Japanese pig meat imports broadly stable

Tuesday, 7 December 2021

By Bethan Wilkins

While not a significant UK trading partner, Japan is the second largest global pig meat importer, with domestic production unable to meet demand. With the Chinese market outlook uncertain, the performance of other key importers has become increasingly important.

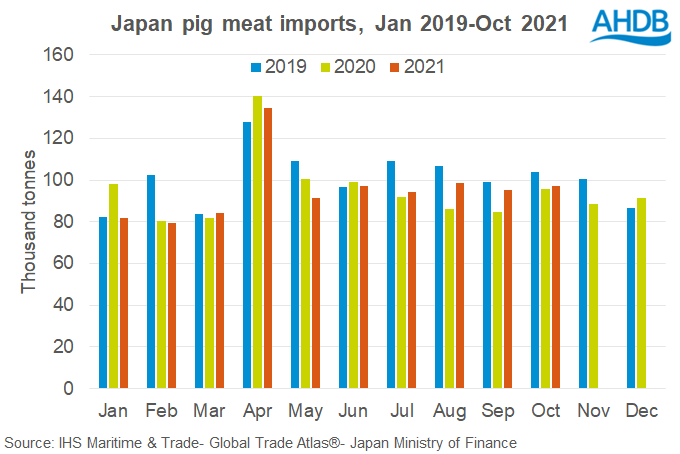

During the first ten months of this year, Japan’s imports of pig meat (primarily fresh/frozen pork, but also some sausages and processed meat) were virtually unchanged compared to the same period last year, totalling 953,100 tonnes. However, shipments in the third quarter alone were up by nearly 10% on 2020 levels, before slowing again in October (+2% year on year). The more recent growth has been particularly driven by an increase in volumes from the US, the main supplier. Most other suppliers also shipped increased quantities in the third quarter, the exception being Germany, which remains banned due to African Swine Fever.

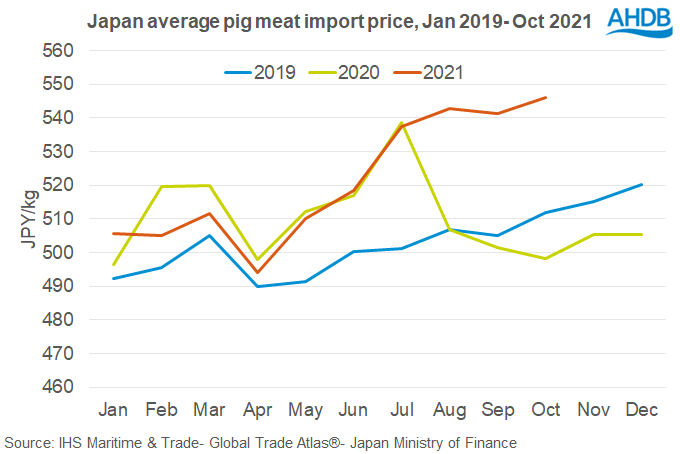

Higher shipments in the third quarter were likely influenced by increased supply availability at this time, with China reducing its import requirements. Increased reopening of foodservice outlets at the time may have also played a role. Nonetheless, prices have been high, and this likely limited the attractiveness of further import growth.

Across the year so far, imports of chilled pork actually showed a small increase, while frozen volumes have been below 2020 levels. Frozen pork imports totalled 395,000 tonnes, 3% lower than in 2020, whereas chilled pork imports totalled 356,000 tonnes, 4% higher than last year. However, in the third quarter, more frozen product was also imported, particularly from Europe. This may well be product that would otherwise have been sent to China.

Looking at other pig meat products, processed ham imports have seen very little change compared to last year. Volumes in the first nine months of the year were only down by 1% and totalled 160,000 tonnes. The US remained the main supplier. Sausage imports have seen more of a decline, falling by 14% to 22,000 tonnes as volumes from Brazil were nearly 45% lower.

Looking forward, the path of recovery from the COVID-19 pandemic will be key to developments in Japanese import requirements, with foodservice an important outlet for imported frozen pork. Cases have been low since the autumn, which ought to be positive for import demand if this can be maintained. Global pork supply availability, and competition from other markets, will also be important. Currently, Chinese import demand continues to be reduced, and US farmgate pig prices have dropped back in the second half of the year, both of which may be supportive of import levels.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.