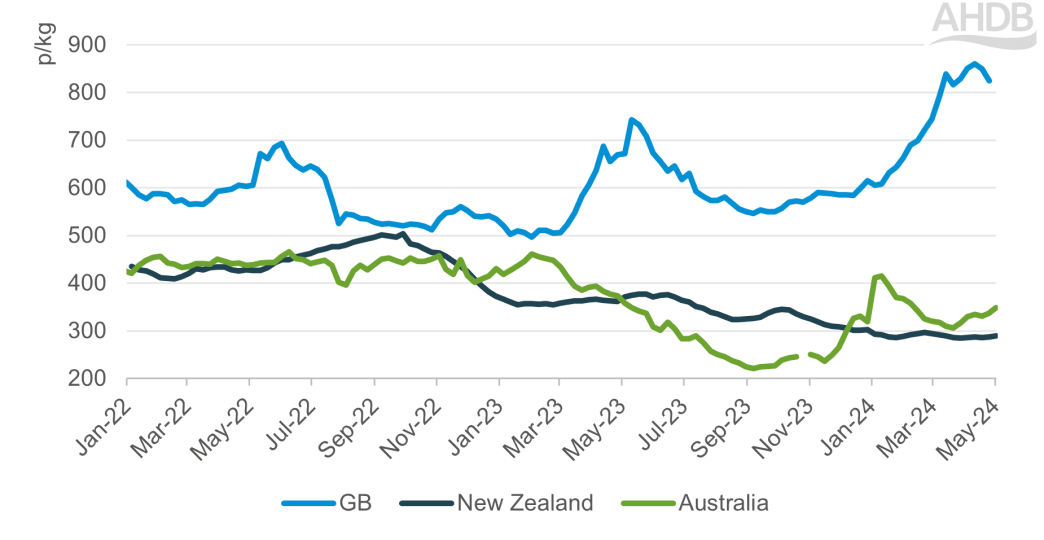

Comparison of deadweight lamb prices in GB, New Zealand and Australia (p/kg)

Source: AHDB, MLA, NZ AgriHQ

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.