La Niña weather can drive your wheat price: grain market daily

Wednesday, 16 February 2022

Market commentary

- May-22 UK wheat futures closed yesterday at £219.40/t, down £3.60/t Monday’s close. New crop values (Nov-22) were also back, closing at £200.50/t down £2.00/t on Monday’s close.

- The domestic market was pressured with the Chicago and Paris markets. Reasons were due to Russia reportedly slowly retreating away from the Ukrainian border, tempering worries that Black Sea grain exports will be disrupted.

- SovEcon has raised its forecast of 2022 Russian wheat production by 3.6Mt. The crop is now estimated at 84.8Mt, increase is due to favourable weather.

La Niña weather can drive your wheat price

2021/22 is seeing a consecutive La Niña weather event in the South Pacific. This hasn’t been experienced since 2010-2012.

Cold ocean temperature anomalies have now weakened in the South Pacific and there are suggestions that the La Niña will start to weaken and go back to a more neutral phase by this summer (National Oceanic and Atmospheric Administration).

Why does this matter to me?

If this happens, this weakened La Niña event will still influence weather, notably in South America. Between now and UK harvest 2022, 86Mt tonnes of maize still has to be grown in Brazil. This second maize crop will account for over 75% of Brazilian total production for this marketing year.

The second (safrinha) crop is vital for global supply & demand. What happens to this crop will drive maize prices, which will influence the direction of your ex-farm wheat price.

Looking back to look forward

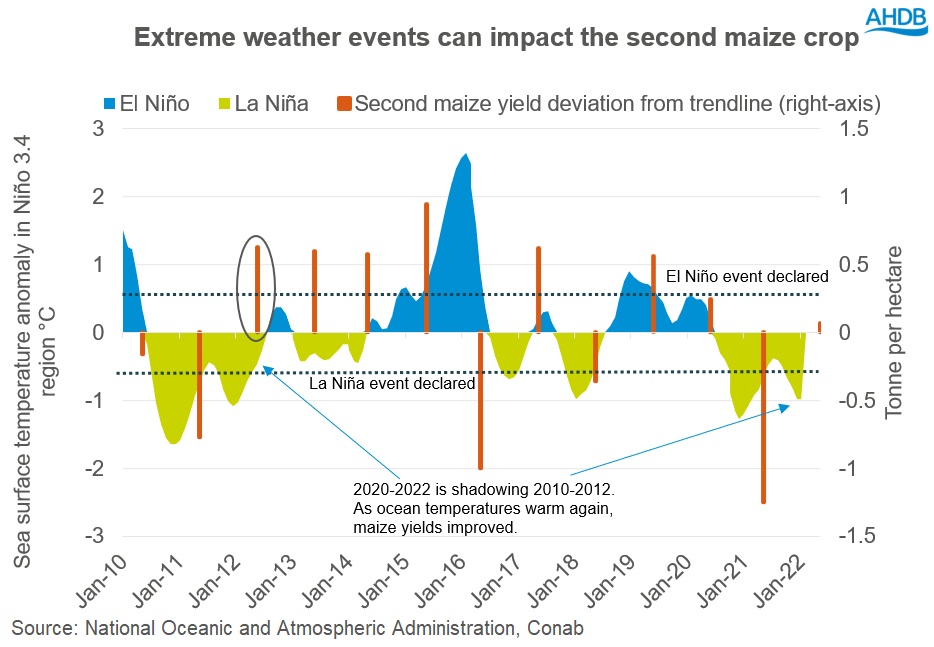

Extremes of the La Niña/El Niño weather event do influence second maize crop yields.

As the graph shows, in 2010/11 the first La Niña weather event contributed to hindered Brazilian maize yields; they were -0.8t/ha below the trend line. However, in 2011/12, when we were heading out of the La Niña weather event, yields rebounded and production increase 41% year-on-year to 39Mt.

Currently the South Pacific is shadowing these two years and is forecast to head into the neutral ocean temperature phase by summer. Could the same yield rebound be seen this season as in 2011/12? Markets will be watching closely for any positive or negative weather news.

Conclusion

This information on the Brazilian crop isn’t set in stone and dryness could continue in the region into spring.

Currently planting progression for the second maize is at 35%, considerable better than the same point last year when this was 10%. Crop development is a watch point from now until harvest starts in May.

Brazil is still forecast a record total maize crop of 112Mt, but the global market is relying on this to plug the grain gap until Northern Hemisphere harvests. This second maize crop development could very well influence what you get at the farm gate.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.