Is maize supply a concern? Grain Market Daily

Wednesday, 24 July 2019

Market Commentary

Global grain markets remained relatively flat yesterday with no real change in fundamentals affecting the markets.

- UK feed wheat (Nov-19), down £0.10/t at £146.25/t.

- Paris milling wheat (Dec-19), down €0.25/t at €179.25/t.

- Chicago wheat (Dec-19), down $0.27/t at $183.06/t.

- Chicago corn (Dec-19), up $1.87/t at $169.88/t.

European and US oilseed markets also remained relatively flat to Mondays close, with a marginal uptick in European markets and an even slighter drop in US markets.

- Paris rapeseed (Nov-19), up €1.75/t at €375.50/t.

- Chicago soyabeans (Nov-19), down $0.73 at $332.04/t

Global harvest progress will continually be monitored, likely causing any drives in price movements.

Is maize supply a concern?

- Uncertainty remains around US maize planted area but conditions have eased

- South American prospects are strong as harvest progresses

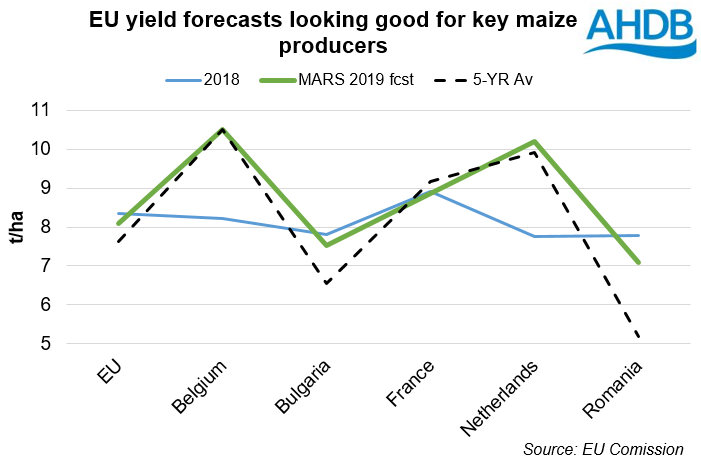

- The MARS report pegs EU maize yields above the 5-year average

Since May, there has been concerns over US corn supply when planting struggles became real due to wet weather. As a result, prices reached a contract high for Chicago maize futures (Dec-19) of $184.44/t in June. Uncertainty remains around US maize area as we await the August revisions to the acreage report. The season has been challenging for US maize with a wet start followed by hot and dry conditions, although 57% of corn is still in good-excellent condition (USDA). Recently, cooler weather has alleviated condition concerns.

South American corn crops are also looking good, with the Brazilian safrinha harvest surpassing 50% completion. Yields are above expectations for all major safrinha crop producing states. CONAB predict the combined maize harvest to exceed 98Mt for 2019/20, with the safrinha crop estimate 34.2% above last year. The USDA estimate is another 3Mt above this.

Closer to home, the latest MARS report shows minimal impact on maize crops from the extreme heatwave experience by much of Europe. The French hot spell at the end of June has returned, but crop prospects for maize remain relatively good. Yields are forecast to drop only marginally, knocking expectations just 3.4% below the 5-year average.

Yields are expected above the 5-year average for most of Eastern Europe’s crop.Romania’s yield outlook is up 37% from the 5-year average. Expectations for Bulgarian maize crops are also positive at 7.53t/ha, 15% up from the average. Also one to note is Ukraine, where yields have been forecasted up although still below last year’s level.

Regardless of the uncertainty in the US, corn supply is still looking ample. Should the price remain high, we could see a switch to barley use in feed rations decreasing the maize demand.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.