June survey and BPS discrepancies, a first look: Grain Market Daily

Wednesday, 6 February 2019

Today has seen Defra release the latest update to the Basic Payment Scheme planted area dataset that was first released a year ago. The dataset looks specifically at land use including grassland but we’re concentrating on the main crop areas in England only.

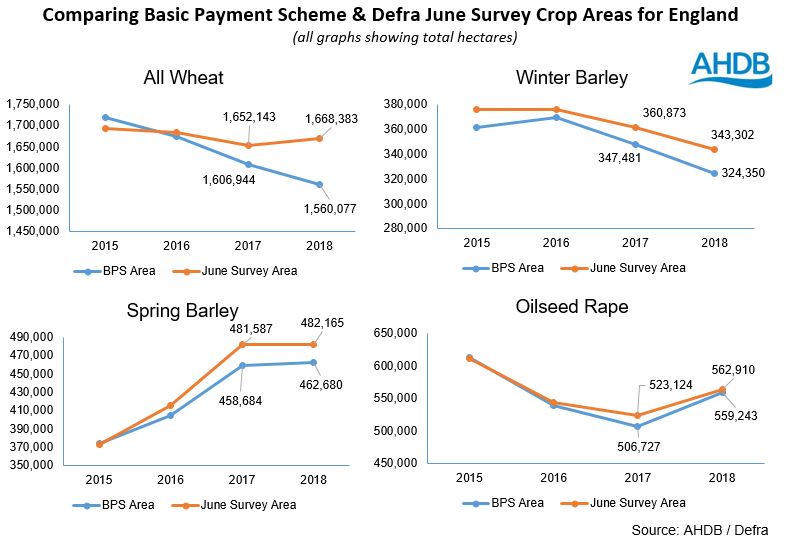

The total wheat area planted for harvest 2018 for England using the BPS data set is estimated at 1.560 million hectares (Mha). This is in stark contrast to the June Survey area figure of 1.668Mha. The 108,306 hectare difference (-6.94%) between the two figures is very large in comparison to previous years.

Last season we also saw a BPS area figure which was below the Defra June Survey area. However, the difference between the areas was much less. The 2017 BPS area figures was estimated at 1.607Mha, 45,199 hectares (2.81%) below the June Survey figure of 1.652Mha.

Looking at other crops, we also see a BPS area figure below the June Survey area for both winter and spring barley. The spring barley BPS area is estimated at 463 thousand hectares (kha); this figure would be 19kha (-4.21%) below the June Survey area. For winter barley the area difference is similar with the BPS dataset area of 324kha being 19kha (-5.52%) below the June Survey area.

For oilseed rape, the variance is much less. The BPS area figure for 2018 stands at 559kha; this is only 3.7kha (-0.66%) below the June survey figure. Looking at previous years, the oilseed rape BPS area has been much closer to the June Survey figure.

Opinion

The variance in the two datasets area figures does raise significant questions regarding the total supply of wheat and barley in England. If the BPS area figures are true, then for the current season (using the June Survey England yield) English wheat production could be up to 849 thousand tonnes (kt) lower than is currently estimated.

This is a huge variance, and surely we would be seeing a much larger market reaction in terms of higher delivered premiums in relation to futures in certain areas if this was the case. Exports have continued to move out of the south-east coast when price competitive into the near continent and predominately to Ireland. If the English wheat production truly is over 800kt lower, then we would not be in a position to export any wheat out of the country at this stage. So we have to question whether this extremely lower area figure represents the “true” supply and demand perspective.

For barley, we have seen domestic (and European) prices drop sharply over the last two weeks as there is still a large amount of barley in the country to be marketed (especially in southern areas). Whilst the lower BPS areas would translate into a potential 226kt reduction in barley, we would still be in a position of over supply for barley which would give an exportable surplus.

Defra have not released the more detailed dataset which breaks down the area into the NUTS2 regions at this stage as the total area figures (for wheat and barley specifically) are showing an extreme variance. Defra are looking into this variance further to ascertain why it is so large before releasing the final area.

Having Defra official statistics, and those from one of its agencies, not being in line with each other is confusing to say the least. The draft agriculture bill put data provision and clarity as a key function of future markets and so we need clarity to ensure business decisions across the supply chain are well informed. Many in the grain trade are suggesting that the government proceeds to get their own data provisions in order before putting more obligations on the supply chain to provide clear data.

AHDB will continue to push for clear and impartial data to be provided across the industry and will be publishing the next set of domestic usage data statistics tomorrow (Thursday 7th). We will look into the BPS data in more detail and produce a comprehensive review of the 2018 dataset to be published in the week commencing February 11th. In the meantime, if you have any questions regarding this dataset & UK supply and demand information, please do not hesitate to get in contact.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.