Lacking US biofuel demand undermining grain prices: Grain Market Daily

Wednesday, 21 August 2019

Market Commentary

- UK feed wheat futures lost more ground yesterday closing down a further £1.40/t, at £135.85/t. The latest move lower follows further confirmation of ample global wheat supplies.

- Forecasts for the Ukrainian wheat harvest, and subsequently exports, have grown once more. The Ukrainian grain trader union, UZA, have suggested exports from the Black Sea nation could reach as much as 21.0Mt this season, up from 15.5Mt last year.

- There could be some support for wheat prices against a bearish backdrop from the ongoing crop tour in the US Midwest. Yields in Indiana and Nebraska are estimated down year-on-year.

Lacking US biofuel demand undermining grain prices

- Larger than expected maize production forecasts have seen prices for the crop pressured in recent weeks.

- Additional exemptions for biofuel blending could reduce demand for maize, further limiting prices.

- That said, ongoing US crop tours currently see yields significantly down year-on-year which could offer further support.

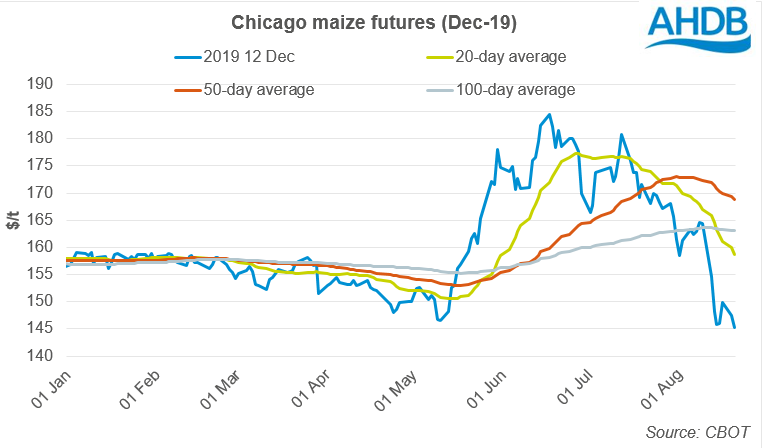

Over the past few months the direction of US corn prices has been a significant focus for EU grain markets. Thoughts of tighter production in the US maize belt caused prices to rise considerably before last week’s USDA supply and demand estimates bought them crashing down. Prices of corn could now be further undermined.

Last week the US government announced a series of exemptions to oil refineries reducing the volume of ethanol required to be blended into fuel. The exemptions have the potential to cut demand for ethanol in the US and subsequently reduce the demand for maize, the primary feed stock for US bioethanol.

Production of bioethanol in the US Midwest was marginally down year-on-year in July, a trend which has continued into August. If we see further reduction in bioethanol demand from oil refineries as a result of the latest exemptions then support for corn maize prices could wane further.

There is still the potential for some maize price support in spite of the blending exemptions. Ongoing crop tours in the US are highlighting yields sharply lower than a year ago, and below the USDA estimates.

- In Ohio, maize yields have been estimated at 10.38t/ha, down from 12.08t/ha last year and 0.67t/ha lower than the three year average.

- In South Dakota, yields are estimated at 10.36t/ha, down from 11.97t/ha last year and 0.31t/ha below the three year average.

- Yields in Nebraska are seen at 11.60t/ha, above the three year average but below last year’s 12.05t/ha

- Indiana yields are estimated at 10.86t/ha, down on the year and 0.95t/ha lower than the three year average.

The current USDA forecast for maize yields is pegged at 11.40t/ha.

The next USDA production estimates are due on 12 September, and will be watched closely for maize price direction.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.