Is GB animal feed demand picking up? Grain market daily

Tuesday, 23 July 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £196.35/t yesterday, up £1.55/t from Friday’s close. The May-25 contract gained £0.65/t over the same period, ending the session at £206.15/t.

- Domestic wheat futures rose for the third consecutive session, following global markets up on the back of short-covering and concerns over crop prospects in Europe and the Black Sea region.

- Nov-24 Paris rapeseed futures gained €7.00/t yesterday, to close at €501.50/t. The May-25 contract gained €4.00/t over the same period, closing at €500.75/t.

- European rapeseed prices were supported yesterday as concerns over yields rose. The European Union crop monitoring service MARS revised this year’s rapeseed yield estimate down, in its latest report published yesterday. Yield is now pegged at 3.10 t/ha, from 3.16 t/ha estimated last month. More analysis on yesterday’s MARS report will be released in tomorrow’s Grain Market Daily.

Is GB animal feed demand picking up?

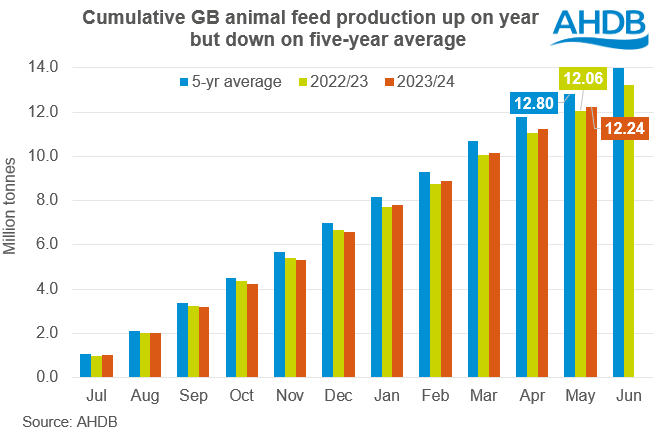

Earlier this month, GB animal feed production data up to the end of May was published. The data showed that this season to date (Jul-May), total feed production (incl. Integrated Poultry Units (IPU)) was up 1.5% on the year, reaching 12.2 Mt.

When excluding IPU’s however, production of feed by compounders was down 0.3% (28.2 Kt) on the year. Production by IPU’s from July to May was up 11.2% (207.4 Kt) on the year, more than offsetting the loss in production by compounders.

Aside from Integrated Poultry Units, cattle and calf feed was the only group to see a yearly climb in production, up 1.4% on the year, with the wet spring likely to have contributed to increased demand.

On the other hand, pig feed production saw the greatest yearly decline from July to May, down 1.7% or 29.5 Kt year-on-year. The pig sector continues to experience a historically elevated cost of production, though net margins are in a positive position and industry sentiment is said to have improved. As such, some recovery in the sector could be something to watch out for in this new season.

What does this mean for cereals usage?

This season to date usage of wheat, barley, oats and maize in feed production is down 0.5% on the year, at 4.41 Mt. Barley is the only cereal to see a yearly increase in usage, up 4.0% compared to the same period last season.

This is perhaps unsurprising given the discount of barley over other cereals for much of the marketing year. In May, the UK ex-farm feed barley price averaged a £22.70/t discount to feed wheat. In the same month a year earlier, the discount averaged £14.50/t. Given that we are expecting a considerable reduction in the wheat area this harvest, and a climb in the barley area, it is likely that we will continue to see a firm discount against wheat at least in the short-term.

However, it is also important to look at the increase in usage of maize. Since March, maize usage has been picking up due to its relative price against other cereals. For the month of May, usage was up 12% on the year. As such, any revisions to global maize supplies (with the crop in the northern hemisphere now largely in its key development phase), are a watchpoint over the next few weeks, with potential impact on cereal rations in GB feed prooduction.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.