Influence wearing thin for US weather on wheat: Grain market daily

Tuesday, 10 August 2021

Market commentary

- UK feed wheat futures closed £0.50/t lower yesterday, at £186.00/t. The UK market followed the general drift in grain markets globally, as we drift towards the USDA supply and demand estimates (WASDE) and crop production estimates on Thursday.

- US crop conditions maintained to improved over the last week (read more in today’s article). US maize is now rated 64% “good” or “excellent”, up two percentage points on the week. Soyabean conditions were unchanged at 60% rated “good” or “excellent”.

- Rapeseed futures moved lower yesterday. The Indian government has announced plans to reduce the nations reliance on vegetable oil imports, with a $1.5bn investment to grow domestic edible oil output (Refinitiv). India is the worlds largest vegetable oil importer.

Influence wearing thin for US weather on wheat

A key part of recent price support has been the unfavourable weather in the US and Canada. Hot and dry conditions across the high plains and parts of the Midwest have seen soil moisture plummet and crops suffer.

The condition of US spring wheat in the latest USDA crop condition report is the lowest since 1988. That said, over the past couple of weeks, the proportion of the crop rated “good” or “excellent” has improved slowly.

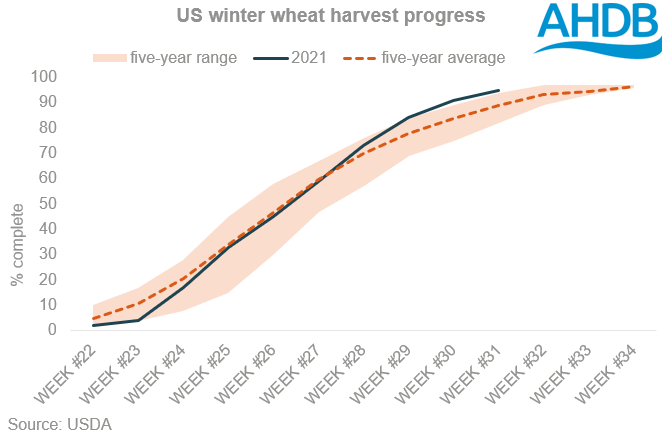

US wheat markets (both winter and spring) have been supported by the poor US conditions. In August, Chicago wheat futures (Dec-21) have revisited levels seen in May, when the contract peaked. However, with harvests in the US rolling on, the influence of US weather, on wheat at least, may be coming to an end for now.

In the week ending 8 August, the winter wheat harvest in the US was 95% complete and the spring wheat harvest 38% complete. The latter crop harvest is 17% ahead of the 2016-20 levels, unsurprising given how dry the US has been.

Models continue to point to dryness for the US. As a result, we may still see adverse impacts for US crops, but with a smaller area open to impact each week, the subsequent effect on prices should reduce.

With the US weather story waning for wheat, we need to look elsewhere for drivers. Yield results will likely be the next big impact, and attention will be focussed on the US crop production report and global supply and demand estimates (WASDE) on Thursday.

Elsewhere, we need to watch progress in the EU, although harvests on the continent are also rattling along, and progress in Black Sea. According to SpecAgro, the Russian wheat harvest was 53% complete as of 6 August. Ukragroconsult report that the Ukrainian harvest is 72% complete.

From here, weather impacts on maize will be an increasingly important watch point.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.